Capacity increases and cost reduction – but how?

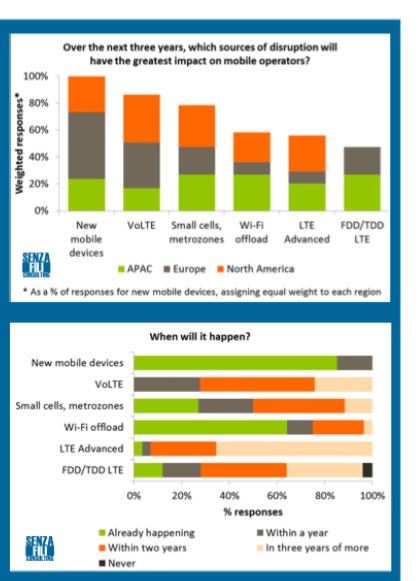

As Mobile World Congress starts there will be much talk about what is concerning mobile operators from both a strategic and technical point of view. But what do they themseves think (see pic left. Click for bigger)? Research by wireless analysts Senza Fili Consulting, conducted on behalf of Radisys Corporation, has shone a light onto some of the key areas concerning mobile operators ahead of Mobile World Congress.

In January and February 2012, Senza Fili interviewed operators from North America, Europe and Asia Pacific asking which technologies operators expected would have the most significant effect on the industry, how those technologies would impact network performance, subscriber experience and revenue, and which they would support or fight.

The results showed that although operators are investing in solutions that support increased capacity, they are still challenged by the need to drive aditional revenues. They also feel that the impact of new devices are having on network is just starting to be felt.

“Devices will continue to be the main driver to change in our industry,” commented Monica Paolini of Senza Fili Consulting. “They have fundamentally changed the way subscribers use mobile broadband – why they use it, what they do with it, and how much traffic they generate. Yet, there is a pervasive feeling that we have just started to scratch the surface.”

Yet although small cells, WiFi offload, LTE and broadband management techniques were all mentioned, Senza Fili said that there was a “conspicuous absence” of service creation and monetisation drivers in the top six list of priorities mentioned by operators.

Radisys CTO Manish Singh added: “It is clear that capacity increases and cost reduction are still at the forefront of mobile operators’ near-term operational plans. Operators are focused on making their networks faster and more efficient. Yet this is all set in an environment where to grow revenue is enormously challenging, and competition on new services from OTT players is fierce. Operators are seeing increase in adoption of exciting new applications, but they are not able to benefit so capacity and cost remain paramount.”

A new phase as operators again promote, not restrain, data consumption

The report author said that its conclusion was that operators, who currently “feel distant from their subscribers” and “unable to predict what they want and to shape services in a personalised way”, will look to adopt solutions that allow them to leverage their customer data by actively managing traffic all the way from the devices to the core network.

“The availability of tools has increased in the last few years and changes are afoot in traffic management and service enablement. The increasing load on the network was the first driver for exploring traffic management tools such as streaming video optimisation or policy. Increasingly, however, the attractiveness of traffic management comes from a reversal in the mobile operators’ approach. Rather than containing data growth (i.e., data caps and throttling), we should expect operators to promote more services and increased data consumption.”

Report author Monica Paolini thinks this is the “right call”. “Restricting traffic growth blocks service monetisation,” she wrote. “More services and more traffic create more pressure on the network, though, and require a more sophisticated take on traffic management, one that is attuned – in real time – both to what subscribers want and to what the networks can do.”

Senza Fili broke its conclusions down into the following seven areas.

1. Small cell networks

A rather startling 100% of European and Asia Pacific operators said that they intended to deploy small cell networks within two years; 100% of North American operators will do so but in three years’ time. Small cells deployed in urban or other high traffic locations as an underlay to increase cellular capacity density are seen as a “game changer”, especially in Asia Pacific, where they are the joint highest-rated source of disruption. There are, however, obstacles to be overcome before deployments are widespread and many operators view small cell topologies as a gradual solution to capacity pressure points, rather than a radically new type of network topology.

Challenges to small cell adoption included:

Management of interference between the small-cell and macro-cell layers: if the same spectrum band is used. Most survey participants were confident that it is only a question of time before this issue is addressed, and in many cases they are actively engaged with vendors in finding such a solution.

Network optimisation: To make small-cell deployments manageable and cost effective, self- organizing networks (SONs) are needed to automatically optimize network performance. Interoperability, a requirement in multi-vendor deployments, is perceived to be still elusive.

