Ups the ante on telcos monetising AI, leveraging it as a strategic enabler to drive sustainable growth

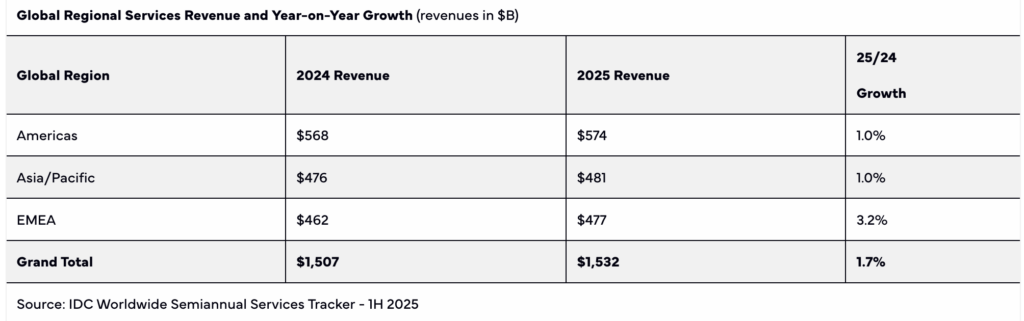

Worldwide spending on telecommunication and pay TV services will reach $1,532 billion (€1,324.68) in 2025, representing an increase of +1.7% year-on-year. This is according to the International Data Corporation (IDC) Worldwide Semiannual Telecom Services Tracker. The latest forecast is slightly more optimistic compared to the forecast published earlier this year, as it assumes a 0.1 percentage point higher growth of the total market value.

“The regional dynamics remain mixed, with inflationary effects, competition, and Average Revenue per User (ARPU) trends playing a central role in shaping market trajectories,” says Kresimir Alic, Research Director, Worldwide Telecom Services at IDC.

The breakdown by telecom service type confirms that established trends remain intact, despite adjustments to overall market forecasts. Mobile continues to dominate, driven by rising data consumption and the expansion of M2M applications, which are offsetting declines in traditional voice and messaging revenues.

Fixed data services

Fixed data services are also expected to grow steadily, fuelled by increasing demand for high-bandwidth connectivity. In contrast, spending on fixed voice services will continue to decline, as losses in legacy TDM voice are not being compensated by gains in IP voice. While the traditional Pay TV segment is projected to contract slightly due to the rise of VoD and OTT platforms, these services will still play a key role in bundled offerings from telecom providers globally.

The global connectivity services market is projected to grow at a compound annual rate of 1.5% over the next five years, maintaining a cautiously optimistic outlook. As highlighted by recent IMF forecasts, the overall market environment is expected to be less stimulating than in previous years, shaped by rising protectionism and persistent economic uncertainty in key regions.

Cost pressures

While declining inflation may ease cost pressures, it is also likely to reduce the inflation-driven boost to telecom service spending seen in recent cycles. Political instability in areas such as Eastern Europe and the Middle East adds further complexity to the growth landscape. Most notably, saturation in mature telecom markets continues to be the primary constraint on expansion, limiting upside potential in traditional service segments.

“Our outlook for the Asia Pacific telecom market has been modestly downgraded, reflecting economic uncertainty in key countries such as China, Japan, and Indonesia,” states Alic. “On the other hand, India continues to outperform, with exceptional growth in mobile ARPUs pushing the market toward double-digit expansion and helping offset regional value erosion.

In the Americas, expectations for the northern part remain largely unchanged, with slight upward revisions in major Latin American markets. The EMEA region has seen only marginal downward forecast adjustments, but it is still projected to outpace other regions – driven primarily by hyperinflation in markets like Turkey, Egypt, and Nigeria, where nominal growth rates are in the high double digits.”

Marginal improvement

In this environment, operators are expected to shift focus toward margin improvement, operational efficiency, and monetization of emerging technologies to sustain shareholder value. Leading telecoms are therefore deploying AI across network operations, customer service, and fraud prevention to drive efficiency and reduce costs.

These initiatives are already contributing to EBITDA margin gains, with predictive maintenance and automated support systems leading the way. AI also enables personalized offerings and dynamic pricing, boosting ARPU and reducing churn. Fraud detection systems enhanced by AI are helping reduce losses, reinforcing customer trust and regulatory compliance.

With AI accelerating time-to-market for new services, telecoms can better monetise emerging technologies like 5G and edge computing. In the longer term, as AI continues to evolve, it will be increasingly recognised not as a mere technological enhancement, but as a strategic enabler poised to drive sustainable growth for telecommunications operators.