Partner content: This metamorphosis from one to the other of these two distinct business models is a complex undertaking

In the ever-evolving telecommunications industry landscape, traditional telecommunications companies (telcos) are embarking on a transformative journey, seeking to redefine themselves as technology companies (techcos), specifically as technology services companies.

This metamorphosis has its challenges, as the fundamental characteristics of these two distinct businesses present hurdles that demand careful navigation. Many telcos are pursuing this transition by tapping into the rich technology ecosystem.

However, a common misconception exists that the shift can be achieved solely through acquiring tech talent or signing partnerships with technology giants to develop and offer new technology services. In this article, we delve into the intricacies of this transformation, emphasising the critical importance of addressing core business structures and cultural nuances.

While the allure of acquiring tech specialists is undeniable, true transformation requires a holistic approach beyond the surface level.

Core business model

A crucial element for any business is how it employs its assets to generate revenue. A brief analysis of the financial statements can provide valuable insights. Let’s start with the balance sheet. A company’s balance sheet is a financial statement that provides a snapshot of its financial position at a specific time. The balance sheet comprises three main sections: assets, liabilities, and shareholders’ equity. Here’s a brief overview of the primary two to consider for our argument:

Assets:

• Current assets represent resources anticipated to be converted into cash or utilized within a year, encompassing cash, accounts receivable, and inventory.

• Non-current assets are expected to provide benefits over multiple years, including property, plant, equipment, and investments in long-term securities.

Liabilities:

- Current liabilities, like accounts payable, short-term debt, and accrued expenses, must be settled within one year.

- Non-current liabilities are long-term obligations, such as long-term debt, pension, and deferred tax liabilities.

The balance sheet follows the fundamental equation: Assets = Liabilities + Shareholders’ Equity. It reflects the company’s financial health, liquidity, and ability to meet short-term and long-term obligations.

How telcos’ balance sheets differ

The balance sheet of a telecommunications (telco) company and a technology (tech) company may have some similarities, but they also exhibit notable differences due to the nature of their businesses. Here are vital distinctions:

Assets composition

- Telco: Telcos typically invest substantially in physical infrastructure, such as networks, cell towers, and data centres. These assets are categorized as non-current assets.

- Techco: Tech companies often focus on intellectual property, software, and research and development. Their assets may include patents, copyrights, and significant investments in intangible assets.

Liabilities

- Telco: Telcos may have significant long-term debt due to the substantial capital expenditures required for infrastructure development. This debt is usually considered a non-current liability.

- Techco: Tech companies may have lower long-term debt levels if their business relies less on physical infrastructure. Instead, they might have liabilities related to research and development or software development costs.

Working capital

- Telco: Telcos often have higher working capital needs due to the ongoing maintenance and expansion of their physical networks, which can require substantial short-term investments.

- Techco: Tech companies may have lower working capital needs as their business models often revolve around software development and intellectual property, which may require less ongoing capital expenditure.

Revenue streams

- Telco: Telcos derive a significant portion of their revenue from subscription services like mobile plans, internet connectivity, and landline services.

- Techco: Tech companies may generate revenue from a diverse range of sources, including software licensing, advertising, e-commerce, and hardware sales.

Risk profile

- Telco: Telcos often face regulatory and competitive risks due to the highly regulated nature of the telecommunications industry and the competition among providers.

- Techco: Tech companies may face rapidly changing market dynamics, technological disruptions, and intellectual property challenges.

In summary, while telco and tech companies have balance sheets that follow the same accounting principles, their asset compositions, liabilities, working capital needs, revenue sources, and risk profiles can differ significantly due to the distinct nature of their businesses.

