There was a depressing start to Informa's LTE World Summit. The government minister who was going to provide the opening gags about enjoying the food and not getting robbed on La Ramblas couldn't make it because all hands were required on deck in Madrid to steer the ship of state through the Euro crisis.

Then Orange Spain's CTO got up on stage and delivered a presentation of such downbeat realism and near misery that the Asian, US and Middle Eastern audience must have been tempted to ask if they were at the right event. Margins are sliding, growth is slow, LTE is only a partial cure, we need network sharing at a deep, deep level (or, you know, fewer operators) and my coffee's just gone cold. That sort of thing.

To give us a lift, next came the Group CTO of Vodafone – surely he would be upbeat, what with the 800MHz LTE done and urban deployments beginning to happen. But he also couldn't make it in person, because of an ear infection stopping him from flying (really, where's the commitment, people? Get that man some antibiotics and a fast car). Anyway, Mr Jacobfeuerborn was bravely attempting a live Skype video conference using an LTE-connected laptop at his end. The quality was somewhat grainy given his image was blown up to a five meter high screen, but it worked well enough. The only problem was, and this is kind of key in a Skype call, was that Jacobfeuerborn couldn't hear very much at all of what was being said to him – seemingly because the laptop Informa was using couldn't pick up the audio from the presenter standing a few metres away on stage. In the end, Jacobfeuerborn abandoned the session, depriving us of his views on OTT competition, carrier WiFi and more. LTE 1 AV 0

Over at the OTT track – how the telcos can deal with and profit from OTT services and applications – there was an interesting-looking talk listed from Viber CEO Talmon Marco – subtitled "How are Viber collaborating with operators to provide improved end user services". If you combine the curent industry preoccupation with OTT providers with the fact there was also a whole conference track scheduled on VoLTE, looking at LTE VoIP and all that, this looked like a key presentation to be at. But, sadly, Mr Marco didn't make it to the event either. Not even over Skype, er, Viber.

Lamp post land grab…

"When I ask the incumbent vendors if interoperability can happen, they say it can't be done. If I ask the new entrants, they say it's not a problem…" Jaime Lluch, Telefonica Spain.

And so goes the world. If you're protecting a position, then you say that it's a nightmare integrating all this new fangled stuff. If you're producing the new fangled stuff, you say it's a cinch, you've designed with all interoperability in mind.

It's nice to be NSN then, who is both incumbent and newcomer for small cells. How so? Well obviously it has a well-established positioned as incumbent provider in many 2G and 3G networks. But its small cell Flexi Zone architecture, which combines clusters of small cells, was largely developed by Motorola before its acquisition by NSN. Now, Motorola essentially has no 3G position at all (sorry, but it's true), and therefore approaches the market as a challenger – so we have a product designed to operate in a macro network provided by another vendor.

That aside, I thought one of the most interesting points to come out of NSN's presentation from Stefan Dueble was him urging mobile operators to get street furniture signed up. Essentially, he is urging operators to make a land grab for lamp posts, or light poles, bus stops, anything they can get their hands on at street level, or rather just above street level. Even if operators aren't going to deploy small cells in high density any time soon, he still thinks operators should get in there and get ownership of urban real estate. There's a chance there will be many, many individual negotiations

NSN has definitely been thinking this stuff through. I had sight of an app it has developed for the field deployment guys that combines QR codes and satellite-view Google maps with an on-phone app that gives installers a simple checklist of deployment. Power on, check lights, etc It goes further, though – Dueble said that the vendor has a unit developed that "shrouds" the base station in a fake lamp. However, it soon learnt it had to put some LED lights inside the "lamp" as local authorities would get calls from residents saying that there were non-functioning lamps on their street. It goes to show that it's all very well getting excited by the technical possibilities of underlay and overlay networks, but the "dirty street" practicalities are very much part of the battle. Expect to see vendors make a great deal more of this side of things – deployment and operation – around small cells over the year.

This also plays into the "site where the traffic is" or "site where the backhaul is" discussion. Do you find the hottest of hotspots, or zones, and deploy there? Or do you find where you can "do" some viable backhaul and go with that. NSN thinks the former, which is why its units include Non Line Of Site (NLOS) microwave for backhaul integrated in the unit. Others think NLOS MW does not have the capacity required, and other options will be required – form millimetre wave to mesh or P2MP architectures. There didn't seem to be a great deal of clarity coming out at LTEWS on this topic. We are still at the trails stage with operators in all instances.

