Connecting the future with blockchain

Partner content: Celfocus has defined enterprise applications and private ledgers as the cornerstone of its blockchain offer to meet the demands of enterprise clients

Although blockchain as a technology can tackle diverse challenges across multiple contexts, Celfocus’s vision is primarily focused on enterprise B2B2X instead of community approaches with the ultimate goal of helping its clients move from web2 to web3, unlocking the full potential of blockchain. Unlike community-led blockchain projects, which are typically permissionless, business secrets are still key to achieving the desired level of confidentiality required by most enterprise clients when doing business in a sound ecosystem.

The trust protocol

If we think about it as the primordial stage of the internet, web1 was a great way to start consuming information and communicating from a global perspective. Web2 shortly followed, where we could read information, write, contribute, and generate data in a distributed manner.

Web3 is a huge leap from that, built on top of the protocols inherited from web2 and enabling both the decentralisation and ownership of information, as well as accountability and trust as a fundamental technological feature across all network layers – that is the power of blockchain.

It’s on web3 that blockchain technology is best equipped to enable new use cases and businesses we have never imagined before. Blockchain promises a huge revolution, not only business-wise but also in how businesses are run and governed. All this revolving a fundamental value for performing any type of interaction across a distributed ecosystem: the concept of trust.

Unlocking new opportunities

Celfocus is focused on creating offers to address the needs of its customers around blockchain technology and web3, centred on both the Telecom and Financial Services sectors in Europe and the Middle East.

The company’s goal has always been to create disruptive, decentralised, and modern solutions to help clients either reinvent themselves by optimising business processes or create new disruptive business cases to “shake” their respective markets, such as the following examples:

- Financial Services – blockchain solutions for Financial Services have been popularised by all the DeFi trends, which have been thoroughly adopted by the community. In this context, it is easy to imagine all the products and services banks could offer their clients soon, even considering all the technological challenges around these assets, like access, ownership, and custody. Another interesting trend is the advent of Central Bank Digital Currencies (CBDCs) and the ongoing adoption of these digital currencies by central banks and banks alike, in the form of wholesale and retail CBDCs.

- Insurance – when we talk about Insurance, a change of mindset is probably needed to move from web2 to web3. Final customers are today more aware of their data potential, and how it could be used. They are also more willing to share it if they consider it a fair trade. Insurance tokenization and parametric insurance are now possible, and we have the right tools on the market to accomplish them.

Empowering telcos through blockchain

In the rapidly evolving landscape of Telecommunications, the integration of blockchain technology holds immense potential for telcos to transform their operations and embrace the TechCo future.

For instance, telcos face significant challenges in managing cross-border roaming agreements and settlements. Blockchain can streamline this process by providing a transparent and decentralised ledger for recording and verifying roaming data. Smart contracts could automate settlements, reducing costs, enhancing operational efficiency, and bringing transparency to the ecosystem, removing intermediaries and unnecessary settlement times.

Another interesting use case tries to bring security and fraud prevention into the telco ecosystem, which remains a critical concern in the industry. Blockchain’s decentralised nature makes it inherently resistant to tampering and unauthorised access. Telcos can leverage blockchain for secure identity management, ensuring the integrity of customer data and reducing the risk of fraudulent activities.

This could be a good opportunity for telcos to leverage the concept of Decentralised Identifiers – DIDs, proposed by W3C, making the data access and authorisation streamlined, decentralised and open to the industry stakeholders, creating what could be a proximity to an open ecosystem of data and network access.

The Internet of Things (IoT) is also a key focus for telcos, and blockchain can enhance the security and efficiency of IoT networks. Digital twins, virtual representations of physical devices or systems, can be securely managed and updated using blockchain, ensuring synchronisation between the physical and digital realms.

Here, DIDs play another important role, creating the independence needed for those devices to act as themselves, in a complex ecosystem of players and services, automating not only identification but also service usage, interactions, data trading, and payments. Hopefully, the settlement will not be needed since everyone benefits from the same source of truth – the ledger.

There are also interesting use cases around 5G, network, computing and communications management, applications and services, and assets management, but as we saw previously, the common denominator is collaborations, open ecosystems, and communication with other parties. That’s where blockchain plays a major role, baselining communication in a trustful environment – being the trust protocol.

