Ten months after becoming CEO of Vodafone Group, Margherita Della Valle puts her stamp on the operator, including boardroom changes

Vodafone Group has announced a reorganisation of its business into five divisions and a shake-up at CxO level. The new divisions are: Germany; European Markets; Africa; Vodafone Business; and Vodafone Investments.

Rightsizing Europe

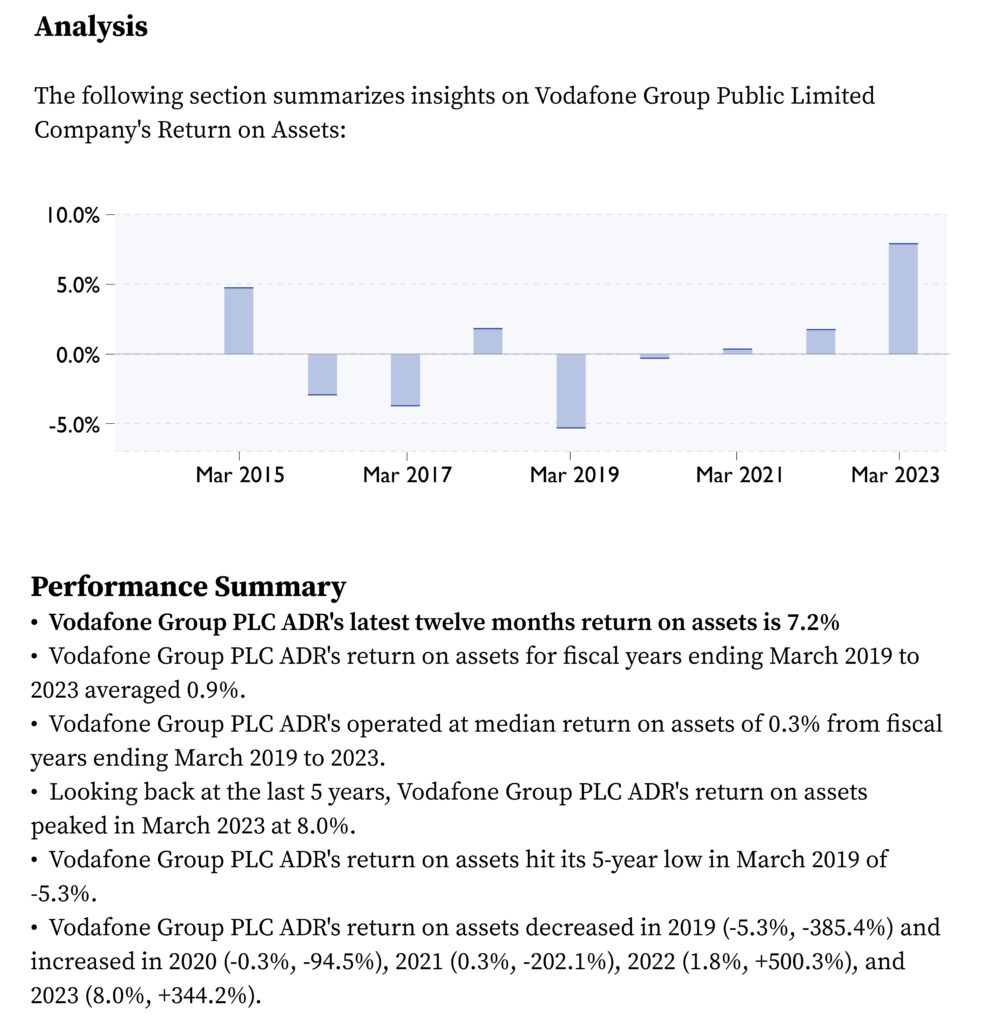

Vodafone Group has entered into a binding agreement for the €8 billion sale of Vodafone Italy to Swisscom. It describes this as the final step in its “rightsizing” strategy for Europe. The strategy was announced by Group CEO Margherita Della Valle (pictured above left) in May 2023. Spain and Italy were high on that agenda because Vodafone could not achieve a return on capital employed (ROCE) higher than the cost of capital.

Della Valle said in a press statement, “Today, I am announcing the third and final step in the reshaping of our European operations. Going forward, our businesses will be operating in growing telco markets – where we hold strong positions – enabling us to deliver predictable, stronger growth in Europe. This will be coupled with our acceleration in B2B, as we continue to take share in an expanding digital services market.”

She added, “Our transactions in Italy and Spain will deliver €12 billion of upfront cash proceeds and we intend to return €4 billion to shareholders via buybacks, as part of our broader capital allocation review.”

The operator group is selling its business in Spain to Zegona Communications for €5 billion. It received approval from the European Union to proceed in February and is now awaiting the go-ahead from Spain’s authorities. It is expected permission will be granted.

