Further integrate network: get ready for LTE

Everything Everywhere has confirmed plans to further integrate its two mobile networks, upgrade existing network technology, and kick-off preparations for the rollout of cutting edge 4G mobile technology with an investment of more than £1.5 billion over the next three years.

The investment amounts to double digit growth in its 2012 network investment compared to 2011.

Olaf Swantee, CEO of Everything Everywhere, said, “With mobile data increasing 250% over the past two years, we are making these investments so we can deliver on our ambition to provide the UK’s most reliable, biggest and best mobile data network. We believe that the UK requires a 21st century infrastructure and are committed to rolling out 4G as soon as possible to support growing data use, connect parts of the country with little or no mobile broadband, and drive economic growth.”

Throughout 2012, Everything Everywhere will continue to integrate its two networks. The company is in the final stages of “the big switch on” — enabling Orange and T-Mobile customers to use 2G and 3G signals from either of the networks and benefit from fast data speeds in more places.

Over the last year, more than 22 million customers have used 326 billion kilobytes of data, made 1.33 billion calls, talked for over 2.8 billion minutes, and sent 5.5 billion texts while using a signal from the alternate network. Customers are already benefiting from a 20% reduction in dropped calls in localised areas.

Everything Everywhere said that customers’ devices would, from teh first half of 2012, automatically select the stronger signal from either network if their own signal is weak. The company will also begin a phased programme to streamline network sites, which will reduce its carbon footprint and go towards meeting its synergy savings target of £3.5 billion NPV by 2014 as committed to in September 2010.

Everything Everywhere is investing in improved equipment that provides wider, faster and more reliable coverage, and which can be easily upgraded to 4G once the appropriate spectrum becomes available. Everything Everywhere is also making significant investments in its mobile backhaul – the fixed network that connects individual cell sites – and is critical to delivering even faster data speed for customers.

Everything Everywhere was the first mobile network operator in the UK to launch a live customer trial of 4G technology, in partnership with BT Wholesale. The trial, which launched in September, has demonstrated that broadband can be cost-effectively delivered to rural areas over LTE, helping the government to connect the last 10% of the population who currently have no mobile or fixed broadband access. The trial has delivered satisfaction rates of over 90%.

Fotis Karonis, Chief Technical Officer, Everything Everywhere, said, “Everything Everywhere is committed to building a world-class 4G network for Britain. We are devoting huge resources – including our 15,000 workforce and significant investments in technology – and already trialling, learning and laying the ground-work so that we are prepared to introduce 4G services as soon as it’s feasible.”

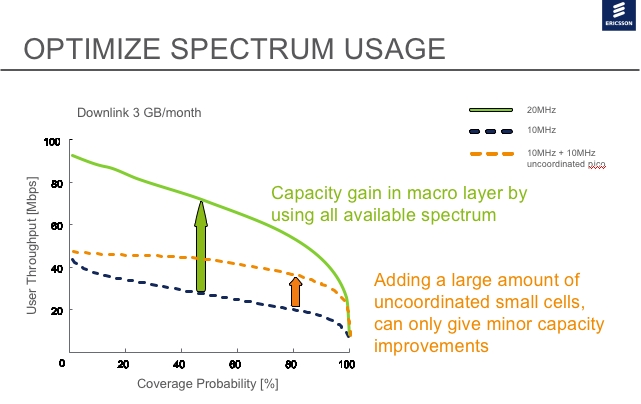

Ewerbring said that although what he jokingly termed “the goons of the small cells” would say “spray this area with small cells”, that approach could lead to a degradation of performance as these cells are not co-ordinated with the macro layer.

Ewerbring said that although what he jokingly termed “the goons of the small cells” would say “spray this area with small cells”, that approach could lead to a degradation of performance as these cells are not co-ordinated with the macro layer.