Tellabs predicts end of profit on data traffic by 2015 for Western European operators

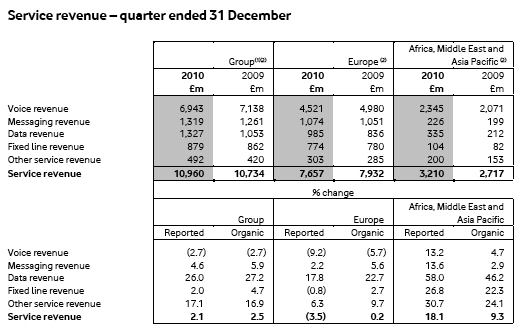

Today, Vodafone released quarterly results that showed the company to be on course to make “towards the upper end” of its £11.8 to 12.2 billion annual profit forecast.

Its service revenue figures for the quarter ended December 31, 2010, showed that the biggest driver of revenue growth was data, which was up 27.2% and had overtaken Vodafone’s income from messaging.

Vodafone also reminded the market that is has now introduced tiered data plans in eight territories. Despite a fall in voice revenues, which continue to provide the bulk of service revenues, that upward trajectory of data revenue seems to offer hope that operators can benefit from the rise in customer data useage.

Remember, overall profits were also up – despite voice revenues falling.

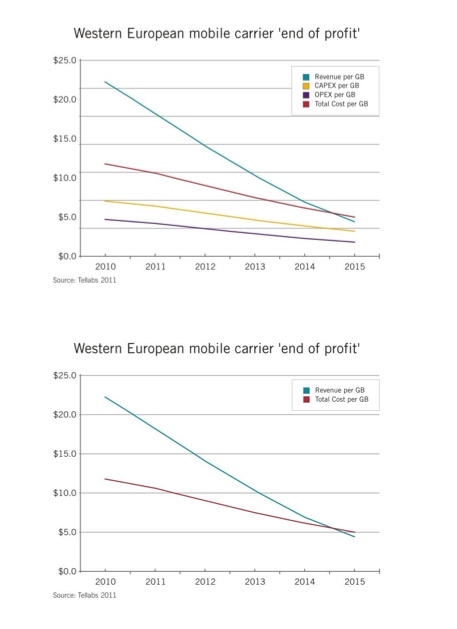

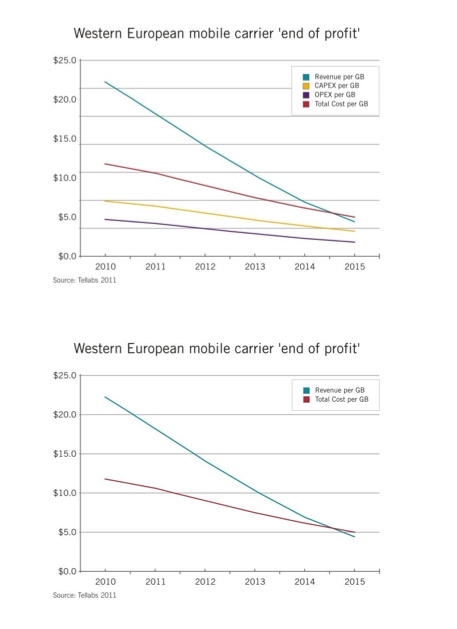

Yet today was also the day on which Tellabs released a report, compiled with Analysys Mason (AM), purporting to show that operators have about three to four years of profitability left, before they start slumping into operating losses on their data traffic.

At the moment, the Tellabs report finds, operators are still turning a profit on their data traffic. But increasing demands on bandwidth driven by OTT services being accessed on flat rate tariffs, mean that the cost of delivering that same bit will outweigh revenue by mid 2015, in Western European markets.

At the moment, the Tellabs report finds, operators are still turning a profit on their data traffic. But increasing demands on bandwidth driven by OTT services being accessed on flat rate tariffs, mean that the cost of delivering that same bit will outweigh revenue by mid 2015, in Western European markets.

How can this be? After all, network upgrades and expansions, including the move to all-IP and higher bandwidth solutions are designed to reduce the cost of operation of mobile networks. At the same time, operators are taking action on their data plans, as evidenced by Vodafone introducing tiered pricing in eight markets to date.

Yet the Tellabs model purports to show that carriers cannot spend their way out of the capacity crunch by merely adding capacity – this is because although the cost of network provision is decreasing the revenues from mobile data, on a per-byte basis, are decreasing much faster. In Western Europe, AM and Tellabs predict a revenue per Gb decline of 80% between 2010 and 2015. The report describes this an “astonishingly high” number.

This is the key number in the whole report – the collapse of the per GB revenue for mobile data – and it is a number taken from the Analysys Mason Wireless traffic forecast, 2010. That report, produced back in August 2010, said that in developed markets average revenue per gigabyte will fall from $23.21 in 2010 to $4.27 in 2015. AM warned that because of “the ongoing decline in revenue per megabyte” operators “will need to abandon flat-rate pricing models – and sooner than they might think”. A combination of rapid growth in traffic volumes and demand for data, and of slow growth in revenue, is putting increasing pressure on operators’ profit margins,| said AM analyst Terry Norman.

