In an age where fibre is seen as the access tech of the future, Vaughan O’Grady looks at how DOCSIS is providing a highly viable alternative.

Data Over Cable Service Interface Specification (DOCSIS) is a global technology specification that adds high-speed data transfer to an existing cable TV system and at almost a quarter of a century old, it is about to go through another iteration – DOCSIS 4.0.

In fact, it could equally well be described as an elegant and cost-effective way of getting the most out of infrastructure. As Alan Breznick, Cable/Video Practice Leader at Light Reading, explains that was certainly the idea when DOCSIS technology was developed in the late 1990s, “but it’s performed much better than even its early pioneers could have expected.”

It has also evolved. Older DOCSIS implementations sent signals strictly over coaxial cable, but modern headends (which receive, process and distribute TV signals) usually drive signals down fibre lines to smaller nodes. Each of these nodes uses coax to serve just a few hundred subscribers.

In each node, the signal from the fibre is split and sent down coax for the final few hundred metres to subscribers’ homes. These deployments are called hybrid fibre-coax (HFC) networks.

Competitive at less cost

John Chapman, CTO Broadband Technologies at Cisco Systems and one of the people instrumental in the development of DOCSIS, explains, “DOCSIS takes an existing asset, which is the HFC plant… built for delivering video, and it converts it into a broadband platform, and therefore delivers broadband to the end user at a data rate that is equal to or above what the market needs at a cost point less than what competitors can provide.”

He adds, “It’s really the transformation of a video-only service into a video-and-DOCSIS service. It’s a very effective platform – and should be an effective platform into the future. It works and it’s cheap.”

It brings other benefits too. Curtis Knittle, VP of Wired Technologies, CableLabs (the company that developed and now leads the standardisation of DOCSIS technology), states, “Operators with an abundance of conduit have a special set of economic circumstances that allows them to use FTTH solutions in a cost-effective manner, but most cable operators don’t have this luxury.”

Nor is it any coincidence that the standard has remained relevant for so long. As Wim De Ketelaere, CTO of Excentis, notes, “By making sure that the newer standards had built-in backwards compatibility with previous generation products, operators could gradually but surely introduce newer products and benefit from these.”

Excentis co-authored an early European-focused standard, with its own testing and certification programmes. It was called EuroDOCSIS. However, since the DOCSIS 3.1 standard arrived, US and European standardisation has begun to converge. Today the Excentis offering involves testing, monitoring tools, consultancy and training.

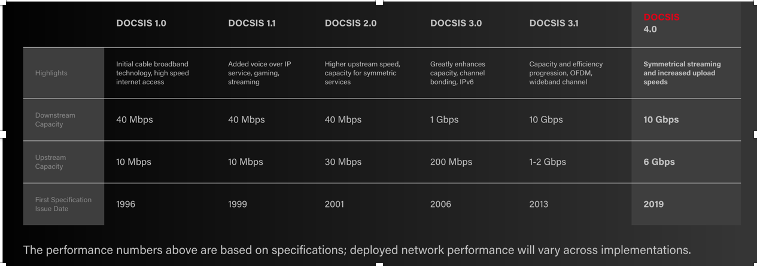

The evolution of DOCSIS

Source: CableLabs

The new standard

So DOCSIS 3.1 is the most recent commercially deployed standard and it can reach speeds of up to 10 Gbps in the download stream and 1 Gbps in the upload stream. Sometime next year, however, we may see the first deployments of DOCSIS 4.0. Knittle says, “The DOCSIS 4.0 specification was finalised in March 2020 and will enable downlink speeds of up to 10Gbps and uplink speeds of up to 6Gbps once deployed.”

It’s also the first DOCSIS standard to incorporate both Full Duplex DOCSIS (FDX) and Extended Spectrum DOCSIS (ESD) – the two primary pathways for evolving today’s HFC networks, offering lower latency and greater operating efficiencies.

De Ketelaere says: “All things considered, for most operators it will be significantly less expensive to upgrade the HFC network to support DOCSIS 4.0 than to deploy fibre to the premises. DOCSIS 4.0 offers capacity comparable to 10G PON [passive optical network] and a lower overall expense to deploy.”

DOCSIS is mostly used for last-mile connectivity, but De Ketelaere adds, “Depending on their current infrastructure – length of amplifier cascades, access to passives, quality of existing cables – they need to make an analysis of how and when using DOCSIS 4.0 makes most sense.

“The fact that operators continuously make nodes smaller for capacity upgrades – and as such reduce the number of amplifiers and coax cable lengths – makes reaping the benefits of DOCSIS 4.0 technology easier.”

Greater upstream capacity

All kinds of access systems were originally designed to support much faster download than upload speeds, and the demand for faster uploads began long ago, but, says Breznick, “It got a real jump-start with Covid” due to conference-calling like Zoom, videoconferencing, posting videos and work-related activity to name only a few. For now, however, he believes DOCSIS can cope with demand.

It has even been implied that symmetrical down- and upstream data is the next selling point for DOCSIS, but Chapman isn’t convinced. “Most traffic is asymmetrical,” he says, referencing YouTube and TikTok. “What turns the bandwidth around may be webcams or videoconferencing, but they’re a small percentage compared to what video streaming services are doing”.

