Service platform provider OpenCloud is writing two articles for Mobile Europe on the opportunities and challenges of voice in LTE networks. This first one outlines the basic issue – that OTT players have more opportunity to grab market share in LTE, given the better latencies and higher capacities of LTE. But it also argues that there are still advantages for operators, such as service ubiquity, and their background in offering value added voice services.

However, to bring the intelligent network capability of 2G voice to LTE, operators need to make sure they have the correct service layer architecture, this piece argues.

A second article will look at mobile operator business models around VoLTE.

VoLTE vs. VoIP: How Operators Can Exploit the Potential Difference

LTE offers both Operators and Over-The-Top (OTT) players the opportunity to offer compelling voice services to consumers. However, operators have the ability to outperform their rivals through the adoption of Voice over LTE (VoLTE). Mark Windle, Head of Marketing at OpenCloud explains how operators can retain their position as the leading providers of voice services.

Over-The-Top VoIP Presents a Current Threat

Voice is still vitally important for mobile operators. Voice revenue still accounts for two thirds of their income. With the advent of 3G+ and the proliferation of Wi-Fi, mobile subscribers now have a choice between OTT VoIP and traditional operator-delivered mobile voice services. The operator’s key revenue stream is under attack.

The roll-out of LTE will increase that threat. With better mobile broadband, OTT providers will be able to further capitalise on the appetite for ‘free’ calls and in some cases, a better service quality with features such as HD voice, and mobile video calling.

However, LTE also enables operators to reduce the cost of providing voice services. This will, at least, help them maintain margin if revenue falls. Yet VoLTE also has potential advantages that will help operators defend their share of the voice market, and protect that key revenue stream.

Today’s Battery of Advantages

Saving money is one of the main reasons why subscribers start to use VoIP applications instead of the operator’s voice services. The ability to make a voice call from, and to, anywhere in the world for free, as long as you have a data connection, is extremely appealing. OTT VoIP services also often allow users to take advantage of the advanced features such as HD voice and video. For example, the latest iOS upgrades have allowed iPhone users to take advantage of video calling with the ‘FaceTime’ application.

Historically, however, OTT use has typically accounted only for extra, discretionary minutes; particularly for international calls where the cost benefit is at its peak. Furthermore, OTT use has typically occurred when mobile subscribers were stationary and connected to the internet via Wi-Fi. The use of HD voice and video has similarly been limited to times when a sufficiently high-bandwidth connection was available.

Whilst OTT service providers have managed to gain a foothold in the international voice market they have not yet become the first choice for making day-to-day mobile phone calls. For now at least, mobile broadband is inadequate for reliable voice with an acceptable quality. Today, the vast majority of originating, and terminating, mobile voice calls are still served by the mobile operators. Despite the attraction of free calls, the operators’ mobile voice services have valuable distinguishing characteristics that consumers find compelling.

Operators’ voice services connect more than four billion people with a universal service enhanced by key supplementary features that we, as end-users, now take for granted. Voice features such as call divert, find-me-follow-me, parallel ringing, multi-party calling, voice mail, short number codes and so forth are all elements of the voice service that are universal and work everywhere, regardless of the network hosting each calling party. Network specific Value-Add Services satisfy further needs of consumers and enterprise customers.

One advantage, however, stands above the rest: the operators’ voice services are dependable. In addition to providing simple, universal services, they have a consistent quality and reliability that is worth paying for. But the protective advantages enjoyed by operators today will not all survive. Trends already established are set to change the balance of power.

The Power Shift

The global reach of operators’ voice services is currently a significant differentiator. OTT providers are limited in their audience reach through the use of a ‘closed’ user group model (e.g. Skype to Skype calls) and there is no guarantee of connection. However, increasing numbers of subscribers use smartphones and can download free OTT voice applications. The OTT applications are deepening their integration with the phone address book and offering “live” features that provide up-to-date status of contact availability. With increasing numbers of users, and tools to simplify identifying and calling available contacts, the OTT providers are slowly eating into the operators ‘global’ advantage.

In the US and some other parts of the world, operators are now rolling out LTE broadband; making better use of their spectrum to meet the growing need for more mobile data bandwidth. With LTE OTT voice providers will have access to a network that is much better suited to the delivery of voice. In addition, they will be able to improve their VoIP services by using the power of the smartphone – delivering such capabilities as HD voice, video. On the one hand, operators have to implement LTE to meet their customers’ demands for more bandwidth within the constraints of their spectrum allocation. On the other, this opens up a huge threat to their core revenue stream.