Multi-sector driven collaborations

From a supply chain perspective, blockchain can ensure transparency and traceability in automotive parts distribution, not only in the primary activity of building a vehicle but also in supplying the aftermarket. Telcos can contribute by establishing decentralised ledgers that track the production, shipment, and maintenance records of automotive components – ensuring that each step is recorded by the right party, at the right time. This not only reduces fraud but also enhances the efficiency of supply chain management.

In the Food and Retail sector, it is possible to track not only deliveries for B2B or B2C but also how food was grown, transported, and stored to the end customer. In Finance, it enables the use case of syndicated loans, creating more liquidity for enterprises. In Healthcare, blockchain can be used to track medical records and consolidate a patient’s history, archiving a Decentralised Electronic Health Records (EHR) paradigm.

It can even be used in the pharmaceutical area, to supervise the chain from the manufacturing of active ingredients to the distribution of medicines to patients, guaranteeing the quality and authenticity of products on the market.

Telcos can collaborate through blockchain consortiums to address industry-wide challenges. Shared ledgers can facilitate trust and transparency among multiple stakeholders, leading to the creation of common standards and streamlined processes for the benefit of the entire telecommunications ecosystem.

Celfocus has been closely following cross-industry trends that play foundational roles in the overall blockchain solutions landscape and that create synergies across different use cases, such as: decentralised digital identities, loyalty programs, NFTs and data marketplaces for asset monetisation on top of ledgers, smart contracts for IoT payments, wallets custody, and management systems.

Bearing a practical approach in mind, the Celfocus’ blockchain team has been developing several solutions to address each of these topics, with a special focus on solving problems in the Telecommunications, Finance and Retail sectors.

Know more at celfocus.com

About the author

Marco Carvalho is the Blockchain Lead at Celfocus, aiming to bring blockchain technology and its potential to the enterprise world and help customers move from web2 into web3 mass adoption.

Marco has always had a huge connection with innovation and R&D, which led him to found the Blockchain area at Celfocus, in 2018. His responsibilities range from hiring and scaling teams, R&D, managing technical teams, pre-sales activities, developing offers around blockchain and architecture, and scoping blockchain ideas into real-impact businesses.

Zegona looks to acquire Spanish rural broadband supplier to bolster Vodafone

British investment fund in the process of acquiring Vodafone Spain as Orange and Másmóvil merger waits for approval

El Economista reports [in Spanish] that the British investment fund, Zegona Communications, is in negotiations to acquire Avatel Telecom, a rural broadband provider in Spain. Zegona is already in the process of acquiring the business and assets of Vodafone Spain for €5 billion. It received approval from the European Commission (EC) earlier this year and is awaiting permission to proceed from Spain’s national competition authorities.

Vodafone Group is keen to exit the Spanish market as along with Italy, it is a drag on the group’s European financial performance. Vodafone Group’s CEO, says it cannot cover the cost of the capital employed in these markets.

Jockeying for position

According to the El Economista report, Avatel is the fifth largest broadband operator in Spain measured by the number of subscribers with about 400,000 customers. They would boost Vodafone Spain’s broadband base and overall competitive position. There are no details about financial terms of the potential takeover of Avatel.

Spain has proved a fiercely competitive market which spurred the €18.6 billion merger between Orange (Spain’s second largest operator in Spain behind Telefonica) and Másmóvil (the fourth largest) announced in summer 2022. They are still waiting for approval from the EC, which is expected with remedies attached to safeguard competition in the Spanish market.

Virgin Media O2 unleashes fibre NetCo to take on Openreach

Telco adopts wholesale model for its fixed line broadband network as parent firm Liberty Global restructures Belgian, Swiss and Dutch ops

Virgin Media O2 and shareholders, Liberty Global and Telefónica, have initiated plans to create a distinct national fixed network company (NetCo) that they say will underpin full fibre take up and roll out and establish the biggest dedicated fixed network challenger to BT’s Openreach in the UK.

The trio signalled NetCo would also provide “new financing optionality” – cue infrastructure investors – and a platform for “potential altnet consolidation opportunities”, which signals the UK fibre altnet pool is about to get smaller.