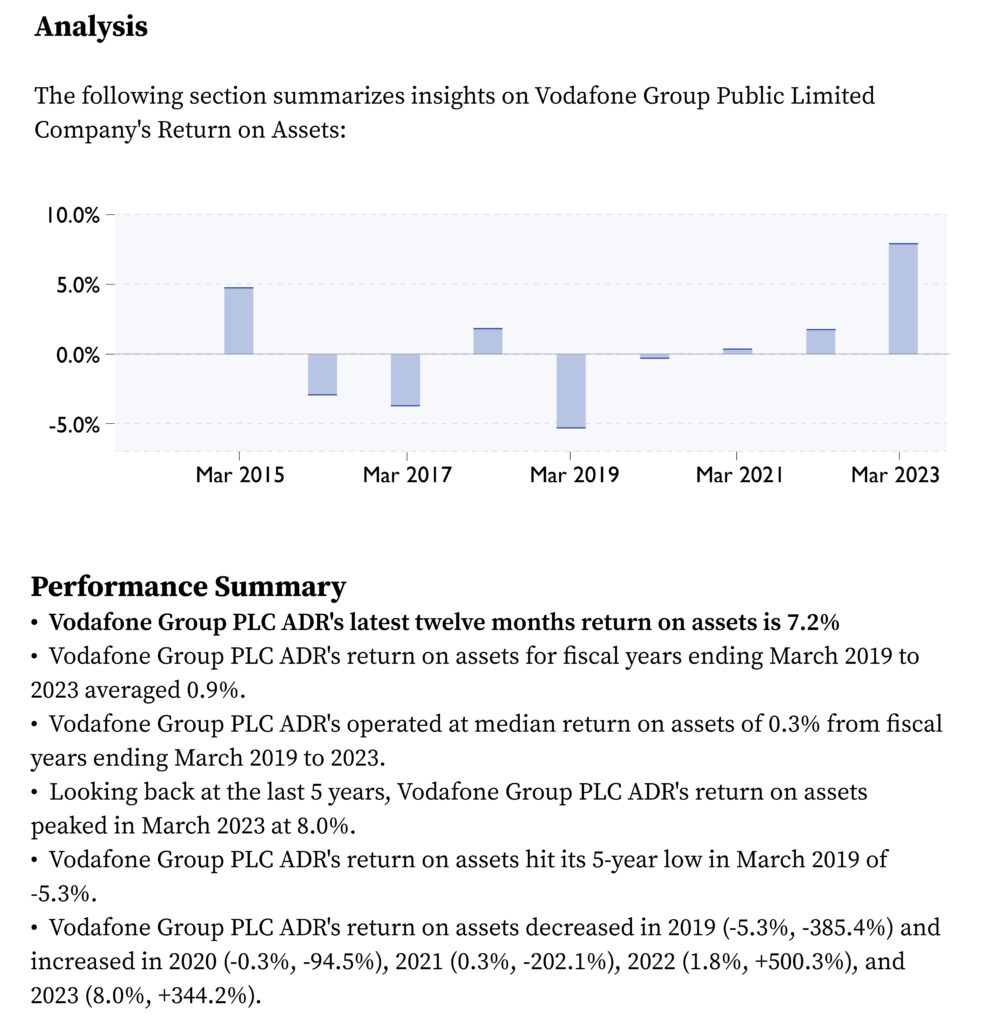

Vodafone Group’s Return on Assets

Source: Finbox

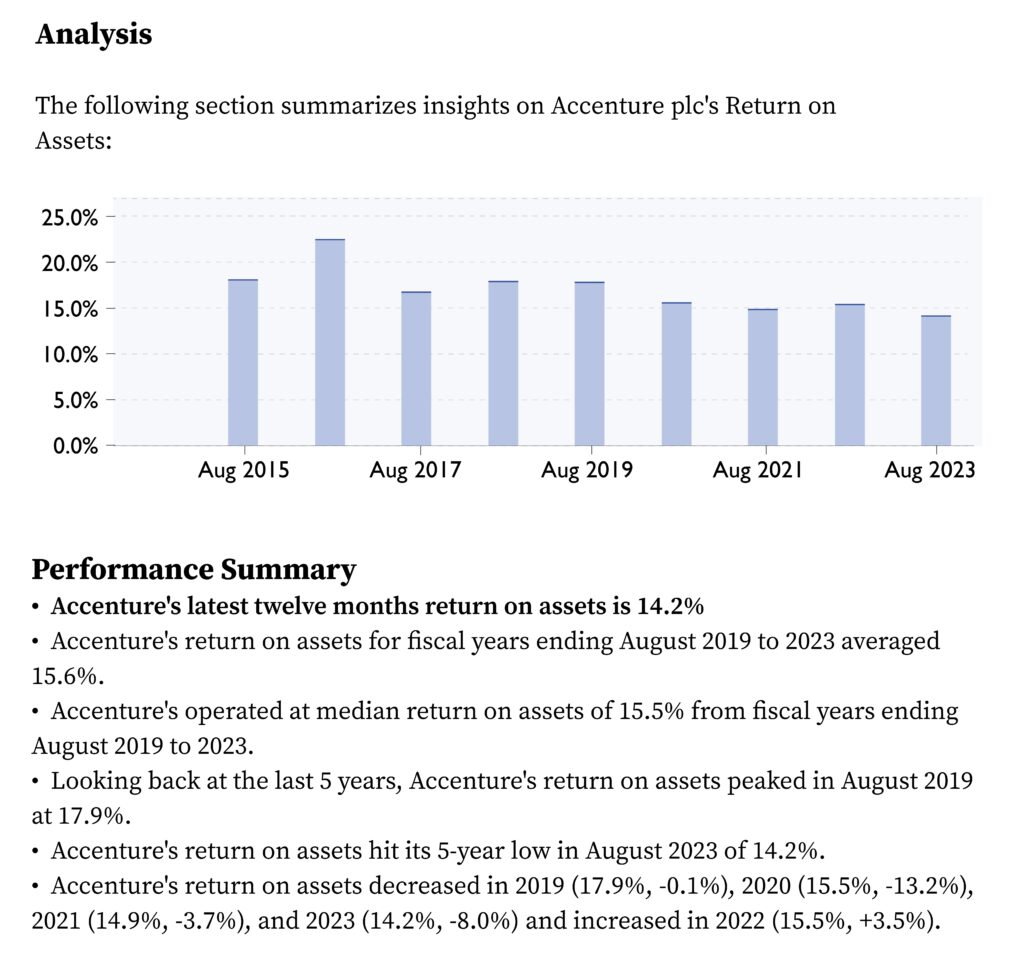

Accenture’s Return on Assets

Source: Finbox

The cultural dynamics

Let’s recall that most telcos traditionally functioned in monopolistic or oligopolistic markets at worst, shaping culture and perception in and among customers that differ from those forged in fiercely competitive markets for technology services companies. This culture influences every facet of the business, from the business model to the types of talent the company attracts. Here are some fundamental cultural differences:

Innovation focus

- Telco: While also valuing innovation, telcos may have a more regulated and traditional approach to product development due to the need for network reliability and compliance with industry standards.

- Techcos prioritise innovation and rapid product development, fostering an environment where workers are encouraged to take risks, experiment with new ideas, and embrace a culture of continuous improvement.

Hierarchy and bureaucracy

- Telco: Telcos may have more hierarchical structures and bureaucratic processes, given their legacy and regulatory requirements. Decision-making can be slower due to thorough planning and compliance.

- Techco: Tech companies tend to have flatter organisational structures focusing on agility. Decision-making can be decentralised, allowing employees at various levels to contribute ideas and make decisions more quickly.

Work environment

- Telco: Telcos may have more traditional office-based work environments, varying depending on the specific company and its location.

- Techco: Tech companies often offer more flexible work environments, including remote work options and flexible schedules, to attract and retain top tech talent.

Talent and skills

- Telco: Telcos require a mix of technical and operational expertise, including network engineers and customer service professionals. They may also have a strong focus on compliance and regulatory knowledge.

- Techco: Tech companies attract a diverse range of talent, including software developers, data scientists, and engineers. They highly value technical skills, creativity, and problem-solving abilities.

Customer-centricity

- Telco: Telcos often prioritise customer service and reliability as their core values, given that customers rely on their services for communication and connectivity.

- Techco: Tech companies may prioritise user experience and customer feedback but can strongly emphasise rapid growth and market disruption.

