Microwave backhaul vendor DragonWave recently launched a new product called Avenue.

Avenue is an integrated RAN/backhaul product designed for small cell backhaul. Keith Dyer was given a brief glimpse during 4G World.

Microwave backhaul vendor DragonWave recently launched a new product called Avenue.

Avenue is an integrated RAN/backhaul product designed for small cell backhaul. Keith Dyer was given a brief glimpse during 4G World.

The UK’s Ministry of Defence has announced plans to sell blocks of spectrum at 2310-2400MHz and 3410-3600Mhz. The spectrum will be made available to the market in 2013/14 and 2015/16 respectively.

Until then, some of the spectrum will be made available on a short term lease basis, with spectrum between 3500-3580MHz made available for “short term” sharing. Interested parties are being asked to lease that spectrum in that block for the next three years, until it goes for sale in 2015/16. The MoD said that spectrum at 3480MHz may also become available for sharing on a lease basis in 2012/13. Spectrum sharing within Olympic areas will be “unlikely” until 2012, the MoD said.

The sale of spectrum is part of a stated government policy to free up and sell 500 MHz of spectrum below 5 GHz by 2020, with the goal of raising money for the UK Government.

The Ministry is also “considering offering” limited access in other bits and pieces of spectrum, at:

A Ministry spokesperson said that the MoD wants to gauge interest in these spectrum bands before proceeding with Ofcom clearance to start sharing. Those interested in these bands are requested to register interest by 16 December 2011.

Alastair Davidson, Managing Director of Government, Mobile and Enterprise at Arqiva, said that the spectrum release was a “step in the right direction” but questioned whether companies would see value in a three year lease of spectrum, without certainty they would gain ownership of those frequencies in the long term.

He pointed out that the band being made immediately available, 3500-3580 MHz is used for mobile broadband services in some parts of the world, so equipment is available, making these “potentially valuable bands”. But Davidson described the lease time frame as a “stop gap that is really not very helpful.”

The MoD’s spokesperson, however, said that there had already been commercial interest in rural and urban applications using the spectrum on the leased basis. “We’ve certainly had some interest, there’s a market for it,” the spokesperson said.

Airvana has today announced the “successful demonstration of the world’s first end-to-end LTE femtocell solution” in partnership with Hitachi Communications Technology Americas. Airvana said that the live demonstration was conducted for a Tier 1 Mobile Service Operator in September 2011.

The end-to-end solution used commercially available LTE terminals, the Airvana LTE femtocell, the Hitachi HeNB Gateway, and Hitachi’s commercially available Evolved Packet Core (EPC) solution. The demonstration included performance tests as well as live video streaming and internet browsing.

An LTE femtocell, also known as a Home eNode B (HeNB), provides LTE base-station functionality in a very small, cost-effective form factor to ensure maximum LTE performance to users inside businesses and homes. In wireless networks where data demands are constantly outpacing existing infrastructure, LTE femtocell solutions enable the efficient handling of LTE data traffic while minimizing the signaling load to the existing EPC elements in the core network.

“Airvana has a history of innovation, with the first 3G CDMA femtocell, the first IMS-based femtocell, and the first standards-based, open femtocell management system,” explained Michael Clark, Airvana’s General Manager for femtocells. “Being the first vendor to successfully complete an end-to-end LTE small cell demonstration is another tremendous accomplishment and proves the readiness of our LTE femtocell network architecture, soon to be introduced into commercial LTE networks,” added Clark.

Airvana and Hitachi have partnered in the past to provide end-to-end CDMA femtocell solutions; the partnership is now extended to LTE. “The HeNB Gateway leverages the Hitachi ER5000 MME’s proven subscriber and mobility management software and demonstrates the innovative architectural flexibility of Hitachi’s solution. We are pleased to provide this product as part of the end-to-end LTE femtocell solution with Airvana,” said Don Keeler, VP of PLM & Business Development, Hitachi Communication Technologies America, Inc.

“In addition to the LTE femtocell, Airvana provides a standards-based femtocell management system for automated configuration, radio interference management, and monitoring of both CDMA and LTE femtocells,” noted Michael McFarland, Airvana’s Senior Director of Product Management and Marketing. “This platform is already managing hundreds of thousands of multi-mode 1x/EVDO CDMA femtocells in commercial wireless networks and is being extended to support LTE.”

How will Sprint move users onto LTE? What will it do with its WiMax service and spectrum? Are there any real differences between vendors of LTE technology?

As European operators grapple with their own plans for LTE, and whine about spectrum harmonisation and availability, spare a thought for this guy. He’s got CDMA users, old iDen customers from Nextel kicking about, a WiMax network serving Clearwire customers, and two strong competitors piling forward with high profile “4G” campaigns.