NetCo will be a fully consolidated subsidiary of Virgin Media O2, will comprise the operator’s cable and fibre network assets covering 16.2 million premises across the UK today, with all upgraded to fibre in the coming years. The companies confirmed that the independent fibreco JV between Liberty Global, Telefónica and Infravia, nexfibre, will remain separate as in contrast to Virgin Media O2’s mainly urban footprint, that fibreco is targeting greenfield areas. It aims to expand FTTP to 5 million premises by 2026.

Collective footprint

Collectively, Virgin Media O2 and nexfibre have a full fibre footprint of more than 4 million premises today. However, the combined nexfibre and NetCo fibre footprints are planned to reach a combined total of up to 23 million homes depending on the rollouts which puts it neck and neck with Openreach. In December Openreach CEO Clive Selley said the company intends to keep building after it reaches its initial 25 million target, reaching up to 30 million premises with full fibre by the end of 2030.

VMO2’s mobile assets will not form part of the NetCo, nor will its consumer and B2B units. Through a wholesale agreement, NetCo will connect Virgin Media O2’s entire fixed customer base, providing revenue and attractive cash flow from day one of operation. NetCo will focus on completing the company’s ongoing fibre upgrade programme which sees the existing cable network overlayed with full fibre.

Logical evolution

“This is a logical evolution of our fibre strategy that creates a clear, focused and scaled network entity within the Virgin Media O2 family which underpins our shift to a fully fibre network and reinforces our position as the leading challenger to Openreach in the market,” said Virgin Media O2 CEO Lutz Schüler.

“Working closely with our shareholders, this network business will provide a platform for potential altnet consolidation and wholesale opportunities in future, offering widescale network choice for other providers, as well as giving financing optionality,” he said. “While nothing changes today work is well underway and you’ll hear more from us later in the year.”

According to the companies, the development of NetCo is underway between teams at Virgin Media O2 and its shareholders Telefónica and Liberty Global. As such, further details and operational timelines will be announced in due course and subject to any necessary regulatory approvals. In the meantime, fibre upgrade activity continues unchanged at Virgin Media O2.

Restructuring Belgian, Swiss and Dutch ops

Virgin Media O2’s parent, Liberty Global, separately announced a raft of restructures in a bid to boost its flagging shareprice, some of which have been hinted at by Liberty Global’s CEO Mike Fries a number of times in the last few months.

According to the Financial Times (subscription needed), the company intends to list its Swiss telecoms business Sunrise later this year, which it acquired for $7.4 billion less than four years ago, with shares allocated to Liberty Global investors.

It will also create a holding company for its Belgium unit Telenet and its stake in Dutch JV VodafoneZiggo as a precursor to a potential listing and to help it raise further capital.

Sunrise’s CEO André Krause said “We are excited at the prospect of being listed in Switzerland once again and providing local and international investors with access to our scaled FMC challenger position in the market. Following the successful integration and synergy delivery of the UPC combination, Sunrise has a very strong FCF profile and plans to offer an attractive shareholder remuneration framework. We will present more detail at a Capital Markets Day later this year.”

Telefónica teams up with EHang on air mobility

Only $410,000 for Ehang’s EH216-S pilotless passenger-carrying electric vertical take-off and landing aircraft

Telefónica Tech has announced an alliance with China’s Electric Vertical Take-off and Landing Vehicles (eVTOL) company EHang which is launching its EH216-S model to the world on 1 April. The two companies are looking at what they dub the “low-altitude economy” and the vehicles would be used for the transport of passengers and cargo without a pilot on board in both Europe and Latin America.

Naturally, visitors to Mobile World Congress (MWC) can check out the partners. EHang has chosen Telefónica Tech’s connectivity capabilities (5G and private networks) to enhance the security and efficiency of this type of mobility in both regions, and to continue expanding and exporting its smart solutions with unmanned aerial vehicles.

Both companies intend to implement use cases in Europe and Latin America around air mobility and solutions in areas as diverse as passenger transport, logistics, health services, emergency response and smart cities management. The “low-altitude economy” will no doubt spawn a new “low-altitude insurance sector”.

Telefónica and EHang will also collaborate on drone light shows with swarms of drones to digitalise and increase the sustainability of large-scale shows and events. The two companies have set out to develop connectivity solutions based on 5G mobile networks for the safe and efficient integration of drones and eVTOL aircraft with digital unmanned air traffic management systems (UTM and U-Space). Both companies rely on Telefónica Tech’s TheThinX laboratory and EHang’s Urban Air Mobility Centre in Europe, located in Spain.