Regulatory compliance

- Telco: Telcos operate in a heavily regulated environment, so compliance with industry regulations and government policies is a fundamental aspect of their culture.

- Techco: While tech companies must also comply with various regulations, they may have more freedom to disrupt traditional markets and experiment with new technologies.

It’s important to note that these are generalisations, and the culture within individual telco and tech companies can vary widely. Some telco companies may adopt a more tech-oriented culture, especially if they diversify their services into digital technology. In contrast, some tech companies may have a more conservative approach to certain aspects of their business. Culture is shaped by leadership, industry dynamics, and each organisation’s specific values and goals.

Charting the complex path

The blurring lines between telcos and tech companies signify a broader industry trend where adaptability and technological prowess are central to sustained relevance. As telcos face challenges of the complexities of this metamorphosis, the imperative lies in embracing change holistically, incorporating technological advancements, fostering a culture of innovation, and strategically addressing business fundamentals. The success of telco to techco transformation hinges on navigating these challenges while capitalizing on opportunities presented by a tech-centric future.

In conclusion, the journey from being a traditional telco to embracing the identity of a techco is a multifaceted transformation marked by challenges, strategic shifts, and cultural evolution. As telcos navigate this transition, they must redefine their service offerings, operational structures, and core cultural values. Integrating technology, innovation, and agility becomes paramount in fostering success in an increasingly dynamic business landscape.

About Intellias

Intellias is a global technology partner to Fortune 500 enterprises and top-tier organizations, helping them accelerate their pace of sustainable digitalization. Intellias empowers businesses operating in Europe and the US, as well as the MENA and APAC regions, to embrace innovation at scale. The company has been featured in the Global Outsourcing 100 list by IAOP, recognized by Inc. 5000, and acknowledged in Forbes and the GSA UK Awards. With two decades of experience, Intellias is geared towards ensuring the sustained success of clients on their value journey. For more information, visit www.intellias.com.