The operator group is also awaiting regulatory approvals for Vodafone UK to merge with Three UK although the press statement seems to assume the UK deal will go ahead.

The press statement read, “All telecom markets within the new geographic footprint have been growing over the last 3 years and we will now accelerate our performance where we can create value. In the near-term, the new footprint with the sale of Vodafone Spain and Vodafone Italy, will also result in a step-up of Vodafone Group ROCE of more than 1 percentage point.”

This is significant, given that ROCE of members of the European Telecommunications Network Operators (ETNO) has fallen sharply: in 2017 their ROCE was 9.1% but 5.8% in 2022.

Exiting Italy, closer ties to Swisscom

Although the sale to Swisscom is described as a “full exit from Italy”, under the terms of the deal, Vodafone will continue to provide certain services to Swisscom for up to five years. The annual charge for these Group Services for the first year after completion is estimated at €350 million.

Should Vodafone subsequently enter an agreement for an alternative transaction involving Vodafone Italy within 12 months, Vodafone is to pay Swisscom a break fee of €150 million.

Vodafone and Swisscom are also exploring “a closer commercial relationship to enable collaboration across a broad range of areas, beyond Italy” which include “IoT, enterprise services and solutions, procurement, operational shared services and roaming”.

Vodafone says this aligns with its strategy of commercialising shared operations and broadening partnerships.

Partner power

From 1 April, most of Vodafone’s central operations will start to move towards “a fully commercial model”. This programme is expected to complete in financial year 2025, opening platforms and services to third parties, offering them the opportunity to access shared operations such as procurement, roaming, IoT and other business platforms.

These offerings will be extended to partners including To better serve our own markets and telecoms partners Swisscom in Italy and Zegona in Spain.

B2B engine for global growth

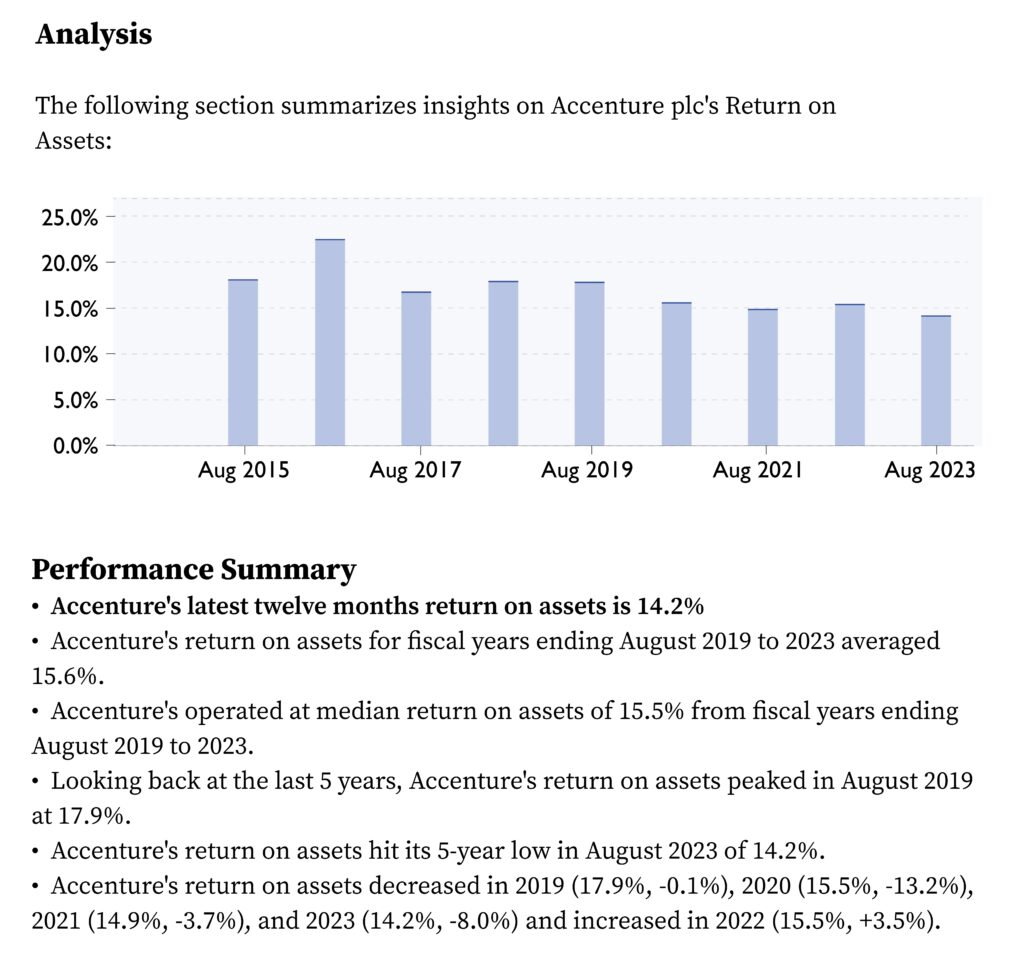

Vodafone sees its biggest growth opportunity in B2B, stating that “demand for digital services is strong and we are particularly well positioned to support SMEs and public sector customers, as their strategic partner in transitioning to the cloud and generative AI”.