Not everyone appeared to be on board with the inevitability of huge reductions in per-byte revenues, though. By November 2010, though, another AM analyst, Rupert Wood, said, “Mobile network operators can easily meet the demands on their networks at the current growth rates without huge investment in LTE, and could even emerge from the initial phase of market growth with substantially improved revenue-per-byte rates and much healthier margins.” [our bold italics]

Now, however, AM is again leaning on its August numbers to predict the same “astonishing” fall in revenue per byte over the next four years if operators carry on in their current mode.

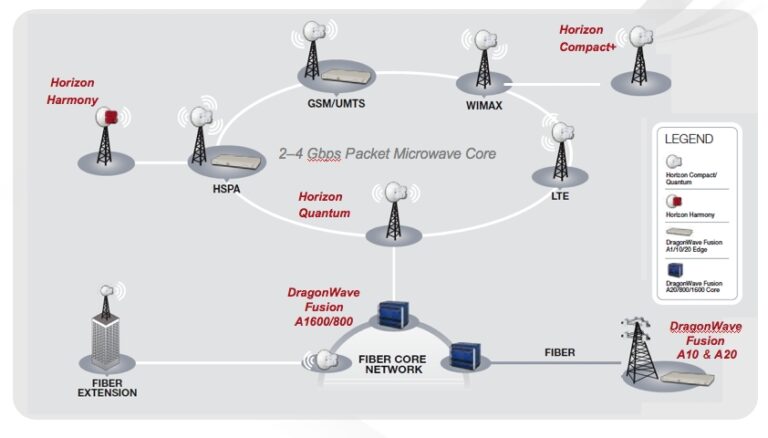

If you do take that 80% reduction in per Gb revenue at face value, then, the case for operators to transform their business model is pressing. The answer, says Tellabs, is to add intelligence in the network so that application-aware traffic decisions can be made, reducing the cost of supporting application traffic, and allowing new revenues to be raised from personalised services that are formed as a result of that intelligence.

Ben McCahill, Sales Director, Tellabs, told Mobile Europe that at the moment all application traffic is treated the same. “It all hits the same load balancers, is transported across the backhaul and the core network in the same way, regardless of where the choking points are in the network, or what the characteristics of the application flows are across the networks.”

McCahill instead talked of context and socially-aware traffic management, rather than mere throughput, allowing operators to provide the right bandwidth at the right time, taking advantage of dynamic bandwidth capabilities.

“It’s about going from traffic engineering to application engineering, and changing the business model to something that looks beyond a flat ARPU number,” McCahill said.

Report methodology assumptions:

The following is an overview of the parameters and assumptions included in the Tellabs model.

Starting point and network evolution:

Analysys Mason has assumed a modest traffic growth of seven fold by 2015 for both voice and data combined

It is assumed for all regions that the hypothetical carrier uses a flat rate pricing model

It is assumed for all regions that the hypothetical carrier transports the majority of its traffic on 3G (HSPA) networks at present

All hypothetical carriers use technologies from GSM family

All carriers will evolve from HSPA to HSPA+ to LTE, with the percentage of traffic on each new technology increasing steadily

A CAPEX vs. OPEX ratio is used to show how investment is divided between Core and Access (including RNC) for each technology

All carriers are carrying a small amount traffic on HSPA+ in 2010

LTE deployments begin, at a small scale, in 2011 in North America and Developed Asia Pacific; in 2012 in Western Europe

It is assumed that all carriers in all regions are offloading a considerable percentage of traffic to indoor, internet, solutions. The percentages utilized in the model are conservative

The network carriage cost for offloaded traffic in the Core remains in line with other technologies; cost in the Access is minimized

Network operating conditions and planning:

The model assumes 175% average-to-peak ratio for all regions. This is the percentage of traffic experienced at the peak hour compared to the day average

The model assumes 30% headroom allowance for all regions. This is the percentage of spare capacity infrastructure that carriers must provide before additional capacity increase is required. Spare capacity comes from Ethernet and IP overhead and capability to handle traffic bursts

Capital expenditure (CAPEX):

Cost per Mbps for HSPA is consistent across all regions

Cost per Mbps for HSPA+ is consistent across all regions

Cost per Mbps for LTE is consistent across all regions

Cost per Mbps for Internet offload is consistent across all regions

Equipment price erosion (falling cost of equipment) has been applied to all technologies. Mature technologies show the most significant price erosion in the timeframe given

Estimated sunk costs are accounted for in the model

All figures are based on KPI numbers used in Tellabs’ work with major carriers in the key regions

Operating expenditure (OPEX):

OPEX has been calculated throughout as a percentage of CAPEX

The CAPEX/OPEX ratio is lowest in technologies that offer mobile carriers the lowest network carriage costs

All figures are based on KPI numbers used in Tellabs’ work with major carriers in the key regions

At the moment, the Tellabs report finds, operators are still turning a profit on their data traffic. But increasing demands on bandwidth driven by OTT services being accessed on flat rate tariffs, mean that the cost of delivering that same bit will outweigh revenue by mid 2015, in Western European markets.

At the moment, the Tellabs report finds, operators are still turning a profit on their data traffic. But increasing demands on bandwidth driven by OTT services being accessed on flat rate tariffs, mean that the cost of delivering that same bit will outweigh revenue by mid 2015, in Western European markets.