5G does the work

Telefónica Tech believes 5G mobile networks have the capacity to guarantee reliable communications, low latency and high data transmission capacity in the development and integration of the urban air mobility sector. 5G make it possible to optimise the real-time control and monitoring of aircraft by sending telemetry or multimedia data to both ground control systems and centralised public information systems for immediate processing and management. Similarly, 5G helps to ensure the continuity of UAV operation by preventing potential interference and providing security through the encryption of SIM cards in UAVs.

In addition to these attributes, in the case of private mobile networks, the level of privacy and security of the information obtained by the drone is enhanced by preventing data traffic from being shared outside the customer’s premises and can also provide coverage in isolated and remote areas.

“The partnership with EHang means being part of a pioneering project for the air mobility of the future,” said Telefónica Tech global head of IT Alfredo Serret. “The fact that EHang relies on our connectivity to develop the sector in Europe and Latin America confirms the strong positioning of our service in both markets, and means combining capabilities to enable connected, safe, efficient and green air mobility for all.”

“Telefónica Tech’s capabilities and expertise in connectivity and the internet of things will enable EHang to deploy its solutions efficiently and securely, allowing millions of people to benefit from its applications in their daily lives,” added EHang COO for Europe and Latam Victoria Jing Xiang.

Ehang’s new EH216-S secured what it claims is the the world’s first Type Certificate and Standard Airworthiness Certificate for pilotless passenger-carrying eVTOL aircraft from the Civil Aviation Administration of China in 2023.

Korea lift-off

Telefónica is not the only telco wanting to enter this space with South Korea’s SK Telecom also signing an agreement with – in addition to investing $100m – Joby Aviation, a California-based company developing electric vertical take-off and landing (eVTOL) aircraft for commercial passenger service. The two make up one of seven consortia that have been selected for the Transport Ministry’s K-UAM Grand Challenge to compete and cooperate in bringing flying cars to Korea with their partners.

Pictured: Alfredo Serret, global head of IoT at Telefónica Tech and Victoria Jing Xiang, EHang COO for Europe and Latam

Dell, Nokia team up on network cloud and private 5G

Dell is preferred infrastructure partner for AirFrame servers; Nokia’s Digital Automation Cloud is Dell’s preferred private wireless platform

Dell Technologies and Nokia have extended their strategic partnership. Each will use the other’s expertise and solutions, including infrastructure from Dell and private wireless connectivity from Nokia.

The plan is “to advance open network architectures in the telecom ecosystem and private 5G use cases among businesses”.

As part of the agreement, Nokia will adopt Dell as its preferred infrastructure partner for existing Nokia AirFrame customers. It will offer Dell’s technology as the infrastructure of choice for telecom cloud deployments.

Nokia and Dell will graudally transition AirFrame customers to Dell’s broad infrastructure portfolio, including Dell PowerEdge servers, purpose built for modern telecom network workloads from core to edge to RAN.

Two-way street

In exchange, Nokia Digital Automation Cloud (NDAC) private wireless solution will become Dell’s preferred private wireless platform for enterprise customers’ edge use cases.

The companies will integrate Nokia’s NDAC solution with Dell NativeEdge, an edge operations software platform, to provide a “comprehensive, scalable” solution for enterprises.

The two build on research and development efforts around core network functions and collaborate on platform and application testing and lifecycle management in the Dell Open Telecom Ecosystem Lab.

Dell and Nokia plan to certify workloads on Dell Telecom Infrastructure Blocks that support Nokia Cloud offerings, while also continuing to collaborate on OEM engagements.

Dennis Hoffman, SVP and GM, Telecom Systems Business, Dell Technologies, said, “With our decades of digital transformation experience, we’re ready to work…with Nokia’s customers to continue their network cloud transformation journey on the industry’s top selling compute platform.”

For his part, Nishant Batra, Chief Strategy and Technology Officer at Nokia stated, “This…will make both companies more flexible and able to better address future customer needs.”

He added, “Dell’s digital transformation expertise and global scale, services and support will provide a seamless transition option for Nokia AirFrame customers, and Nokia’s vast experience in the design, deployment, and operation of high-performance public and private mobile networks will provide Dell’s customers with a comprehensive, scalable private wireless solution.”

