Backhaul and international transit savings; leading Unified Comms provider in the enterprise

Vodafone's acquisition of Cable & Wireless Worldwide will create the UK's second biggest telco, a leader in enterprise unified communications services in the UK, and enable network efficiencies for Vodafone internationally, CEO Vittorio Colao told analysts on a call this morning.

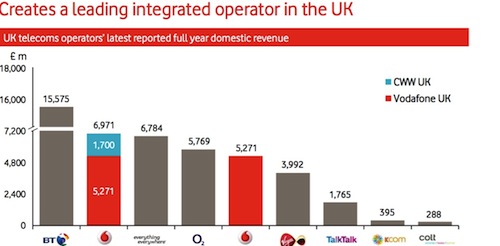

A combined company would move Vodafone from number four to number two in the UK market, Colao said, with revenues of £6.9 billion. That makes it just bigger then Everything Everywhere (£6.7 billion) and number two to BT (£15.5 billion).

The operator also said that the deal would enable it to become the leading enterprise communications services provider, and enable it to strengthen its Unified Communications abilities, an area it had previously identified as a strategic priority for the business.

"It's clear that fixed services remain important for enterprise in the future, so the ability to serve both is important for us, and will allow us to leverage additional capabilities in Unified Communications. We have said for two years that enterprise UC is our strategic focus, so we see this as a strengthening of our capabilities in this area," Colao added.

The acquisition of C&W's network will also change the way in which Vodafone manages its mobile backhaul. It said that C&W fibre comes within 100m of a third of its base stations. This makes it likely that Vodafone would look to move away from leasing capacity to those stations, to owning their own backhaul links. Vodafone said that it would consider running fibre direct to base stations that fall within that 100m range.

(Just for comparison, when Everything Everywhere signed its deal with Virgin Media Business, it said that Virgin's network came within 200m of half its base stations.)

Vodafone has a current backhaul deal with BT. It is also the host provider for mobile airtime and data connectivity BT sells to enterprise customers. Colao said his "first call" after the investor briefing would be to BT's Ian Livingstone. But he said he saw no reason why Vodafone shouldn't continue its relationship with BT, both as customer and as provider. In fact, Colao said, in his view "BT should be happy" to see further rationalisation in the UK telco market.

Outside of the UK, Vodafone will look to take advantage of C&W's international network, to carry its own global traffic and to improve its service offer to others. The acquisition would move Vodafone's peering position up from 45th globally to 28th. That would "significantly improve our sales opportunity and IP transit cost reduction" according to Vodafone.

Colao said that it was clear that C&W' had strengths in its network, IT and provisioning platforms of C&W but that there were also areas of under-investment. Vodafone envisages making some investment in the first 2-3 year to strengthen those platforms, and has already embedded the cost of that in its offer price.

Vodafone will operate a two-phase integration strategy, with the first phase keeping the business separate, but with a steady migration of Vodafone traffic into the C&W network. The operator will also create join enterprise account teams.

The full integration phase would see the operators' two networks integrated, with a combined UK network infrastructure and Vodafone's Group function taking control of international assets. That phase would also see the merger of management, sales and services teams, with C&W's regional operational assets integrated into Vodafone's offices.

Vodafone said in its bid offer that "following the completion of the Offer, there is likely to be a reduction of headcount and places of business where there is administrative or operational overlap although specific individuals and locations have not yet been identified by Vodafone."

(Chart from Vodafone: UK Telecoms operators – last full year revenues)