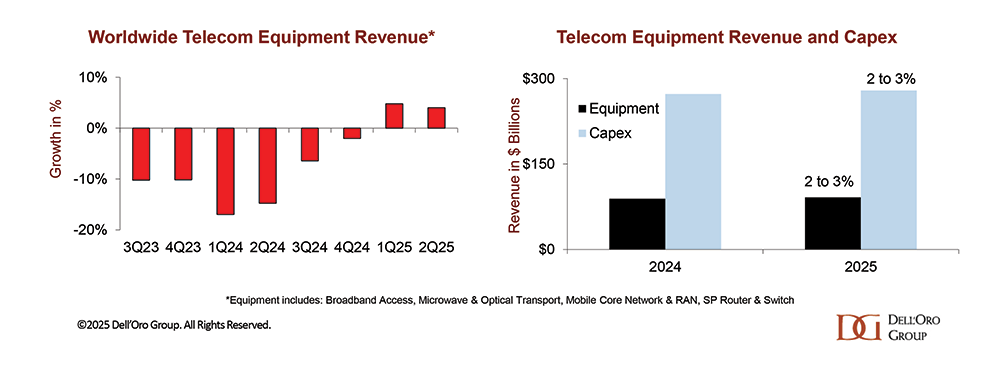

Dell’Oro says after two years of declining revenues, the pendulum is beginning to shift across six key sectors

After two consecutive years of falling investment in telecom equipment, the pendulum is finally starting to move the other way according to Dell’Oro. It says preliminary findings indicate that aggregate worldwide telecom equipment revenues across the six sectors it tracks increased 4% year on year in H1 of 2025. Outside of China,better market revenues led to increases of 8% year on year in the first half.

The six sectors are broadband access, microwave and optical transport, mobile core networks, the RAN and service provider router and switch. The research house says improved market conditions are driven by factors including easier year-on-year comparisons, inventory stabilisation and favourable currency movements.

The recovery was broad-based across all telecom programs; however, it is worth noting that mobile core networks, optical transport, and routers and switches for service providers led the gains.

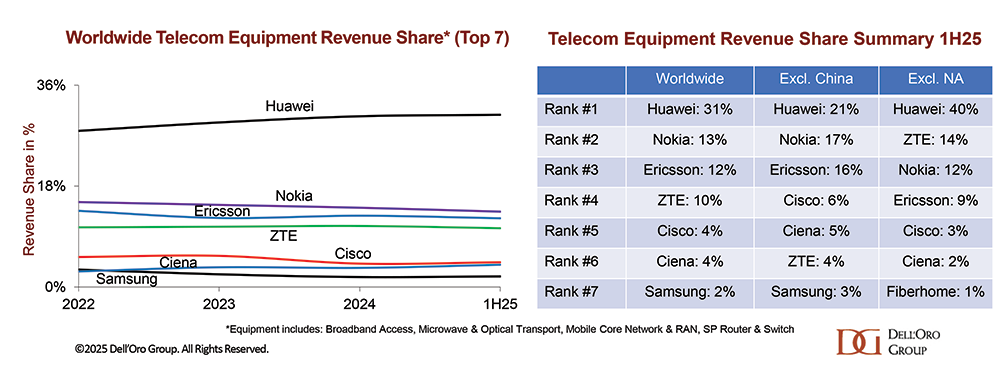

Dell’Oro noted that global supplier rankings remained largely unchanged, though revenue shares shifted modestly as Huawei continued to gain ground. Ericsson and Nokia saw slight declines compared with 2024 levels.

The short-term outlook has been revised slightly upward. The analyst team now expects global telecom equipment revenues across the six areas it monitors to grow 2% to 3% in 2025, compared with a flat outlook in the 2024 update.