Wi-Fi has reached ‘a pivotal moment’ as users demand seamless, secure, high-performance connectivity in homes, enterprises and cities

At the Wireless Broadband Alliance (WBA), we are committed to driving innovation, interoperability, and standards that empower the Wi-Fi and broadband connectivity industry to meet the needs of today while laying the foundation for tomorrow’s connected world. Here are our top 10 predictions for Wi-Fi in 2025 and beyond.

- Wi-Fi 7 adoption

Early adopters of Wi-Fi 7 will include technology-driven industries, smart home enthusiasts and enterprises needing high-density, high-speed connectivity. Large tech companies and advanced enterprises will be among the first to implement Wi-Fi 7 in their office infrastructure to support increased demands from remote collaboration tools, IoT sensors, and high-definition video conferencing.

Smart cities will also lead the charge, adopting Wi-Fi 7 to enable real-time data collection from IoT devices for traffic management, public safety, and environmental monitoring. Public venues like stadiums, airports, and convention centers will adopt Wi-Fi 7 early to manage the connectivity needs of thousands of simultaneous users, providing seamless streaming and data access for fans, travelers, and attendees.

Within the consumer sector, tech-savvy users and smart home aficionados will upgrade to Wi-Fi 7 routers to maximise the performance of their growing array of connected devices, such as smart appliances, security systems and entertainment systems for 8K streaming and gaming.

- 6GHz expansion and AFC

Automated Frequency Coordination (AFC) systems will see phased roll-outs across multiple regions, particularly in the US, Canada, the European Union and parts of Asia, as more regulators approve the use of 6GHz for unlicensed Wi-Fi under AFC management.

In the US, the FCC will lead AFC implementation for standard-power Wi-Fi operations in the 6GHz band, with licensed database administrators managing these AFC systems. Following the US model, other countries are expected to adopt similar AFC frameworks, accelerating deployment in enterprise and public spaces by ensuring devices can operate at standard power levels in outdoor or high-traffic areas without compromising incumbent communications.

In Europe, the European Telecommunications Standards Institute (ETSI) is likely to coordinate region-specific AFC guidelines, balancing connectivity’s needs with protection for incumbents.

- AI-driven network optimisation

AI-powered routers and cloud platforms will analyse traffic patterns, adjust bandwidth allocation, and manage devices for optimal performance, particularly in smart homes and IoT-heavy environments. As hardware is increasingly commoditised, infrastructure vendors will create their respective secret sauces to innovate and differentiate.