Ericsson sets out its store and growth acceleration strategy ahead of MWC

The vendor announced new radio products and software, and explained how APIs will save 5G’s bacon

At its annual analyst and press briefing ahead of MWC Ericsson set out its strategy to boost its own fortunes and revive the telecoms industry. In particular it focused on how it intends to enable operators to make money from enterprises and how it is moving to a horizontal platform approach, away from vertical networks based on generations of mobile tech. It sees networks as the foundation layer, with APIs (cloud and device) as enablers at every level.

Clearly buoyed by its perhaps surprising deal with AT&T at the end of last year, which was mentioned frequently, at times a speaker got somewhat carried away. For instance, suggesting that enterprise revenues could be three times those from consumers by 2030. The speaker backtracked when asked for confirmation.

Open-RAN ready radios

On Open RAN, Ericsson launched a range of new radios, which it says are all Open RAN-enabled and supports use of mid-range frequencies. The flagship is the AIR 3255, a Massive MIMO time division duplex (TDD) radio which is more 25% more energy efficient and has 20% lower embodied carbon than previous generations. Meaning greener sourcing of material used to produce it and across the supply chain.

AIR 3255 has a new small metal filter scalable to all TDD sub-6GHz frequency bands to promote 5G mid-band deployment. Ericsson says it is also the first to use the new generation of Massive MIMO Ericsson Silicon (System on a Chip) and uses a single printed circuit board which “is unique to the industry in terms of building practice, as well as passive cooling”.

Johan Hultell Head of Product Line Radio Business Area Networks said that two years ago the focus was on downlink capacity and capabilities because in five years’ time a super strong uplink would be essential.

This big push on the promoting the use of middle band spectrum is interesting in the light of comments when asked why the expected enterprise revenues from 5G and the delivery of services through ecosystems has not materialised.

Erik Ekudden CTO at Ericsson replied that “We were too hopeful when we built the standards. It needs a mid-band network built out in countries and not every country has that.” He also said end-to-end service orchestration is required. In short “We need all those pieces in place and it has not happened yet across enough countries. We don’t think there’s any question of lack of demand for services with SLAs.”

Indeed differentiated connectivity backed by SLAs, slicing, the combination of hardware and software and the perhaps most of all, the critical importance of APIs were the recurring themes.

It is putting a huge amount of faith in open APIs to create ecosystems and monetise 5G, which is not surprising given how much it paid for Vonage.

Ericsson also announced new software. The Service Orchestration and Assurance stack is to enable network operators to orchestrate and manage services across multivendor network domains in hybrid IT environments. The plan is, according to the press statement, that it “works across network generations to efficiently coordinate service creation and management.”

The Dynamic Network Slicing solution is based on Ericsson’s Service Orchestration and Assurance system.

APIs top the agenda

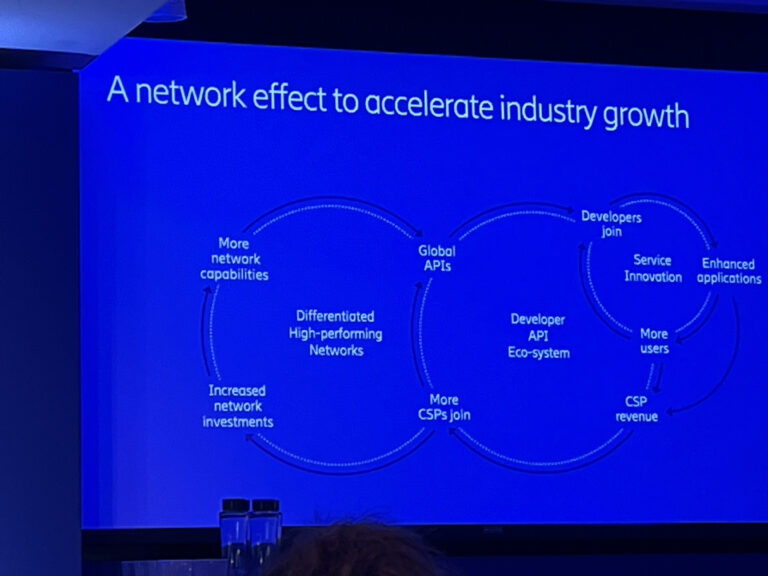

The new CEO of Vonage, Niklas Heuveldop, and guest speaker Peter Arbitter, SVP Magenta API Cap Exposure at Deutsche Telekom (DT), acknowledged at the moment progress towards its API vision were baby steps, but the message is “you have to start somewhere”. There was much talk of CAMARA and signs of inflexion points, network effects (see slide above from event yesterday) and setting the flywheel in motion.