In the analyst briefing today, Della Valle said when asked about capex and reinvestment that “There are definitely two areas of our business in which standing back from capex and just thinking of financial resources, we have made shifts”. The two areas of highest prirority for financial resources will be B2B and improving customer experience across the board.

Group CFO Luka Mucic (pictured above right) added, “when it comes to the B2B side…most of those investments are more on the opposite side of the house. We are investing in sales coverage, in demand generation, in building up the product portfolio, so most of that is more opex. B2B has a very nice feature to it, especially the fastest growing parts of the portfolio of cloud, IoT, and beyond connectivity solutions. They have a very low capital intensity, and therefore are very attractive from a returns perspective.”

B2B service revenues grew 5% in Q3 of the financial year 2024 and the operator claims it is “gaining share against all our primary competitors”. It plans to improve and expand its range of platforms and capabilities through investments and new partnerships such as with Microsoft.

From 1 April 2024, Vodafone’s new IoT company plans to extend its “global leadership position” by entering new markets and creating a platform-as-a-service to support other telcos.

Obviously leadership can be defined in a number of ways, but last week, Telefónica was been recognised for the tenth consecutive time as a Leader in the 2024 Gartner Magic Quadrant for Managed in IoT Connectivity Services, Worldwide report via its subsidiary Telefónica Tech.

Africa

There seemed to be little new in the announcement regarding Africa apart from continuing to “drive growth at attractive returns through mobile connectivity, fixed connectivity and financial services”. And a note that its fintech platform serves more than 75 million customers with double digit growth.

Changes at the top

Vodafone has also announced extensive changes at CxO level. At the Group Executive Committee, the following changes will be effective from 1 April 2024.

Ahmed Essam will become Executive Chairman Vodafone Germany and CEO European Markets. He will have responsibility for markets across Europe, including the UK, Albania, Czech Republic, Greece, Ireland, Portugal, Romania and Turkey. Essam joined Vodafone in 1999 and has held a number of roles including CEO Other Europe, Chief Commercial Operations and Strategy Officer and most recently CEO UK.

Serpil Timuray has been appointed CEO Vodafone Investments with responsibility for Vantage Towers, Vodafone Ziggo, Vodafone Idea and TPG Telecom plus for partnerships with telecom operators, including Partner Markets. Timuray joined Vodafone in 2009 as CEO Turkey. Subsequent roles have included Regional CEO AMAP, Chief Commercial Operations and Strategy Officer and most recently CEO Other Europe.

Philippe Rogge, CEO Vodafone Germany, is to leave the company. Germany is Vodafone’s biggest market and has put in a less than stellar performance, dogged by changes to the law that gives people within multi-tenanted dwellings the right to chose their own service provider. Previously TV and internet connections were seen as central services that were provided by a single company and charged for by the landlord or lady.

Since buying the cable company in

Group Executive Committee composition from 1 April 2024

• Margherita Della Valle, Group Chief Executive

• Luka Mucic, Group Chief Financial Officer

• Ahmed Essam, Executive Chairman Vodafone Germany and CEO European Markets

• Aldo Bisio, Chief Commercial Officer and CEO Vodafone Italy

• Shameel Joosub, CEO Vodacom Group

• Giorgio Migliarina, Interim CEO Vodafone Business

• Serpil Timuray, CEO Vodafone Investments

• Scott Petty, Chief Technology Officer

• Alberto Ripepi, Chief Network Officer

• Leanne Wood, Chief Human Resources Officer

• Joakim Reiter, Chief External and Corporate Affairs Officer

• Maaike de Bie, Group General Counsel and Company Secretary

In-country CxO changes

Marcel de Groot will become CEO Vodafone Germany, reporting to Essam. de Groot joined Vodafone Germany in 2022 as Consumer Business Director and “has been instrumental in the recent commercial improvements in Germany”. Previously, he was Chief Commercial Officer and Director of the Consumer Business Unit at Vodafone Ziggo and Director of Consumer in Vodafone Ireland.

Max Taylor is the new CEO at Vodafone UK, reporting to Essam. Taylor is currently Chief Commercial Officer of Vodafone UK, having joined in 2019.