- Wi-Fi and 5G convergence

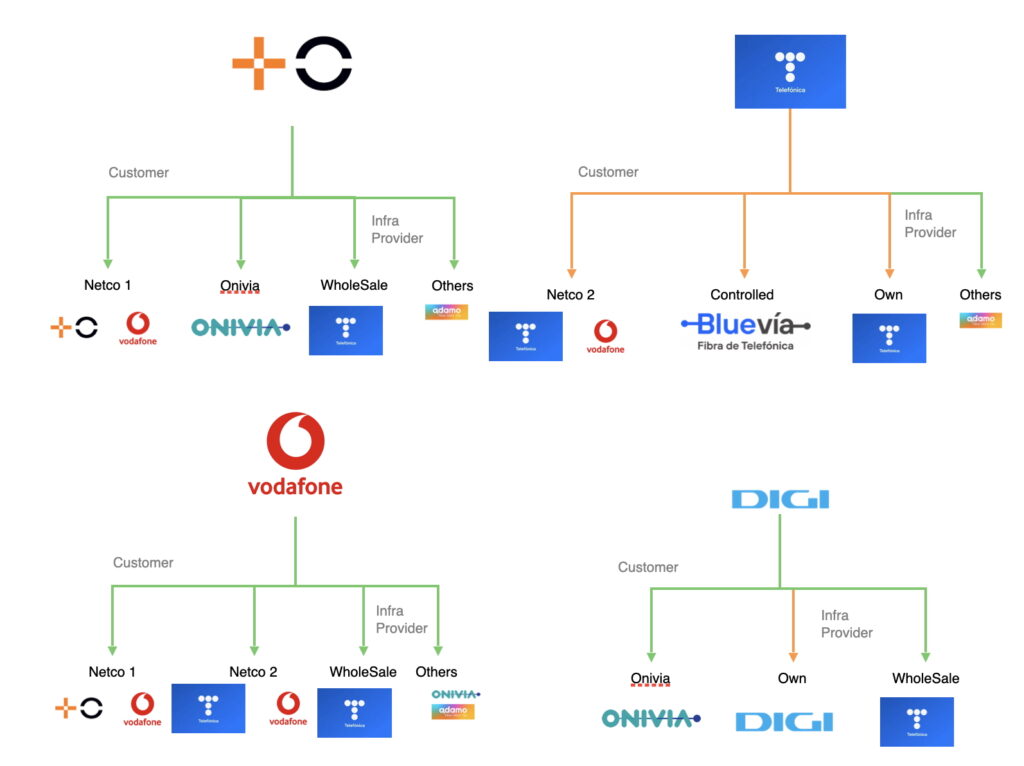

The convergence of 5G/6G and Wi-Fi will ensure seamless, high-quality connectivity by dynamically switching between the best available networks. In a smart city, for example, a person moving from a Wi-Fi-rich office to a 5G-powered urban area will experience uninterrupted service, thanks to technologies like OpenRoaming and Passpoint, which enable secure, automatic connections to trusted Wi-Fi networks.

5G’s network slicing enhances this by dedicating specific network resources to applications like AR/VR and real-time gaming, which can integrate smoothly with Wi-Fi. As enterprises and industries drive this convergence, 6G will add features like terahertz frequencies for nearly instant communication over wide and local areas.

Edge computing, which processes data closer to its source to reduce latency, will leverage Wi-Fi and 5G/6G to offload tasks to the best network, optimising real-time performance. Wi-Fi will dominate high-density areas like offices, while 5G/6G will enable broad IoT deployments, paving the way for innovations like smart cities and autonomous vehicles reliant on robust, ubiquitous connectivity.

- OpenRoaming

The global adoption of OpenRoaming will continue to acceleration in 2025. This will start to transform public and guest Wi-Fi users’ experiences, and change how we connect to Wi-Fi. For example, from remote communities, to universities, stadia, retail chains, large city deployments and more.

OpenRoaming capabilities are extending into IoT, with zero-touch provisioning of devices, emergency calling and response, and private cellular networks.

OpenRoaming means MNOs and MVNOs can incorporate Wi-Fi into their wireless solutions to expand capacity and/or coverage, especially indoors.

- TIP OpenWiFi

The adoption of TIP OpenWiFi is expected to expand, although the pace is likely to be uneven across sectors and geographies. The introduction of OpenLAN switching is expected to stimulate growth, particularly in cost-sensitive markets such as India and among managed service providers (MSPs) in the US and Europe looking for alternative, flexible networking solutions.

TIP OpenWiFi’s success will depend on being able to navigate the challenges of scaling deployments and being seen as credible alternatives to established WLAN providers. The latter have invested heavily in AI to enhance performance and power customisable features to make their offerings more compelling for enterprise-level CIOs and CTOs.

- Increased IoT device connectivity

As the number of IoT devices continues to grow, Wi-Fi networks will be optimised to handle large-scale device connections. Wi-Fi 6’s and Wi-Fi 7’s ability to manage more devices simultaneously will be crucial to support smart homes, IoT and smart cities.

The Wi-Fi HaLow standard will become a disruptive connectivity technology, with the potential to transform the IoT landscape through its extensive range, superior penetration and improved battery life. It could revolutionise industries, like agriculture, smart cities and manufacturing, by improving data collection and their efficiency. Wi-Fi HaLow is ready for primetime in the IoT ecosystem and is a natural fit, especially for long-range, intelligent applications.

- API first

The API-first strategy has transitioned from a progressive concept to a fundamental practice. Wi-Fi vendors are now building applications with APIs as the primary focus, ensuring that integration, scalability and future growth are baked into the DNA of their digital solutions. This approach highlights the critical role of APIs in creating flexible, adaptable, and robust digital architectures.

However, although using APIs provides greater flexibility and potential, every API integration project is inherently unique. Usually, building a single integration will take engineers several weeks at best and then will probably need to allocate several hours per month to maintain that integration.

- Municipalities and governments

Public Wi-Fi networks will be driven by smart city initiatives, offering free or low-cost connectivity in urban areas. These networks will support everything from smart transportation systems to energy management and public safety. OpenRoaming is set to play a pivotal role in the expansion of public and smart city Wi-Fi networks.

For smart cities like Tokyo, Barcelona and others, this seamless transition between networks enables reliable, continuous connectivity for citizens and devices alike, supporting applications like real-time traffic monitoring, public safety systems, and IoT-based services. Municipalities and public Wi-Fi providers could well prioritise OpenRoaming to improve users’ experience, simplify network management and foster richer data environments in urban areas.

- Focus on energy efficiency

Wi-Fi networks will prioritise energy efficiency, particularly for IoT devices that need long battery life. Technologies such as target wake time (TWT) will become more prevalent, reducing power consumption in connected devices by scheduling check-ins with the network.