Cost-effective backhaul: While fibre is the ideal solution,it is frequently no tavailable or affordable in dense environments. Multiple wireless solutions are available, but none has emerged to consistently address the business-case constraints.

What the operators said:

“Today it is Wi-Fi offload, but in the long-term small cells will become more important to increase capacity. But we need to solve the backhaul challenges. Fiber is too expensive, and microwave is not ideal.” – North American survey participant

“Wi-Fi offload is for residential offload and indoor public locations. Small cells for outdoor dense urban areas.” APAC survey participant

2. Wi-Fi offload

82% of all operators surveyed “support” Wi-Fi offload. As operators wait for their LTE networks and their small cell deployments, many have deployed a Wi‑Fi offload solution to ease network capacity pressure. Even though Wi-Fi was in many cases deployed as a temporary solution, the operators surveyed are keen to retain their Wi-Fi infrastructure and/or roaming agreements after deploying LTE and small cells. The role of Wi-Fi may be reduced by small cell deployments, but most operators see the two as complementary.

Because Wi-Fi carries an increasing portion of the traffic generated by mobile subscribers, survey participants indicated the need to make Wi-Fi connections more transparent, to enable subscribers to seamlessly move between cellular and Wi-Fi, and also to be able to retain more control over the subscribers’ experience of Wi-Fi offload. In this context, survey participants mentioned the ability to provide SIM-based authentication, improved standards for traffic management across Wi-Fi and cellular interfaces, and access-aware applications on the devices as useful tools to improve the Wi-Fi experience.

What the operators said:

“Wi-Fi offload is crucial as we wait to deploy LTE or LTE Advanced.” – APAC survey participant

“A crucial element to ensure continued success of Wi-Fi offload is to make the connection to Wi-Fi completely transparent, so that the subscriber does not even need to know whether Wi-Fi is used.” – North American survey participant

3. Tablets and new mobile devices

The impact of new devices on revenues and subscriber experience is expected to be largely positive across the world, yet tablets have potential for creating a new headache for operators. Compared to smartphones, tablets generate much more traffic – and this is slated to increase as tablets evolve, more applications become available, and they increasingly use cellular networks instead of Wi-Fi for access. Because most tablets today use predominantly or exclusively Wi-Fi, operators do not see the traffic on their network. As users start to see tablets as mobile and need cellular connectivity in addition to Wi-Fi, traffic volume will quickly be added to already congested cellular networks. To make things worse, compressing video traffic becomes less efficient with tablets.

What the operators said:

“Devices will become big screens anchored in the cloud for content and applications. We will not need faster processors, but network reliability has to go up to support this model.” – European survey participant

“We expect change to be driven by devices like tablets expanding functionality and gaining ground over other device categories.” – European survey participant

4. Service monetisation

Senza Fili said that during the interviews this was the topic that participants most consistently indicated as the one that worries them most as participants do not believe that they – or their competitors, for that matter – see a clear path forward. Today’s uncertainty means that service creation and monetisation are seen as a challenge, but not (yet) a source of disruptive change. Although everybody agrees that change is necessary, there was little clarity as to what will bring on change or on how sweeping that change will have to be to address the current imbalance between increasing costs and performance, on one hand, and decreasing revenues, on the other.

Operators feel that they are offering more, but receiving less. Competitive pressure in nearly saturated markets leaves them without the ability to simply increase prices. They want to introduce new services and charging models, enter new markets like M2M, and improve subscriber segmentation, but they do not know the most effective way to reach these goals. This is where disruption is most needed – and yet a wait-and-see attitude prevails.

This reaction may strike an outsider as quite odd. After all, mobile data in terms of traffic and subscribers is growing at an amazing pace, especially in comparison with the slow but unstoppable decline in voice revenues. Subscribers rave about the devices and applications in ways that are rare to see in other industries. Why do mobile operators find it so difficult to capitalize on the growth in mobile data?

Senza Fili said that it had got a sense that operators are actively exploring many opportunities, solutions, and approaches, but that they are not confident that any of them will bring in sufficient revenues to justify a big bet. However, as they continue trialing and assessing different solutions, they risk spreading attention over too many targets and delaying the launch of new services, charging plans, or applications.

All operators surveyed agree that their main goal is to increase revenues both to retain profitability and to maintain investment in the infrastructure required to keep up with demand. Operators are challenged to balance future investment while also ensuring service monetization is possible despite the anticipated disruptions.