He explains, “Do you really design your whole plant around a [Cisco] Webex service or a Microsoft Teams service? The answer is probably not. You want to be able to have a symmetric service at a reasonable bandwidth, built on top of an asymmetrical plant.”

Chapman adds, “If your upstream stops at 1 gig, why would you ever stop your downstream at 1 gig? You should really march it to 10 gig and sell that to capitalise on it. The investment envelope – along with the technology – points to asymmetry.”

Either way, he thinks DOCSIS will cope with demand for some time. “If you imagine DOCSIS goes from 1 gig downstream to 10 gig downstream, 10x bandwidth growth within the existing spectrum is possible – and that does involve video reclamation [moving video onto IP and freeing up bandwidth]. Then you can segment your plant; you could go from 500 households in the past to 50, that’s another 10x capacity increase.

“So, if you take the 10x increase in spectral use and the 10x capacity increase, that’s a 100x growth path for DOCSIS.” As he says: “DOCSIS as a technology has a huge runway to it.”

Knittle of CableLabs agrees. “People in the industry have already talked about the possibility of extending the [usable downstream] spectrum beyond 1.8 GHz, with 3GHz being a common theme, and there are other options. The fact is DOCSIS can be extended beyond the 10G downstream and 6G upstream that DOCSIS 4.0 technology will be capable of providing.”

Leveraging installed assets

Most importantly, the cable is already in the ground. Any telecom service provider will leverage the installed plant for as long as they can,” says Knittle. Breznick adds, “To dig everything up and to take out the coax and put the fibre in the ducts takes billions of dollars… [but] PON definitely has the potential to be faster than DOCSIS’ top speed.”

There are other reasons why operators might choose FTTH. Chapman says, “Lower operational costs, it sounds better on marketing – and a big part of it is opportunistic.” In other words, if you have to rebuild a plant anyway and the price is right, why not invest in fibre?

“Ultimately,” says Breznick, “they will all go with fibre to the premises; it’s just a question when they do it.” But this will differ depending on the market. So what is the state of play for DOCSIS in Europe compared to the US?

De Ketelaere points out, “It’s hard to just compare the US to Europe, since the comparison really has to be made from local market to market based on the competition and specific economics for that market. Many operators on both sides of the ocean are just now starting to reap the big benefits of DOCSIS 3.1 [and] the availability of DAA (Distributed Access Architecture) systems is another factor contributing to reaping the benefits of DOCSIS 3.1.”

The DOCSIS 3.1 specification also enables cable networks to provide mobile wireless backhaul services more effectively. This will support an increasing number of small cell architectures and 5G.

Switching to fibre?

As for European operators, Liberty Global in the UK is going to switch over to all fibre at some point later in the decade, but is still using DOCSIS over HFC. Germany remains a big DOCSIS market. Vodafone Deutschland is preparing for the introduction of DOCSIS 4.0: Vodafone Group bought Liberty Global’s cable estates in Germany, Hungary, Romania and the Czech Republic in 2019.

By 2018 Vodafone Spain had completed the DOCSIS 3.1 upgrade of its nationwide network covering 7.9 million coaxial lines. Eltrona (Luxembourg), Altibox, Stofa and TDC (Denmark), Ono (Spain), Com Hem (Sweden), Vodafone-Ziggo (Netherlands) and Telia (Finland) are among other carriers investing in DOCSIS 3.1.

However, a number of European carriers are changing tack. The UK’s Virgin Media O2 (the merger between Telefonica’s mobile operator and Liberty Global’s UK cable firm completed earlier this year) plans to upgrade its entire network to full fibre technology by 2028.

Telecoms giant Altice, which has a reach that spans Spain, France, Portugal, Israel and the US, has decided to skip DOCSIS 3.1 upgrades (apart from a modest deployment in the New York metro area) and invest in a full fibre to the home (FTTH) deployment across its entire network footprint. In June Altice acquired a 12.1% stake in BT, which is playing catch-up deploying fibre at the rate of passing about 40,000 premises a month.

It’s also not clear how committed markets in Europe are to upgrading further, or when, especially while DOCSIS 3.1 serves markets’ needs. Chapman refers to a customer base that is “vastly under-utilising DOCSIS 3.1” today. He says, “I encourage people to go to deploy now with DOCSIS 3.1 and Remote PHY, and to figure out how they’re going to get to DOCSIS 4.0 later.”

He adds, “Obviously in Europe there’s a lot of FTTH and that’s a competitive consideration. If you don’t have an HFC plant, it probably makes sense to build a fibre plant, but if you have that HFC plant, DOCSIS can transform that plant into a strong broadband platform.”

Breznick adds, “The trend is towards all fibre, but it probably will happen slower in the US just because cable operators are the dominant broadband providers in the US and in Canada, as opposed to in Europe where they’re not. As they can use DOSCIS to at least match the speed of the fibre providers they will stay with DOCSIS.” Also, as he says, “Cable was born in the hills of Pennsylvania and Colorado.”

It’s still a question of economics and demand. Fibre will eventually offer speeds that even DOCSIS 4.0 cannot, but is there a market yet? And is it worth completely ripping out cable? As Breznick says, “There’s been a lot of reports about DOCSIS dying and they always turn out to be premature. It’s 25 years old and it’s probably got at least another 10 to 20 years ahead of it.”