Analyst house projects private 5G investments to grow 41% annually to over $5 billion by 2028, led by Industry 4.0 deployments, though the forecast may be optimistic

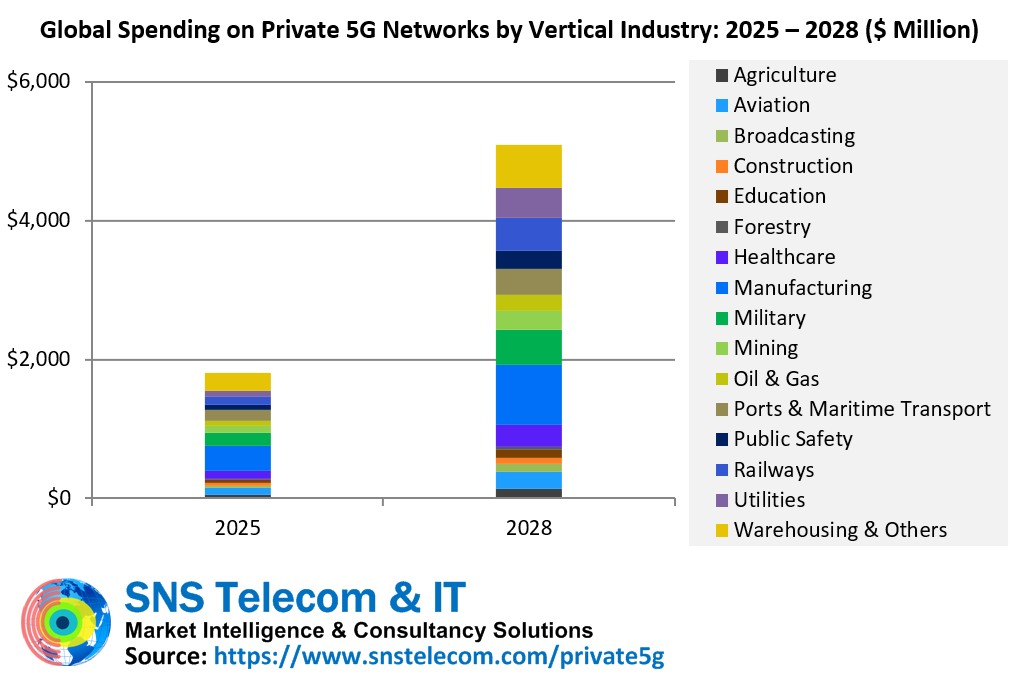

Private 5G is moving from early pilots to mainstream deployment, with the latest figures from SNS Telecom & IT pointing to an eye-catching surge in spending over the next few years. In its latest research report, the analyst firm projects that annual investments in private 5G networks for vertical industries will grow at a stinking 41% CAGR between 2025 and 2028, surpassing $5 billion by the end of that period.

Much of this initial momentum, SNS says, will come from highly localised networks serving Industry 4.0 use cases in manufacturing and process industries. If correct, SNS’s projection would put private 5G growth on a par with some of the fastest-expanding tech markets of recent decades. A 41% CAGR means the market would almost triple in just three years, from roughly $1.8 billion in 2025 to $5 billion in 2028.

That sort of expansion is possible in emerging technologies, but it assumes smooth regulatory conditions, rapid ecosystem maturity and clear returns on investment for enterprises. In a capital-intensive segment with often lengthy integration timelines, some industry watchers will see that forecast as ambitious.

Private LTE networks have been around for more than a decade, with early examples including iNET’s deployments in the Permian Basin, Tampnet’s offshore coverage in the North Sea, and Rio Tinto’s networks in Western Australia. But private 5G, based on the latest 3GPP specifications, offers significant advances over LTE: higher throughput, lower latency, more reliable connections, and support for massive machine-type communication (mMTC) and ultra-reliable low-latency communication (URLLC).

While you can argue that some of these characteristics are yet to see live deployments, overall the improvements make 5G a more credible substitute for wired networks in industrial IoT environments.

China leads

China remains the most advanced market, with extensive deployments in factories, power plants, ports and mines. State-backed rollouts for companies such as Baosteel, China Huaneng Group and Great Wall Motor already incorporate features from 5G-Advanced, including deterministic networking and multi-band connectivity for real-time industrial control. Chinese expertise is increasingly being exported to overseas projects, from Thai manufacturing facilities to African mining operations.

Elsewhere, private 5G adoption is growing in the US, Europe, Japan, South Korea, Taiwan, Australia and Brazil. Applications range from autonomous guided vehicles in warehouses and augmented-reality-assisted maintenance to remote-controlled cranes, wireless vehicle software flashing, and beyond-visual-line-of-sight drone operations. In healthcare, private 5G has even supported virtual neonatal intensive care unit visits for parents.

A major enabler has been spectrum liberalisation. Countries including the US, Germany, the UK, Japan and Australia have opened up mid-band 5G frequencies through shared or local licensing, letting enterprises contract directly with vendors such as Ericsson, Nokia, Huawei, ZTE, Samsung and NEC, or with smaller suppliers including Celona, Mavenir, JMA Wireless and Airspan Networks.

Leaving it to the experts

National mobile operators also are in on the act, often combining private and public capabilities in hybrid solutions. Systems integrators – NTT, Fujitsu, Accenture, Capgemini – have positioned themselves as delivery partners, while neutral-host providers like Boldyn Networks and Boingo Wireless are carving out enterprise niches. SNS estimates that more than two-thirds of private 5G contracts are fulfilled via integrators and service providers rather than direct vendor sales.

Reported returns from early adopters are strong according to SNS: manufacturing plants claim productivity and efficiency gains of between 20% and 90%; one warehouse achieved a 55% labour-cost saving; a rail terminal cut opex by 40%; and an oil refinery reduced accidents and emissions. These are detailed in the report. Increasingly, private 5G is being specified at the design stage for greenfield projects – from Hyundai Motor’s HMGMA plant in Georgia to Formula 1’s Las Vegas complex and Cleveland Clinic’s Mentor Hospital.

Low-band private 5G

SNS also expects private 5G adoption to accelerate in sub-1 GHz wide-area critical communications networks for public safety, utilities and railways. Many of these currently run on LTE, GSM-R or other legacy narrowband systems, but as 5G-Advanced matures toward the latter half of the forecast period, migration is likely to speed up.

The vendor landscape is shifting fairly rapidly. Consolidation is already under way: Airspan Networks has taken over Corning’s small-cell and DAS portfolio; HPE bought Athonet; Boldyn Networks acquired Edzcom and SML; and Australian operator Vocus purchased Challenge Networks. Start-ups are still raising significant capital – Celona has secured $135 million to date – but some hyperscalers are retreating from the segment, with AWS Private 5G winding down and Microsoft’s Azure Private 5G Core due to retire in 2025.

The SNS forecast reflects undeniable momentum: high-profile names are committing to deployments, regulatory frameworks are opening up, and industrial case studies are delivering measurable gains. But whether the global market can sustain 41% annual growth in such a capital-intensive infrastructure category is less certain.