Shows European mobile operators how to diversify with private 5G edge computing offering

US mobile operator Verizon has branched out into Edge computing with a service for enterprises created from private 5G networks running ‘on the premises’, reports RCR Wireless News. The service was created after a year long project collaboration with cloud service provider Microsoft Azure.

The launch of the new mobile computing service, Verizon 5G Edge with Microsoft Azure Stack Edge, comes nearly a year after Verizon announced it was building a system with Microsoft.

Early in 2021 Verizon announced that On Site 5G would run on its mmWave network, 5G Ultra Wideband, to create private networks in indoor or outdoor venues for enterprise and public sector customers. The next step was to create an ‘on-premise’ network that could harness computing and storage services and offer them to users at the edge of the network within the company premises.

A private edge network is more secure and efficient, with faster response times. Its high bandwidth can provide greater throughput for applications involving computer vision, augmented and virtual reality and machine learning, according to a Verizon statement.

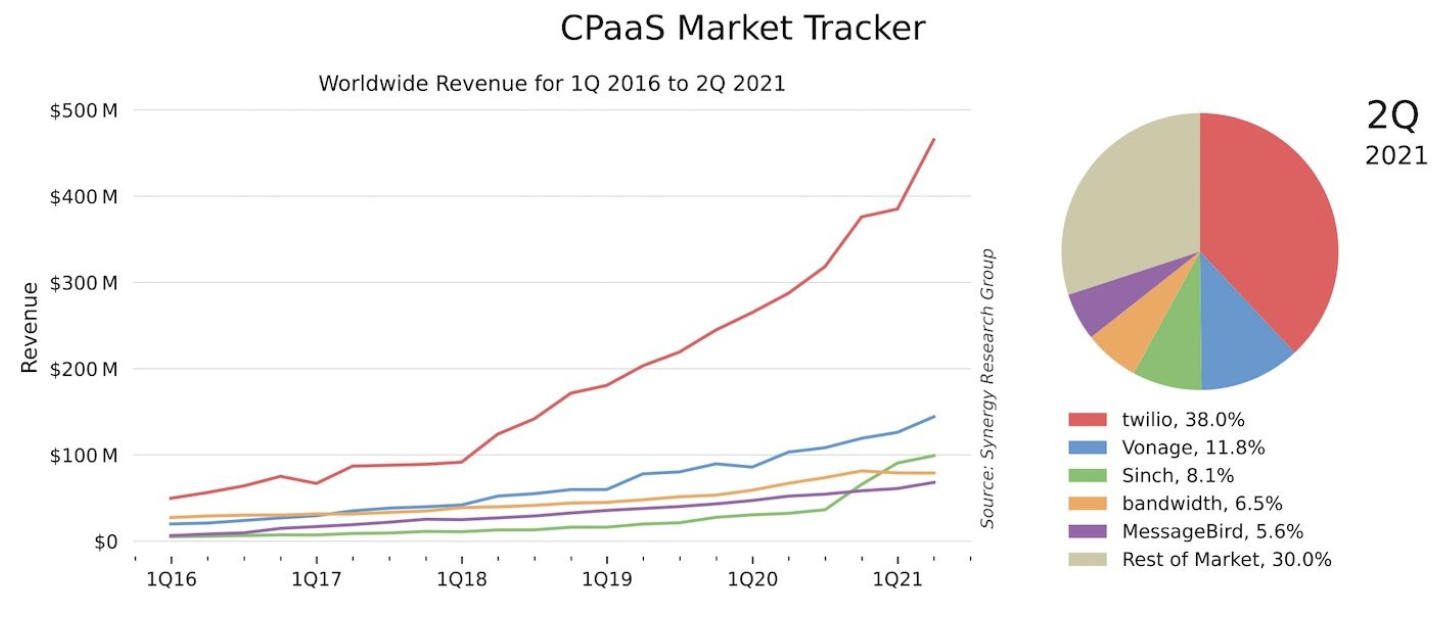

5G gives mobile operators The Edge

“Our partnership with Microsoft brings 5G Edge to enterprises, dropping latency at the edge, helping critical, performance-impacting applications to respond more quickly and efficiently,” said Sampath Sowmyanarayan, chief revenue officer of Verizon Business.

Ice Mobility, a logistics and supply chain solutions company, is an early adopter, using Verizon’s private 5G edge computing for computer vision-assisted product packing. The sophistication of 5G’s network slicing means it could be extended to run near real-time, activity-based costing the logistics firm in future, it said.

The mobile operator’s strength is in providing the connectivity and detailed allocation of multiple resources at sub-millisecond time scales. “With Verizon, we are providing customers with powerful compute and storage service capabilities at the edge of customers’ networks, enabling robust application experiences with increased security,” said Yousef Khalidi, corporate vice president Azure for Operators at Microsoft.

Analyst Ghassan Abdo, research VP at IDC, said that “on-premises, private 5G edge compute deployment model will spur the growth of compelling 4th generation industrial use cases.”