What the operators said:

“We cannot afford to manage traffic growth without corresponding increases in revenues. We have ways to increase capacity but we cannot necessarily afford it.” – European survey participant

“We need new more dynamic, application-based revenue models. Using a tonnage-based charging system is not sustainable in the long term. You do not want to charge everybody the same way: it has to depend on subscribers’ behavior.” – North American survey participant

5. VoLTE

VoLTE was almost universally recognised as a must have, but only at a later stage. Some operators want to deploy it sooner than others, but for most it is not perceived as an immediate requirement. Operators do not plan to deploy VoLTE because they need LTE to carry voice, but because they want to move to LTE-only devices. From a revenue perspective, there is little expectation that VoLTE will provide new revenues by allowing operators to roll out new services. On the contrary, VoLTE may put additional pressure on voice revenues if, as expected, voice services increasingly move to flat-fee plans. Indeed, among survey participants, 25% expect VoLTE to have a negative impact on revenues or customer experience.

What the operators said:

“Circuit-switched voice is not going to disappear over the next five years. But we do need VoLTE to gradually reduce our dependency on legacy 3G and 2G networks, to a point where we will feel comfortable to turn them off. But it will take a long time.” – APAC survey participant

“It is still crucial to have good quality voice on handsets. Without it subscribers will not be impressed by LTE. Equally important is the ability to seamlessly switch between voice and data, and that is not currently available.” – European survey participant

6. LTE Advanced

Capacity came to the fore as the main driver to deploy LTE Advanced, as for small cells and Wi-Fi offload. As the next step in the evolution of LTE, surveyed operators see LTE Advanced as a clear step forward, and they expect to adopt it. However, they do not expect to see much happening for another two to three years, if not more. For operators still planning their LTE networks or in the early deployment phases, there is no sense of urgency.

67% of North American survey participants expect LTE Advanced to be deployed in two years, compared to 33% in Europe and APAC. This is in line with the more accelerated LTE deployment timeline in North America.

LTE Advanced will not be a one-step upgrade, but rather it will include a set of tools, from which operators will decide which ones to adopt. As a result, the impact on costs, performance, and revenues will vary greatly across operators: they may select a small set of software upgrades or choose more extensive upgrades, such as higher-order multiple-in multiple-out (MIMO) or beamforming, which require new hardware installations as well.

While many operators are skeptical about the benefits of higher-order MIMO and beamforming, there is wide consensus that carrier aggregation will be widely deployed from the beginning because of its improvement of spectrum efficiency and consequent lowering of per-bit costs.

A major strength of LTE is its ability to use wide channels, but, to benefit from this feature today, operators need to have large spectrum allocations. In most cases, they do not have the required amount of spectrum, or the financial resources to buy it if available. Carrier aggregation allows operators to combine multiple narrow spectrum bands to create the wide channels that optimize LTE performance.

What the operators said:

“LTE Advanced increases network capacity, but in most cases it will not improve the subscriber experience as small cells will.” – European survey participant

“LTE Advanced is an incremental transition, not a game changer.” – European survey participant

7. FDD and TDD coexistence within LTE

Some FDD LTE operators are considering TDD LTE to inject capacity in dense areas using less-expensive and higher-frequency spectrum than that used for FDD. This approach allows them to avoid the interference between the macro-cell and small-cell overlay in networks that use a single spectrum band.

The underlying commonalities between the two versions of LTE mean that devices can support both TDD and FDD modes, and that TDD and FDD networks can be integrated. Will it happen? Or will TDD and FDD networks develop in parallel along separate tracks? It is too early to tell how close TDD and FDD LTE will grow, but we received interesting insight from our survey participants.

Geography clearly plays a role. APAC operators have shorter-term plans to deploy TDD LTE, and in some cases they are actively focused on both versions. Many European and North American operators are still evaluating the technology and deciding whether or not to support TDD LTE.

Even operators that plan to deploy just one or the other face the issue of how the two versions will coexist, because the development of a common LTE ecosystem will benefit them, and a market split between TDD and FDD may increase costs and reduce choice for everyone. For operators that are considering both technologies, the development of a common ecosystem is crucial to their decision. They do not want to have handsets that support only one version, because they cannot expect subscribers to have two phones – or even two dongles.

What the operators said:

“Traffic loads are growing so fast that FDD LTE will not be sufficient alone. We will need TDD LTE as well.” – APAC operator

“The choice between TDD and FDD often depends on which spectrum you have. What’s important for operators is that we have the flexibility to choose.” – European operator

Additional resources

White paper based on the survey containing full results: “Technology to drive wireless disruption, service monetization mired in uncertainty. A survey of mobile operators’ view of changes in the wireless industry”.

A webinar outlining the full findings of the survey is also available – access the webinar here.