Government to profit the rural networkers

The Spanish government has put up €150 million to fund tower companies that extend 5G into coverage black holes. The offer is part of the government’s post-Covid national recovery plan to encourage infrastructure builders such as Cellnex, American Tower, Vodafone’s Vantage Towers and Orange’s Totem as likely candidates. Under the scheme’s terms any builder of towers, masts or backhaul infrastructure could get funding as long as they give access to at least four mobile service providers.

Competition

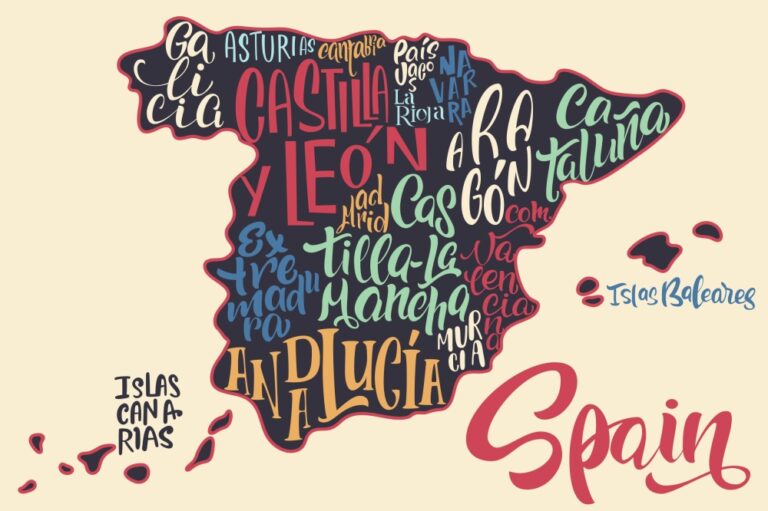

“That’s really just the government ticking the appropriate competition box,” said analyst Mary Lennighan, in Telecoms.com. The policy should prevent any Spanish telco from manipulating the policy to boost its own coverage at the expense of others, said the analyst. The hard to reach Spanish locations are roads, railways and rural areas, divided up geographically into four zones. The biggest financially is Zone 1 which covers Galicia, Asturias, Cantabria, the Basque Country, and Castilla y León and offers funding of €52.9 million. The rest of the fund, €97.1 million, is split roughly equally between the other three zones.

Qualification

Interested parties must pass through a pre-qualification phase, followed by an evaluation in which bidders must present a detailed report on their plans for the region in question. The plans must describe the financial model through to 2032, detailing the cost of deployment of the passive infrastructure and the cost of running it on a wholesale basis. Proposals will be judged on population and geographic coverage, attention to technical details, the potential for job creation in Spain and the EU and access for disaster recovery and emergency services. The closing date for applications is 29 July 2022.