The acquisition of about 20% equity in Tele2 is through the investment vehicle Freya, iliad’s joint venture with NJJ Holding

Freya Investissement has entered into a binding agreement with investment house Kinnevik to acquire its entire shareholding in Tele2 for SEK 13.0 billion (€1.16 billion) in cash. This equates to a stake of about of about 19.8% in Tele2.

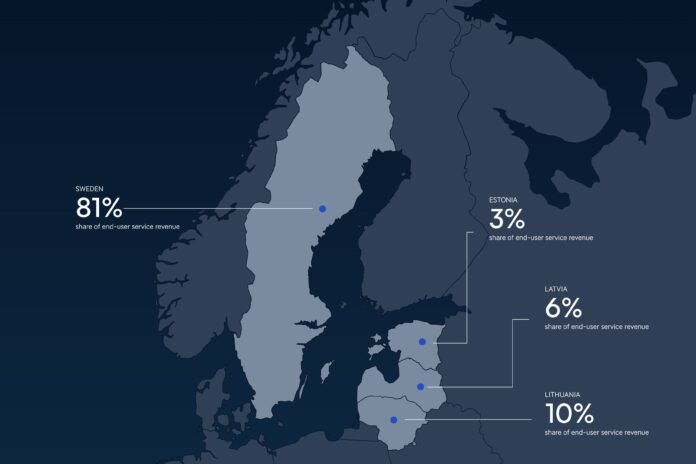

Tele2 is a communications service provider in the Swedish and Baltics markets (see map above). Freya Investissement is an investment vehicle jointly owned by iliad and NJJ Holding.

The iliad Group made the announcement today. It said in a statement that after gaining the approval of the relevant authorities, Freya will become the reference shareholder of Tele2 once the transaction closes. The transaction has received the unanimous support of the boards of directors of iliad, Freya and Kinnevik, according to the press statement.

The statement added that the acquisition “of this strategic stake will offer the iliad Group, through Freya, an opportunity to further Tele2’s growth and to collaborate with Tele2’s management team on innovation, convergence, and investments in next generation networks”.

The transaction has been split into three tranches:

• In Tranche 1, Freya will acquire from Kinnevik 4.5% of the share capital of Tele2 and 3.5% of the voting rights. The closing of Tranche 1 will take place shortly after signing.

• In Tranche 2, Freya will acquire shares from Kinnevik B shares representing, in aggregate with Tranche 1, approximately 18.8% of the share capital of Tele2 and 28.8% of the voting rights. The closing of Tranche 2 is conditional upon receiving foreign direct investment approvals in the relevant countries.

• In Tranche 3, Freya will acquire all remaining shares held by Kinnevik, which in aggregate with Tranche 1 and Tranche 2, will result in Freya owning about 19.8% of Tele2’s share capital. The closing of Tranche 3 may be, if applicable, conditional upon receiving an antitrust approval.

The Parties expect the closing of Tranche 2 to occur during the second quarter of 2024 and the closing of Tranche 3 to occur, at the latest, during the third quarter of 2024.

If all goes to plan, Freya will own less than 30% of the voting rights in Tele2.

A lot in common

Thomas Reynaud, Director of Freya and CEO of the iliad Group (pictured), says: “The iliad Group and the Tele2 Group have a lot in common. We both believe in the power of innovation and the importance of an entrepreneurial mindset. Our business sector in Europe is highly demanding.

“So, we have a great deal of respect for what Tele2’s shareholders, management and teams have achieved, and we’re delighted that Kinnevik has chosen Freya as Tele2’s new reference shareholder. We look forward to contributing to the next chapter of Tele2’s growth story!”