Ericsson Mobility Report says mobile data increased 19% Q1 2024-Q1 2025 but rate of growth to slow; predicts 5G will carry 80% of global mobile traffic by 2030

The new Ericsson Mobility Report (June 2025) finds that fixed wireless access (FWA) has an increasingly strong appeal for communications service providers (CSPs) the world over. About 80% of the global CSPs sampled by Ericsson offer FWA services but the most rapid area of growth continues to be among those offering 5G-enabled speed-based tariff plans.

The report shows that 51% of CSPs around the world that offer FWA subscription include speed-based options – up from 40% on the same period in June 2024 – driven by high adoption in North America, and growth in Europe and the Middle East.

Ericsson concludes that the range of subscriber packages offering different speeds that can be bundled with entertainment options increases “monetization opportunities for CSPs compared to earlier generations of FWA”.

FWA is projected to account for more than 35% of new fixed broadband connections, with an expected increase to 350 million by the end of 2030. 5G FWA plays a crucial role in expanding broadband access, especially in areas where traditional wired infrastructure may be less feasible.

Fibre growing fast

The overall growth projection for global fixed broadband connections is that 1.6 billion broadband connections today will increase to 2 billion by 2030, with 550 million new connections in fibre, FWA and satellite.

More than a quarter of this increase is expected to stem from updating legacy infrastructure as consumers transition from DSL and cable to faster broadband options, resulting in a decline of about 150 million DSL and cable connections. The remaining three-quarters are predicted to come from new connections, fuelled by population expansion and initiatives to connect previously unconnected households.

The number of unconnected households is expected to fall to roughly 550 million – approximately 25% of the world’s households. The report points out that the potential for growth in fixed broadband extends beyond these numbers to secondary homes and small-to-medium-sized businesses, and concludes that by 2030, there will still be opportunities for modernisation and to connect the remaining unconnected.

5G subscriptions

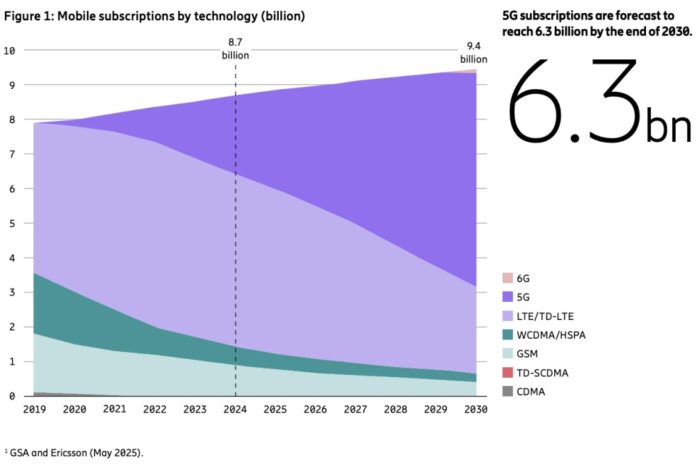

On 5G subscriptions, the report forecasts subscriptions will top 2.9 billion globally by the end of 2025 – about one third of all mobile subscriptions. The 5G subscription forecast for the end of 2030 remains at 6.3 billion.

Mobile network data traffic increased by 19% from the first quarter of 2024 to the corresponding period in 2025. Despite a declining growth rate, net added traffic will continue to increase year-on-year, with the report forecasting that mobile data traffic will more than double through the forecast period through the end of 2030.

5G networks handled 35% of global mobile traffic by the end of 2024, with forecasters expecting the figure to top 80% by the end of 2030.

In Europe, 5G mid-band coverage exceeded 50% of the population by the end of 2024. That figure puts the region in line with the global average but it lags far behind frontrunner countries. For instance, in North America 5G mid-band deployment covers more than 90% of the population and in India had reached 95% by the end of 2024.

5G Standalone

Through commentary, insights and customer/partner case stories, the report highlights the capabilities of 5G Standalone (5G SA) and 5G Advanced that offer monetisation opportunities for CSPs globally, based on value delivery rather than data volume.

CSPs are pursuing new commercial opportunities by offering differentiated connectivity services to consumers, enterprises and public authorities. Use cases include broadcast/video production, point of sale systems, events and arenas, gaming, FWA, virtual private networks and enterprise productivity.

The report includes in-depth articles including:

- Study on how GenAI will impact future mobile network traffic concludes the only applications with high adoption and high data rate requirements will impact the growth of traffic on mobile networks globally.

- Essay co-written with BT Group about the CSP’s launch strategy for 5G Standalone – More than a network upgrade. By the end of March 2025, BT’s 5G SA network was live and available to more than 28 million people across 50 major towns and cities in the UK, covering more than 40% of the population.

- Piece co-written with Sony on how the company works with new and disruptive technologies all the time to enhance the entertainment businesses. Dynamic slicing, in combination with APIs for Quality on Demand (QoD) will enable live media production over mobile networks, delivering great user experiences, Sony says.

Wave of innovation?

Erik Ekudden, Ericsson Senior Vice President and Chief Technology Officer, says: “We are at an inflection point, where 5G and the ecosystem are set to unleash a wave of innovation…Service providers have recognized this potential of 5G and are beginning to monetize it through innovative service offerings that extend beyond merely selling data plans. To fully realize the potential of 5G, it is essential to continue deploying 5G SA and to further build out mid-band sites. 5G SA capabilities serve as a catalyst for driving new business growth opportunities.”