WiFi hedging

There was a slightly surreal exchange about WiFi with Softbank and Informa analyst Mark Newman. Softbank's spokesperson admitted that its outdoor WiFi rollout had been rendered effectively "useless" by the sheer number of APs deployed by itself and all the other Japanese network providers. Yet asked if Softbank is still deploying APs, despite admitting they were useless, he said yes – because the other vendors are too. In other words, if one vendor releases a PR saying it has deployed 200k WiFi hotspots, you have to say you've deployed 250k, even if they don't work because they are hamstringing each other through interference. Kudos to the first operator in Japan to release a PR saying it is helping the user experience by removing hotspots.

Anyway, that exchange seemed to reflect a rowing back from the "Carrier WiFi Everywhere" messaging we were getting at World Congress. There now seems to be more recognition of the potential for carrier WiFi, especially outdoors, to create business and technical issues.

We spoke to one vendor who was pessimistic about operator WiFi. "I can't understand," he said, "how operators are not going to destroy their value. They all talk about monetising their data services, and the need to extract maximum value from their spectrum assets, and then they go WiFi everywhere. How does that make sense?"

"How is your WiFi gateway business working out," I asked.

"That," he said, "was a necessary hedge against operators going that way. I still think it makes no sense."

Ah well, we all need a necessary hedge now and then. I bet Ofcom wished it had a necessary hedge to hide behind at the moment. At the moment it is stuck picking thorns out of its derriere, courtesy of a Hobson's choice decision it has been landed with over Everything Everywhere's desire to use its 1800MHz spectrum.

Auction rules in July, bids in december, spectrum in 2013, the man from Ofcom said. He left out the court dates, though.

Have a good weekend everyone. I'm going to celebrate it by eating each and every one of the 12 doughnuts sent to this office by Everything Everywhere to celebrate the completion of its "Big Switch On" campaign. Six were covered in orange icing, six in magenta – see? I feel like sending one down to Group partner Orange Spain to cheer them up. Doughnut sharing, as it were.

Keith Dyer

Editor

Mobile Europe

SIGN UP TO OUR TWO UPCOMING WEBINARS:

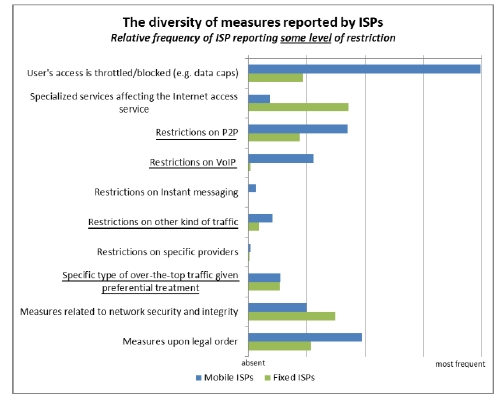

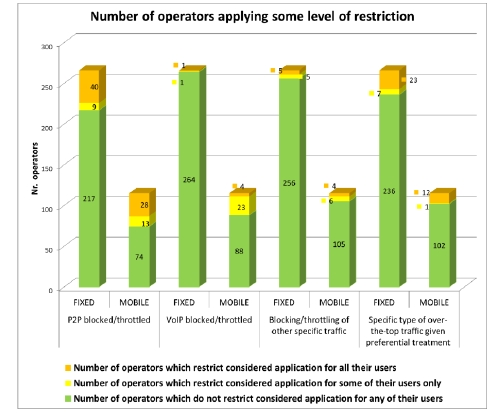

Some examples of special treatment for over-the-top traffic reported by fixed operators are prioritisation of certain kind of traffic or applications at peak times (such as HTTP, DNS, VoIP, gaming, instant messaging, etc.), and assigning lower priority to applications such as file downloading, P2P, etc.

Some examples of special treatment for over-the-top traffic reported by fixed operators are prioritisation of certain kind of traffic or applications at peak times (such as HTTP, DNS, VoIP, gaming, instant messaging, etc.), and assigning lower priority to applications such as file downloading, P2P, etc.