Partner content: Healthcare is under tremendous pressure the world over and needs radical change, including being more efficient at adopting new solutions

Healthcare is under tremendous pressure. There are several factors, but ageing populations, unhealthy lifestyles, pollution, and also, to some extent, the greater focus on preventative medicine and shocks like a major pandemic have led to an exponential increase in the demand for healthcare. This results in staff and resource shortages, ultimately increasing costs while making healthcare less accessible and affordable.

In this scenario, to keep modern healthcare functioning properly, the industry needs to become radically different and more efficient in adopting new solutions. However, as we know, one cannot go about cutting corners in healthcare, so we should focus on finding smarter ways of working.

What holds healthcare systems down?

To understand how to help in such scenarios, let’s be specific about which current day-to-day situations might be holding healthcare back:

- Unreliable communication – when mobile communications or Wi-Fi fail, the doctor is left without access to records, while operational coordination is disrupted, leading to negative patient outcomes.

- Navigating complex hospital facilities – these are often confusing complexes full of people. Patients waste time getting lost, while staff also spends hours on basic wayfinding reaching people and/or critical equipment.

- “Where’s that defibrillator?” Misplaced equipment is shockingly common. This isn’t just about keeping inventory costs down, it’s about potential delays in treatments when critical diagnostic equipment or critical sanitised tools aren’t available where and when they are needed.

- Data in a silo – healthcare operations and the people who deliver and access them generate vast amounts of data, but this data is often not captured or used, making it a missed opportunity to improve efficiency, such as forecasting resources and staffing capacity, as well as process optimisation.

- Security risks – patients’ data is highly sensitive. System breaches cannot happen as they threaten patient privacy and erode their trust in the healthcare system.

- Can autonomous robots help us? Imagine small robots autonomously sanitising rooms and equipment or handing equipment to staff, freeing up medical staff from focusing on distracting non-critical activities. These activities imply robust connectivity and accurate positioning inside buildings that legacy systems cannot provide.

How can 5G private networks help?

So, how can an mobile private networks (MPNs), beyond traditional methods of providing connectivity (Wi-Fi, public cellular networks), meet the needs of modern healthcare?

- Customised, fast, reliable network – tailored to specific healthcare needs, ensuring speed and dependability.

- Enhanced security – ideal for safeguarding sensitive medical and patient information.

- Support for innovation – mobile private enable the adoption of new technologies, processes, and methods, freeing up healthcare workers to focus on their core mission – patient care.

That is why I believe 5G private networks can offer a new breath of life and hope for healthcare systems.

Celfocus: our contribution focused on the main challenges

There is certainly a long way to go before healthcare fully leverages all the benefits of 5G MPN. But we can start with the basics. At Celfocus we are already tackling two of the main pain points that hold back healthcare facilities from being more efficient:

First, we need to start with secure and reliable connectivity that never lets people down. Common difficulties are:

- Wi-Fi limitations when using shared spectrum, meaning that reliability is not guaranteed, thus making it unsuitable for critical medical data.

- Limitations of public mobile networks, as 4G can be patchy indoors, especially in basement floors, and 5G signals have difficulty penetrating buildings.

Secondly, we also want to provide accurate indoor location tracking. In this case, MPNs help us solve the following:

- Tracking services are limited – they are expensive while failing to deliver multiple purposes.

- Inflexible solutions – often tied to specific vendors and lacking pinpoint accuracy.

- Precise accuracy – Wi-Fi’s 5–10-meter accuracy pales in comparison to 5G’s 30cm precision, enabling a whole new range of assistive technologies within healthcare facilities.[CP1]

The cost question

5G offers exciting possibilities, but hospitals and healthcare systems are running on tight budgets. These are the strategies Celfocus is using to make MPNs financially viable:

- Cloud homogenisation – implementing functions on the public cloud or with standardised telco cloud architectures that enable deploying and managing NFVs lifecycles from central to far edges.

- Open standards’ compatibility – including O-RAN for more affordable private mobile access network implementations.

- One-click deployment – making all of the required supported IT solutions components deployable with containerised “one-click”, both on public and private clouds.

- Zero-touch operations – making the network autonomous, reducing the need for large operational teams to take care of the services and their underlying infrastructure.

- Private Network-as-a-service (PNaaS) – Providing orchestrated services that automate, abstract, and enable self-serviced delivery and assurance.

- 5G Monetisation – Enabling organisations to monetise both data and services available in their private networks.

- Partnership ecosystems – Partnerships across different industries can drive cost-effective, industry-tailored solutions running on top of the private network.

What benefits can we already achieve?

- 82% E2E network automation from issue detection to resolution

- 34% Cost Reduction in E2E VNF lifecycle management

- 80% Decrease on new hardware rack provisioning

- 20% Less hardware using the telco cloud

- 40x Quicker configuration of RAN equipment

- 90% Configuration error decrease

Beyond healthcare

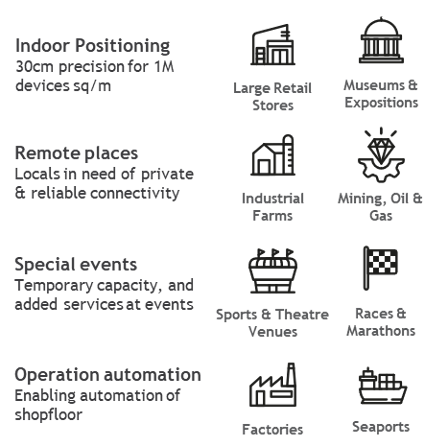

Healthcare is a compelling case study as its needs are urgent. However, the benefits of MPNs are broader than any single industry. Imagine factories where quality control is automated or warehouses where inventory is practically self-managed. Celfocus, by focusing on making MPNs practical and affordable, is laying the foundations for a more interconnected and efficient future across multiple sectors.

About the author

João Miguel Antunes is Head of Autonomous Networks Offer at Celfocus. Committed to the creation of data-driven solutions, Celfocus collaborates with CSPs to deliver the maximum benefits in Network, IT and Service Operations.

João focuses on developing autonomous networks solutions, making synergies between advanced analytics and orchestration & automation to boost digital network transformation towards zero-touch.

João has spent over 19 years designing and delivering solutions for the Telco industry, tackling different business challenges, and gathering comprehensive Telco business know-how mainly in CRM and OSS stacks.