So Keith Dyer spoke to Sprint’s SVP Networks, Bob Azzi, to find out how the number three US operator is handling a change of direction in its LTE deployment, and how he sees its spectrum management working out. Does Azzi think he’s delivering a network that gives Sprint the best chance to succeed?

Well, yes, he does – although he admits the operator is forced to take a pragmatic approach due to the disparate assets it holds.

Tekelec the mobile broadband solutions company, announced today that it has entered into a definitive agreement to be acquired by a consortium led by Siris Capital Group, LLC and including affiliates of The ComVest Group, funds and accounts managed by GSO Capital Partners LP, Sankaty Advisors LLC, ZelnickMedia and other Siris limited partners and affiliates. The transaction is valued at approximately $780 million.

Under the terms of the agreement, all outstanding shares of Tekelec’s common stock will be acquired for $11.00 per share in cash, representing an 11% premium over the closing price on November 4, 2011, and a 38% premium over the 30 day trading average closing price of Tekelec common stock. The deal is expected to close during the first quarter of 2012, pending shareholder approval, regulatory approvals and customary closing conditions. Tekelec’s management team is expected to remain in place, and Merle Gilmore, former President of Motorola’s Communications Enterprise and Chairman of the Board of Airvana Network Solutions Inc., will serve as Tekelec’s Executive Chairman following the closing.

“Our customers can expect the same level of innovation and quality from our market leading products and our global team,” said Ron de Lange, President and CEO of Tekelec. “In addition, the acquisition will provide us even greater flexibility to deliver best-in-class solutions for the mobile data and video market, with an unwavering focus on our global installed base of over 300 customers.”

Tekelec’s Board of Directors unanimously approved the transaction and recommended that the Company’s shareholders approve the transaction. Siris Capital Group, LLC focuses on the technology, telecommunications and healthcare industries. The investor group has secured committed financing, consisting of a combination of equity and debt financing.

“Tekelec presents a unique opportunity to acquire market leading products in the Signaling, Policy, and Diameter Routing markets, a global customer base that includes 16 of the top 20 wireless service providers, and a highly skilled employee workforce,” said Merle Gilmore. “We will continue investing in and building on Tekelec’s reputation for innovation, scalability and reliability to extend the company’s mobile data products to new markets and applications.”

Goldman, Sachs & Co. is acting as financial advisor, and Bryan Cave LLP and Akin Gump Strauss Hauer & Feld LLC are acting as legal counsel to Tekelec. Perella Weinberg Partners and Macquarie Capital are serving as financial advisors, and Simpson Thacher & Bartlett LLP is serving as legal counsel, to the acquirer.

The French regulator Arcep has released its quarterly numbers on the mobile market in France.

I’ll try to pick out some of the more interesting nuggets from in amongst the columns and rows of numbers.

1. Has SMS peaked?

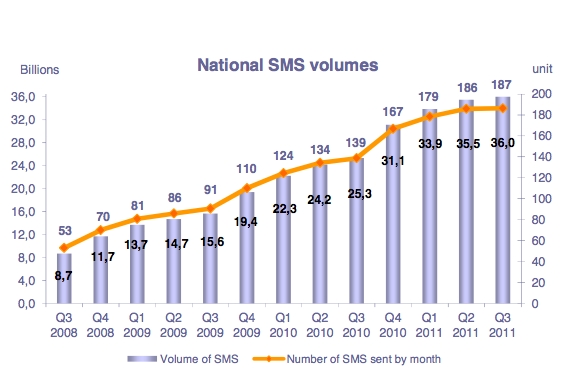

One item which I noted was this chart showing the slow down in growth in SMS volumes.

If you look you will see that the average number of SMS sent per user is beginning to stall, with only a very slight growth in the July/August/September quarter. There were 187 messages per subscriber in the quarter, compared to 186 per sub in the previous quarter. Total volumes stood at 36 billion, compared to 35.5 billion in the previous quarter. There may be some seasonality to this, with the French holiday season falling within the quarter, but it will be interesting to see what the next quarter holds. It will include Christmas, of course, which always generates a boost to SMS volumes — see the leap in Q4 2010 from 139 messages per user to 167 per user — but the overall direction should still be evident.

The question is, do flatlining or falling SMS volumes matter to the businesses of mobile operators? Do we see a consequent drop in either revenues or profitability? Do operators in fact benefit from uptake alternative mobile messaging technologies, as users take to Facebook and Twitter, and IM services on their mobiles? Does that drive smartphone and data package adoption in kind, and if it does so, does that form a more profitable line of business for mobile operators than SMS – which is increasingly being flung in as “unlimited” in many tariffs?

