Juniper Research predicts more than 60% of base stations used in private net deployments in 2023 will be 5G

A new report by Juniper Research has found that 5G’s capabilities are driving enthusiasm and awareness of private cellular networks. This, it predicts, will result in the annual spend on hardware and services for private networks to almost $12 billion (€17.24 billion) globally by 2023, growing 116% from the $5.5 billion expected for 2021.

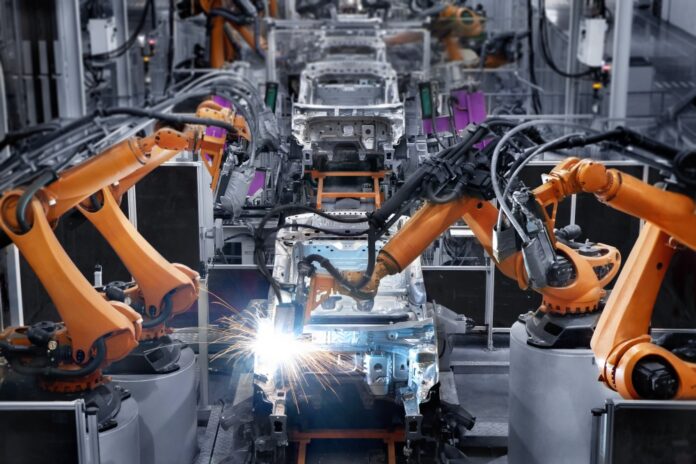

5G deployments have a key role to play here: over 60% of base stations used in these deployments in 2023 will exploit 5G for ultra-low latency and signal propagation in environments where conventional networks struggle.

The new report, Private Cellular Networks: Spectrum Assessment, Business Models & Forecasts 2021-2026, notes that these networks will be almost entirely business driven. The most prominent sectors will be manufacturing, mining, and the energy industry; accounting for 59% of spend in 2023.

Operators risk losing out

The report notes that, despite their dominant position in public cellular networks, traditional operators risk missing out on much of the private network market. Juniper Research believes that telecoms network vendors, like Ericsson and Nokia, are in the best position to capitalise on private networks – offering hardware and value-added services directly to businesses.

“With private networks frequently entirely separate from public networks, the role of traditional mobile network operators can be minimal in many cases,” remarked the author of the research, James Moar.

“This means that hardware providers and systems integrators will play more dominant roles, given the right regulatory framework.”

Spectrum and regulation

The report notes private network deployments are uneven globally, with the largest markets being those with the most open or flexible spectrum allocation. Germany and the US are among the most advanced; offering localised leasing and general spectrum availability. The UK is considering this option.

As a result, these two countries will account for 30% of global private network spend in 2023, although this will decline as other countries release spectrum for private network usage.

Also see Juniper Research’s free whitepaper: Why Private Networks Are the Key to Realising Industry 4.0