Orange has released Q1 results of its European operations, following Everything Everywhere's separate results announcement yesterday. Here are the highlights, on a country by country basis, of its mobile operations.

FRANCE

Despite the apocalyptic reaction to Free Mobile's launch – a fear frenzy that Orange itself did nothing to dispel – the operator saw its net customer numbers decline by a manageable 0.7% over the quarter, although losing 2.5% of its base to Free over the quarter is certainly a worry.

Orange said that translated to a decline in market share of 1.5 percentage points in the first quarter, but added that since mid-March the number of portability requests has returned to the level of the fourth quarter 2011.

So, by 21 March 2012 Orange had 26,475 million mobile customers in France. However, the number of contract customers (19.066 million) rose 0.9% year on year, despite the net loss of 387,000 customers in the first quarter of 2012. This appears to suggest that Orange was mainly bleeding prepaid customers to Free.

Interestingly, the total number of MVNO customers hosted on the Orange network barely shifted, dropping from 3,066,000 to 3,062,000.

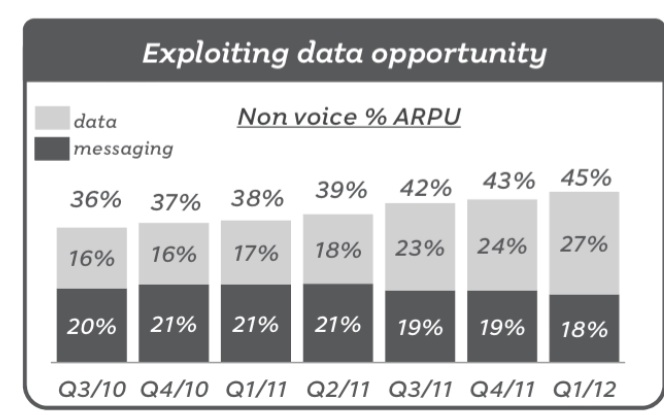

Overall mobile revenues were up 3.8%. Revenues from mobile services showed a 0.5% increase, excluding the impact of regulatory measures – in other words declined slightly. Orange said that growth in data services, as well as the rapid development of national roaming in the first quarter of 2012 (ie its revenues from its contract as Free's national roaming partner) offset decline in mobile voice revenues (that pesky regulation), which became more pronounced in the first quarter of 2012.

Total ARPU was €367, which translates to a per month figure of €30.5. That was down slightly form monthly ARPU of €32 in 2011. For comparison, Everything Everywhere's monthly ARPU is around the £23 mark.

Investment in networks, which represented 53% of the Group’s CAPEX in the first quarter of 2012, rose 4.6%, in particular with the acceleration of investment programmes in HSPA+ and LTE.

SPAIN

Despite the depressing macro economic situation, mobile revenues rose 3.5% to 797 million euros, excluding the impact of regulatory measures (those pesky MTR cuts worth -20 million euros, the operator said). That growth was a reflection of a mobile customer base that also grew 3.5% year on year, to just under 12.5 million.

Once again, it was data that drove revenues, rising 20.7% in the first quarter of 2012 as the number of data services users (smartphones and 3G modem sticks) more than doubled in one year, reaching 3.737 million at 31 March 2012, compared with 1.679 million one year earlier. The hosted MVNO customer base also rose 12.1% year on year to 1.443 million customers at 31 March 2012.

Total ARPU of €21 was slightly down on 2011, but not by much at all. Capex investments were mainly a continuation of the mobile access network renewal plan.

POLAND

Poland also produced some decent results for Orange. Mobile revenues rose 2.6% to 440 million euros, expand the total mobile services customer base (14,613 million customers at 31 March 2012, excluding MVNOs) rose 1.3% in one year, led by a 3.1% increase in prepaid offers (7.685 million customers at 31 March 2012). Data services also rose with 31% growth in the number of smartphones in one year. Orange Poland maintained its leadership with an estimated market share of 30%.

Monthly ARPU in Poland again fell slightly, to €9.75.

REST OF EUROPE

In Europe, revenues rose 0.4%. Revenues in Belgium grew 2.3%, led by data services and smartphone sales. In Romania, revenues improved with the growth of the contract customer base (+3.5% year on year), rising 0.1% overall, in contrast to the 1.8% decline in the second half of 2011. Moldavia and Armenia also reported steady growth of their contract customer bases. Slovakia reported a 9.4% decline in revenues, partly due, Orange said, to non-recurring items in the first quarter of 201.