Ericsson Mobility Report finds 33 providers are offering some kind of differentiated connectivity and there are 65 live commercial services with Europe leading

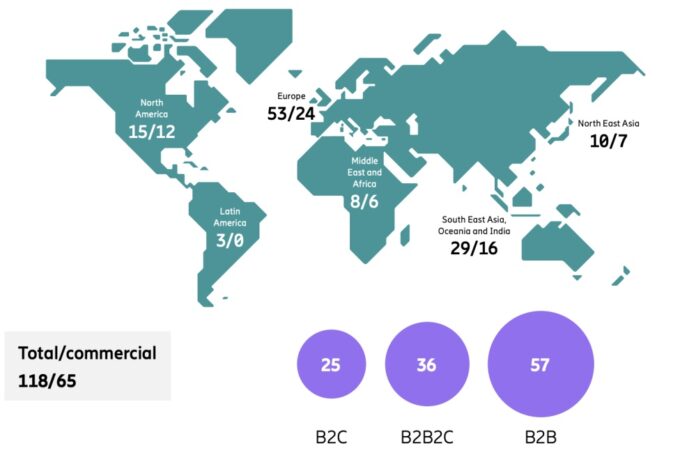

Network slicing is on the up. Some 33 communications service providers (CSPs) are offering a variation on the theme, according to the latest Ericsson Mobility Report. The research identified 118 examples of network slicing and 65 are offering slicing as a commercial services, either as specific subscription services or as add-on for consumers or enterprise customers.

The latest study covers more than 300 service providers across 134 markets and shows a significantly higher number of launches than found in previous studies. The growth is attributed to the accelerating deployment of 5G standalone (5G SA) networks after a slower than expected start.

In the parts of Europe where service providers have deployed 5G SA, they are increasingly active. The region accounts for 45% of all network slicing-related activities globally, including trials, proofs-of-concept and commercial offerings. Proportionally, there are more tests and trials in Europe than in other regions such as Asia-Pacific andNorth America.

Not just the tech

However, although the report attributes progress to advances in network capabilities it also highlights “greater confidence among service providers, with an increasing willingness to explore new monetization models beyond traditional data and speed tiers. The extent of engagement is notable, with many service providers now active in several categories simultaneously.”

Other key findings are that strong growth in both scale and diversity of offerings in network slicing, and that ‘marketing innovations’ – like in-the-moment offers – can seriously outperform traditional channels. Parameters for services can include latency guarantees, priority services, security enhancements, immersive experiences or connectivity targeting specific situations and locations

or app categories.

First mover advantage

The report notes that, service providers that were first to introduce differentiated connectivity, some as early as 2022, have now scaled up their deployments and started to broaden their reach. Across the 65 commercial offerings based on network slicing, half of them are offered by only six service providers.

Two of the service providers have 17 of the commercial offers combined, including both B2C and B2B segments. According to Ericsson’s research this scaling up indicates that the initial launch phase has been successful enough to justify expansion.

The variety of current business models – from guaranteed service tiers for broadcasters to secure connectivity for defense applications – shows both the adaptability of the approach with differentiated connectivity offerings and the market’s appetite for specialised solutions.

B2C and B2B

In the B2C sphere, application or situation-focused services such as video conferencing, gaming, event-specific packages and premium fixed wireless broadband subscriptions make up around

55% of all offerings.

In the B2B area, vertical markets like public safety, transport and logistics, defence and general enterprise use cases dominate.

Out of all commercial offerings globally, 37 and 36% are in Europe and Asia-Pacific, respectively. North America constitutes 18% of the offerings, with just one service provider accounting for three-quarters of all deployments in that region.

The report’s findings on network slicing conclude that the challenge may no longer be whether these services can be launched, but how best to communicate their unique benefits to users, transforming technical capabilities into experiences and outcomes that customers truly value and are willing to purchase.