2. France now has a 100% penetration rate of active connections

Arcep reckons there are now 64.9 million active mobile connections in France, exactly the same number of people as live in France, according to INSEE. This level of saturation means that growth is slow, but still steady. There are now about 1.5 million more connections in France than this time a year ago, with the Christmas quarter still around the corner.

3. “Internet” and M2M SIMs still under-exploited

Of the 64.3 million “Metropolitan” connections, “only” 3.1 million of those are M2M SIMs, with a further 3 million embedded “internet” SIMs in the market. Although these are not small numbers, they show the level of growth opportunity that exists for embedded and M2M connectivity.

4. The rise of the MVNO

10.6% of French mobile connections are now managed by MVNOs, compared to 6.9% a year ago, and 5.6% two years ago. Much more startling is that the MVNO share of gross prepaid sales stood at 34.9% over the quarter. while MVNOs were responsible for 18.7% of all postpaid sales in the quarter.

Kontron’s Sven Freudenfeld tells Keith Dyer how his company’s integrated DPI packages can help operators speed up time to market for IPTV and mobile content delivery services.

Read more about Kontron’s solutions in this area.

(This is a sponsored video)

Kontron’s Sven Freudenfeld tells Keith Dyer how his company’s integrated DPI packages can help operators speed up time to market for IPTV and mobile content delivery services.

Read more about Kontron’s solutions in this area.

(This is a sponsored video)

Telefónica today announced that it has signed a strategic partnership with Quantenna Communications, a leader in ultra-reliable Wi-Fi networking for whole home entertainment. The partnership sees Telefónica making a strategic equity investment in Quantenna which gives it access to the latest Quantenna technology for the deployment of high performance video services to the home.

New services with high interactivity, low latency and huge bandwidth demands (such as high definition video), plus the increasing proliferation of connected devices in the home (many of those mobile) challenge today’s network technologies. As network operators start to roll out fibre services to customers’ homes, capable of delivering speeds of up to 100 Mbps, there is a looming bottleneck on the limited capabilities of current wireless technologies.

Quantenna has the networking expertise to bridge this capability gap and allow high quality video to be deployed wirelessly to multiple devices around the home. Quantenna’s family of Full-11n™ 5GHz chipsets uses the company’s cost-optimized, third-generation 4×4 MIMO technology to deliver up to 600 Mbps of bandwidth. The chipsets enable manufacturers to build products for delivering IPTV and other video streaming and data distribution services throughout the home over an ultra-reliable, high-performance Wi-Fi connection.

“Investing in up-and-coming technology companies is a core part of the Telefónica Digital strategy as we look to build our capabilities in order to succeed in the digital space,” said Matthew Key, Chairman & CEO, Telefónica Digital. “Quantenna’s technology will be a core component of our growth strategy for IPTV deployments in Europe and Latin America.”

Enrique Blanco, Chief Technology Officer at Telefónica, added, “Quantenna is a highly innovative company that has identified the looming capability gap between fixed and wireless networks and developed the solution to bridge it. Access to their technology will enable Telefónica to continue to meet the future home networking needs of our customers across our operating businesses.

“This strategic partnership and funding will enable us to expand our product offering for carrier-grade wireless IPTV services globally, as we continue to strengthen our industry-leading, 4×4 MIMO technology leadership position,” said Sam Heidari, chief executive officer for Quantenna.

The investment in Quantenna has been led by Telefónica Ventures, a division of Telefónica Digital, with offices in Silicon Valley, London, Madrid and Israel.

Telefónica Digital has been formed to lead Telefónica’s growth strategy in the new digital world. Through a combination of research and development, partnership, investment and acquisition it will bring innovative products and services to market that allow it to drive continued growth in the core telecommunications market, as well as taking a leading role in new digital services such as entertainment, financial services, M2M, cloud computing and eHealth.

Swisscom is launching an LTE pilot in seven tourism areas. The area around Davos is already connected, the operator said, with six other areas due to be be connected by the end of December.

The pilot is scheduled to end in mid-2012: pilot regions include Davos, Grindelwald, Gstaad, Leuk-les-Bains, Montana, Saas Fee and St-Moritz/Celerina. Customers will be able to test the network using a USB key for use on their laptops. From January 2012 some Swisscom shops will also be offering trails of the service. For now, Swisscom aims to establish the offerings to customers in the pilot project.

The operator said that the pilot should allow it to ensure optimal user experience for a fuller LTE launch in Switzerland, which will not come until after frequency reallocations have been made in Spring 2012.

When it does launch more widely, Swisscom said it would initially focus on heavily-used sites, with the exact procedure dependent on the frequency reallocation. In addition, Swisscom will continue to expand its existing mobile network to 42 Mbps HSPA network.