It points to partnerships and rising interest in the market as signs of the unstoppable momentum that is building. For instance, last November, DT announced it would charge developers and business customers for the use of APIs on its mobile network in Germany using the Vonage platform.

Yesterday Ericsson announced a global first-to-market service intended to accelerate developer access to Network APIs via the Vonage Network Registry. The idea is operators make their APIs available via the platform and developers can access them within minutes. The thinking as well as accelerating and simplifying access, it will also scale APIs’ consumption by standardising the approvals process.

This will be on show at MWC including the embedded Silent Authentication within Vonage Verify.

Speakers acknowledged the struggles faced by many Communications Platform as a Service (CPaaS) providers but thinks it will avoid the pitfalls with features such as security products and the SIM Swap Network API, which is in the pipeline,

This allows developers to find out if a phone number has undergone a recent SIM card change and whether it involved fraudulent activity, to create trust and protect voice and SMS services. CAMARA-based APIs, such as Verify Location and Device Status will also be incorporated.

Ericsson also pointed to its collaboration with large scale players, for example, it announced it is to develop a global platform to expose network APIs to developers with Amazon Web Services (AWS).

Niklas Heuveldop, Vonage CEO and Head of Business Area Global Communications Platform, Ericsson, says: “By working with AWS, we will accelerate our ability to embed communications and network APIs in applications and deliver new product offerings for AWS and Vonage customers.”

He adds, “With network APIs, we are exposing new capabilities from within the 5G network that have never been available before, allowing existing applications to be enhanced with network information and enabling the development of a new class of applications.”

DT working on replacing apps in smart phones with AI

It is to demo the concept at Mobile World Congress 2024 with Qualcomm and Brain.ai

Deutsche Telekom will its concept of an AI phone with Qualcomm Technologies and Brain.ai in Barcelona at the end of this month. An AI-based assistant replaces the apps on the smartphone; all the owner has to do is issue voiced or text-based instructions, such as “book me an airline ticket”.

DT’s “generative interface” is powered by Brain.ai and will be able to carry out many everyday tasks, apparently, that normally we’d use apps for.

Using AI, it takes over the functions of a wide range of apps and can carry out all daily tasks that would normally require several applications on the device. The concierge can be controlled effortlessly and intuitively via voice and text.

AI for everyone

DT showed off two use cases integrated into Telekom’s T Phone, which is widely available. It said in a statement, “This underlines the Group’s commitment of introducing innovations on devices that are already on the market and making them accessible to everyone”.

The AI is located in the cloud, and so the functionality will be available on more basic models.

DT is also showcasing a version of an AI smartphone based on the Qualcomm’s Snapdragon 8 Gen 3 Reference Design, in which the AI processing is done on the device. This “makes the AI particularly fast, energy efficient and more customized to each user,” DT says.

The partners’ joint development teams are working on implementing their concept and will be demonstrating prototypes at MWC. Although in perhaps something of an understatement, they say, “It will take time until they are available for customers in the store”.

End of app stores?

Still no doubt this vision will come to pass, probably later rather than sooner. Still, it poses interesting questions about the future of app stores and the vice-like grip of Apple and Google. The two control what appears on the phones that run on their operating systems and take cut of everything sold through their stores.

And of course those models are already under attack in the courts, cf Fortnite vs Apple, and under scrutiny by regulators for their alleged abuse of market dominance.

Jon Abrahamson, Chief Product & Digital Officer at DT, might well sound cheery. He said, “Artificial intelligence and Large Language Models (LLM) will soon be an integral part of mobile devices.

“We will use them to improve and simplify the lives of our customers. Our vision is a magenta concierge for an app-free smartphone. A real everyday companion that fulfils needs and simplifies digital life.”

But you do have to wonder if trading apps for LLMs created and trained by massive companies could be simply trading the dominance one duo for a tiny collection of others.