No more blind launches

France’s Amphenol Antenna Solutions (AAS) has created the European mobile network industry’s first official test centre for the aerials and receivers whose functions can make or break a network. Until now, it seems, the European Open RAN network builder has operated in the dark as they assemble their infrastructure. Most mobile network operators have unanswered questions about the real-world suitability of their planned Open RAN system, according to Mette Brink, CEO of Amphenol Antenna Solutions, which seeks to bring order to the chaos. Under pressure to meet deadlines, many operators leave the question of antenna performance to chance. This service could be invaluable as it takes out the fear, anxiety and guesswork involved.

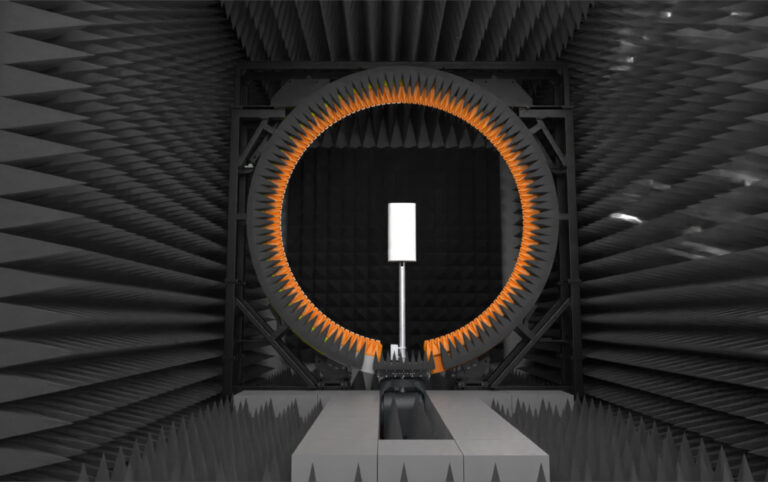

The new facility in Amboise, in France’s Loire Valley, uses an MVG SG Evo measurement system that has been specially designed to enable European network operators check the compatibility and performance of Open RAN hardware and software. It’s the latest ‘state of the art’ SG system developed by MVG, according to MVG’s project engineer Robin Pasquier. The testing equipment maker’s mechanical oversampling is coupled with a positioner capable of supporting heavy antennas. This, said Pasquier, creates the best possible environment for base transceiver station antenna testing. It has “unparalleled accuracy,” said Pasquier.

AAS recognised that Mobile operators, systems integrators and other network builders need to find the best set up for their needs but there was no system that used the antenna as the basis of their investigation. Working on the assumption that much of the success of an installation everything hinges on the performance of these receiversof transmissions, operators can benchmark antennas from different manufacturers. They will be given a full analysis from every perspective, including a view of 3D radiation patterns. The Amphenol review also checks compatibility with backbone networks, runs over-the-air end-to-end tests and shows network engineers the volume of traffic handled and electricity used.

It saves operators a huge amount of time and money if they can get all this information in one place in one set of exercises, according to AAS. Operators will be able understand the impact of changing a system component, run tests to diagnose any issues that might arise and immediately resolve issues in the field.

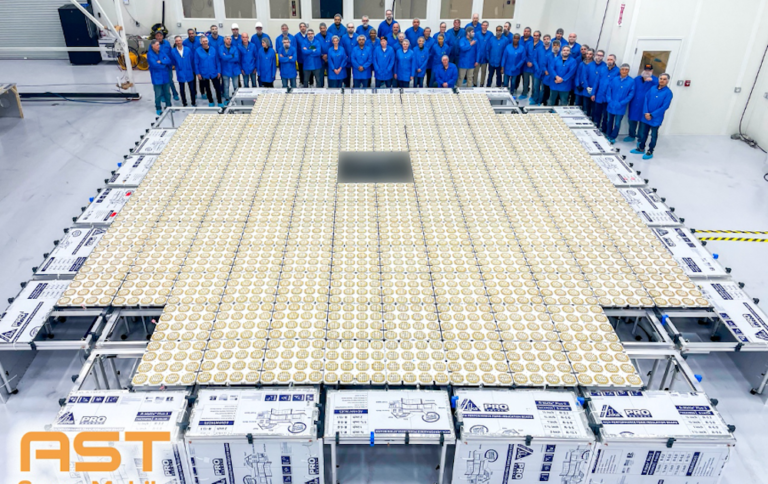

The facility gives operators access to a team with 75 years’ experience in antenna design and testing. The location is convenient for operators to assemble their multivendor Open RAN teams, although it will also be possible to manage tests remotely. The ambient, Loire Valley surroundings would also make this a pleasant work destination for engineers across Europe.

The facility is located in the picturesque Loire Valley region, in the historic town of Amboise, once the home of the French Royal Court and the childhood home of Charles VIII. It also housed the greatest inventor of all time, Leonardo da Vinci. Visiting engineers might also take inspiration from a visit to the Museum of Secrecy while the equipment is being tested. These historical surroundings should remind engineers that Open RAN network cannot afford any secrets and engineers cannot stand on ceremony.

“Most MNOs have many unanswered questions about the real-world suitability of their planned Open RAN system,” said Mette Brink, CEO of Amphenol Antenna Solutions. “By providing a convenient way to answer these questions, we can help them find an Open RAN setup they are confident to take into the field. Ultimately, we’re helping them get closer to achieving the cost savings and flexibility they want from Open RAN.”