French market entry adds to the operator’s facilities in the UK, Spain, Netherlands, Germany, Switzerland and Austria

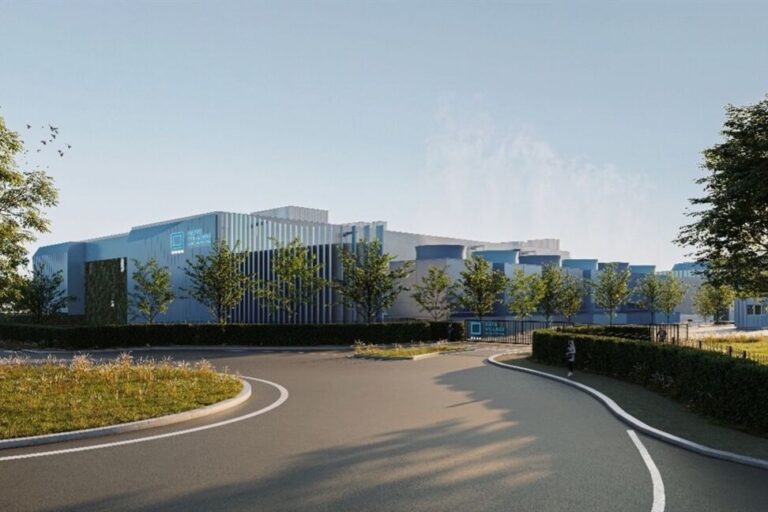

Japan’s NTT has announced that its Global Data Centers division will develop and operate its first data centre campus in the Paris market. The 14.4 hectares (approx. 35.5 acres) campus will host three data centres and will support a planned capacity of 84MW of critical IT load. The site, powered by RTE “from day one”, is located 50km south of Paris in the municipalities of Le Coudray-Montceaux and Corbeil-Essonnes. According to the site owners, Logistics Capital Partners (LCP), the site supports 125MW and is expandable up to 210MW.

“Paris is a significant addition to our global offering and an important area in our expansion efforts,” said NTT Global Data Centers & Submarine Cable CEO and president Doug Adams. “We are pleased to continue to add to our existing portfolio and market share in EMEA and enhance our client offerings to include Paris.”

“This investment complements our existing and growing presence in Frankfurt, London and Amsterdam, and will complete our footprint in the FLAP Tier 1 markets in Europe,” added NTT Global Data Centers CEO EMEA and global COO Florian Winkler.

“We will develop our presence in the Paris metro area in close partnership with the local municipalities, partners, and the government. The addition of Paris builds upon our long-term proven track record of developing and operating in continental Europe and the UK and is a precursor for NTT’s further expansion and growth in both, existing and additional new markets in Europe,” he added.

LCP had first acquired the former brownfield site in 2019 through a public auction and subsequently managed the demolition, decontamination, and obtained the permits and necessary power connections for data centre usage. The company will remain strategically involved to support the development and delivery of this new campus.

Strategic for NTT

Speaking at the company’s recent financial results Board Member, NTT CFO and senior executive vice president Takashi Hiroi reiterated the telco considered data centres were a core growth business despite the operator flagging it was in the process of selling non-core assets. As demand for data usage and computation continues to increase with the wider use of generative AI and other technologies, the need for data centres is expected to continue to grow around the globe.

In Japan, for example, the operator has announced plans to build a distributed data centre model connecting all its facilities to its all photonic IOWN network. Its major data centres are now connected and in 2024 the operator will connect its regional data centres to IOWN. The operator said that due to the very low latency of IOWN, it will be able to operate its remote data centres as a single virtual data centre.

NTT recently entered into agreement with Tokyo Electric Power Holdings, or TEPCO Group, to establish a new DC-focused company. In the Inzai-Shiroi area of Chiba prefecture, NTT plans to develop a data centre, aiming to launch service in the second half of 2026.

The Paris market addition is part of NTT’s global expansion efforts to meet these needs, including recent announcements of new data centre campuses in Virginia in the United States, and in Noida and Chennai in India. All are part of the company’s more than $10 billion investment in data centre growth for fiscal years 2023-27.

Hiroi emphasised at NTT’s result that the operator offers a much broader range of services beyond simple data centre operations, and it will continue to focus on these, like managed services and systems integration to grow its overall data centre business.