The Finnish equipment maker looks to slash costs by as much as €1.2 billion by the end of 2026, including up to 14,000 jobs

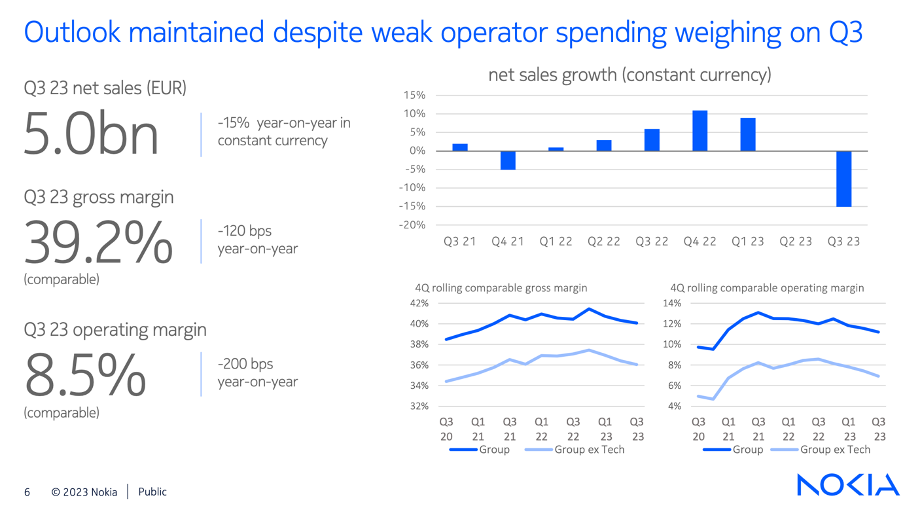

Finnish network equipment Nokia said it would cut up to 14,000 jobs as part of a cost cutting strategy after its Q3 earnings report. During the quarter, net sales declined 20% year-on-year to €4.98 billion, but profits fell 69% year-on-year to €133 million.

The company said it aims to lower its cost base on a gross basis from 2023 by between €800 million and €1.2 billion by the end of 2026 to “address the challenging market environment.”

This will reduce the number of employees from 86,000 now to between 72,000 and 77,000. Earlier this year rival Ericsson announced plans to lay off 8,500 employees as it too struggles with tough market conditions. And earlier this week, its Q3 earnings report resulted in its shares hitting levels last seen in 2017.

Both Nokia and Ericsson have been hard hit by the slowing global economy and reduced spending on infrastructure by mobile operators.

Hence Nokia’s largest revenue-generating unit, its mobile networks business, fell 24% year-on-year to €2.16 billion, but operating profit fell even more sharply, by 64% year-on-year. Like Ericsson, Nokia said this was mainly driven by declines in North America where Verizon and AT&T in particular have cut back on spending.

Again like Ericsson, the Indian market is was a bright spot in Q3, but there too growth is slowing for both. Nokia’s CEO, Pekka Lundmark (pictured), said in a statement issued today that the decline in mobile networks revenue was the result of “some moderation in the pace of 5G deployment in India which meant the growth there was no longer enough to offset the slowdown in North America.”

Remains confident

Nokia has maintained its forecast for the full year of net sales of between €23.2 billion and €24.6 billion.

“I remain confident in the fundamental drivers of our business,” Lundmark said. “Data traffic growth continues, the 5G rollout is still only around 25% complete, excluding China, and networks will continue investment. Cloud computing and AI revolutions will not happen without significant investment in networks that have vastly improved capabilities.”

He also said, “The most difficult business decisions to make are the ones that impact our people. We have immensely talented employees at Nokia and we will support everyone that is affected by this process. Resetting the cost base is a necessary step to adjust to market uncertainty and to secure our long-term profitability and competitiveness.”

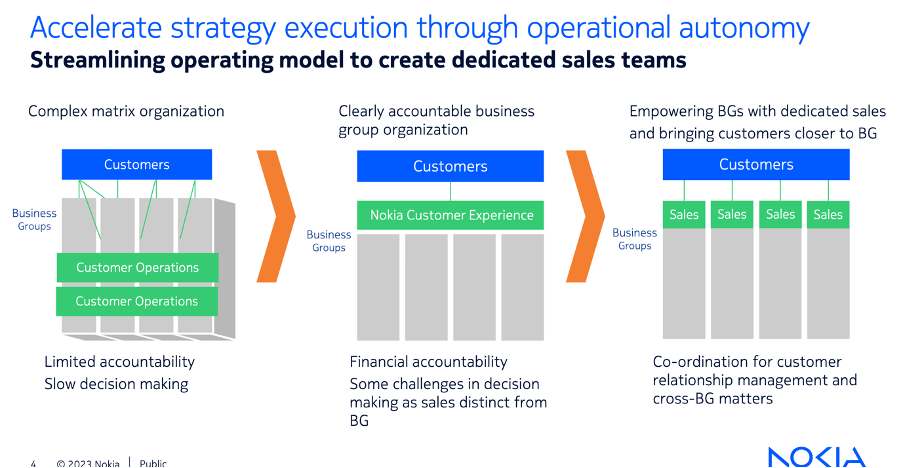

Nokia also stressed that job losses are only part of its ongoing campaign to become more operationally efficient – see below.

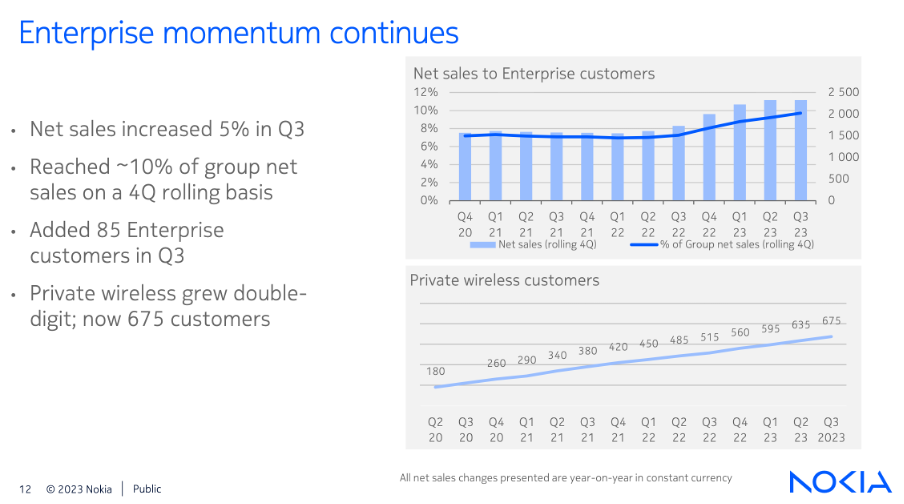

Looking to enterprise for growth

Again, like Ericsson, Nokia is looking to the enterprise market for growth, but whereas Ericsson is looking to its CPaaS platform Vonage to deliver the goods, Nokia is focused private networks, as shown below. While Vonage’s surge in Q3 for Ericsson accounted for 7% of revenues overall, Nokia’s private networks are expected to account for 10% of total revenues in Q4 with less dramatic but steady growth. However, earlier this year, IDC forecast slower than expected growth in private LTE and 5G networks.