GSMA’s Mobile Net Zero report shows progress but operators must accelerate efforts to halve industry emissions by 2030 and keep target of net zero by 2050 on track

The mobile industry’s operational emissions fell by 8% between 2019 and 2023, as mobile connections grew by 9% and data traffic quadrupled, according to the GSMA’s fifth annual Mobile Net Zero report.

The findings show the mobile industry has started to break the link between emissions from data and connectivity growth, in stark contrast to global emissions, which have increased 4% since 2019. However, to continue progress and reach net zero by 2050, emissions must fall by 7.5% annually until 2030, which is more than twice the average annual rate achieved so far.

Key findings from the report include:

• Preliminary data from 2024 suggests a further 4.5% drop in emissions – an acceleration on previous years, but still short of the 7.5% annual reduction needed to 2030

• 37% of electricity used by operators disclosing to the Carbon Disclosure Project (CDP) came from renewables in 2023, up from 13% in 2019, avoiding 16 million tonnes of emissions

• 81 mobile operators (covering nearly half of global connections) have set or committed to science-based targets

• The GSMA Climate Action Taskforce includes 77 operators, covering 80% of mobile connections worldwide

• Europe (-56%), North America (-44%), and Latin America (-36%) lead the way in operational emissions reductions between 2019 and 2023

• New analysis of China shows operational emissions likely fell by 4% in 2024 – the first decline after a 7% rise between 2019–2023 – alongside a more than quadrupling of renewable energy use.

Global, collaborative climate action gathers pace

The acceleration in decarbonisation is driven by operators’ actions to improve the efficiency of how networks consume energy and their transition to clean energy, including solar and battery storage. Many operators are phasing out less efficient legacy networks and reducing their reliance on diesel generators.

Some markets are seeing better access to renewable electricity through policy support and market reform, but the GSMA warns that the accelerated reductions needed by 2030 will require greater access across more markets.

New analysis published today to frame discussions at MWC25 Shanghai indicates China’s operational emissions declined for the first time in 2024, with preliminary data showing a 4% reduction year-on-year driven by a more than quadrupling in renewable energy use by operators. As the industry’s largest single market, China’s progress is instrumental in achieving global net zero targets.

Scope 3 is the key

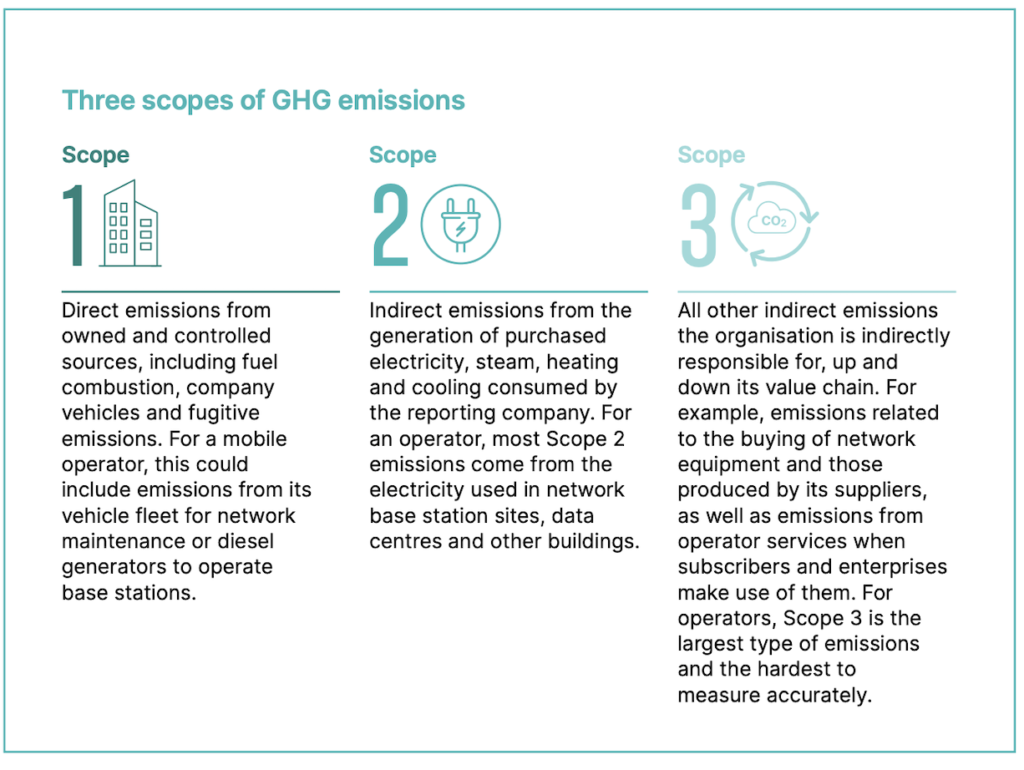

The report emphasises that Scope 3 emissions – mostly from supply chains and manufacturing (see infographic below from the report) – account for more than two-thirds of the industry’s total carbon footprint and require attention. While transparency is improving, Scope 3 emissions remain a blind spot compared with operational emissions (Scopes 1 and 2), making them a critical challenge for operators with science-based targets, which require reductions across full value chain emissions.

Operational emissions in 2023 were around 125 million tonnes (Mt) CO2e (MtCO2e), equivalent to just 0.2% of global GHG emissions

Industry-wide emissions from mobile operators were estimated based on operator data disclosed to the CDP and corporate reports covering a combined 82% of global mobile connections.

The mobile industry’s operational emissions (Scope 1 and Scope 2 market-based) were an estimated 125 million tonnes (Mt) CO2e in 2023, equivalent to around 0.2% of global GHG emissions6. Operational emissions account for around 30% of the industry’s global carbon footprint (Figure 4). Value chain emissions (Scope 3) were an estimated 290 MtCO2e, or 70% of the total emissions of the industry. A total of 93% of Scope 3 emissions came from six out of the 15 Scope 3 categories: 1) Purchased goods and services; 2) Capital goods; 3) Fuel- and energy-related activities; 8) Upstream leased assets; 11) Use of sold products; and 15) Investments.

Circular argument

Additionally, the report points to growing momentum around circular economy initiatives. Consumers’ appetite for sustainable devices is rising, with around 90% of users surveyed by GSMA saying they value longevity and repairability, and nearly half considering refurbished for their next phone purchase.

Buying refurbished instead of new can save consumers money and reduce environmental impacts from manufacturing, with refurbished phones generating 80-90% fewer emissions than new ones. While new device sales have slowed in recent years, the second-hand device market is growing rapidly, and projected to be worth $150 billion by 2027.

Many leading operators are now developing climate transition plans to assess climate risks and map out credible, long-term strategies toward net zero. These plans are expected to become a key focus of the GSMA’s Climate Action Programme over the coming year.

Steven Moore, Head of Climate Action at the GSMA, comments: “This is a global effort, and it’s encouraging to see momentum building across every region…Supply chain emissions, which make up most of our industry’s footprint, must also be addressed – and climate transition plans will play an increasingly important role in navigating what comes next.”