Many operators have already recognised that they must respond through the development of Voice over LTE (VoLTE), in order to protect their revenues associated with their core proposition. LTE enables the operators to benefit in the same way as their OTT competitors: the operators also have the opportunity to deliver voice services more cost effectively, and offer higher-bandwidth services such as HD voice and video. Furthermore, the introduction of LTE also enables the operators to capitalise on their most potent, current advantage: dependability.

LTE coverage will not be universal for a long time, if ever: and until then there will be islands of new LTE coverage and areas where only legacy 3G or 2G coverage is available. Mobile telephony is all about being truly mobile, not just making calls from one fixed location and then moving to another in a nomadic fashion. It is therefore imperative to be able to switch between these new and old networks whilst on the move. This will be an issue for OTT providers, and not one they can solve easily on their own.

OTT VoIP applications are heavily dependent on the reliability and quality of a data connection. As the user moves, the quality of the broadband connection will change. As a result, OTT VoIP users will experience service degradation, interruptions and dropped calls. For OTT VoIP to manage a transition from one network technology to another it requires the handset client app and server to communicate – which can only happen once the new data connection is established. In contrast, Operators can pre-empt and manage the transition for their services in the network itself: enabling call continuity and a better service for consumers. VoLTE will have the ability to automatically switch over when LTE is not available – mid-call – allowing subscribers to keep connected whilst on the move. There is also the issue of “availability” to receive calls when the subscriber has wandered out of broadband coverage. With OTT voice, users will be unavailable, but with voice provided by an operator the network will switch to the existing legacy network automatically. Users won’t notice the changes as they will not be required to change settings on their device: instead they will experience a seamless service.

Although the advantage of offering simple connectivity between four billion subscribers will slowly erode, operators have the ability to develop strong VoLTE propositions and maintain their position over their OTT rivals. Maintaining the advantage of reliability with seamless mid-call transitions from LTE to older networks is key. In order to maximise the value of their VoLTE services, however, operators must also continue to deliver the key supplementary voice features and value-add services, which provide subscribers with the ‘complete’ universal mobile service to which they are accustomed.

An architecture for efficiency

On the legacy (circuit-switched) phone network, the supplementary voice features are implemented by the telephony switch (aka Telephone Exchange) and the Intelligent Network (IN) service layer. For LTE, the equivalent of the switch has no service-specific capabilities – it does not distinguish between voice sessions and their data packets versus email, web browsing or IP TV data. This means that all the standard telephone features we know, use, and depend on, have to be provided separately by the service layer. It is therefore essential that operators have a flexible, reliable and cost effective service layer in order to deliver VoLTE and the service features which cannot be provided by the OTT voice providers.

Value-add services are today typically provided by additional equipment in the service layer. To be able to offer these services for VoLTE, they must be accessible on the LTE network. However, operators are aware that re-creating existing services for the LTE network would be expensive and inefficient. The ideal service layer architecture is sufficiently flexible to enable existing legacy services to continue to serve customers on the legacy network, and at the same time to be re-used for VoLTE.

Furthermore, a service layer that spans both legacy and LTE networks also has a critical role to play in reliably delivering service continuity as subscribers move back and forth between the LTE network and the legacy networks.

Network operators are currently enjoying a degree of protection from the threat of OTT VoIP services. The global reach of their voice services which include a complete variety of supplementary and value-add services coupled with the dependability of the call connection outweigh the appeal of using OTT VoIP for free.

With the right service layer architecture, these advantages can be transferred to VoLTE. VoLTE is not simply an opportunity to reduce the cost of carrying voice services. VoLTE has a crucial role to play in protecting operators voice revenues from OTT VoIP competitors.

Get set for Het Net bet

It was a week when Mobile Europe gave you insight into the plans and strategies of O2, Virgin Media, EE, Deutsche Telekom, and SFR, among others.

SFR, despite being in the midst of corporate reshufflings that would test the patience of many, continues on with an integrated network plan that includes free WiFi, free femtocells, HSPA+ nearly everywhere, and a slightly more vague LTE path (although it’s teeing things off in November in Lyon).

To match this increased network goodness, and some new devices that we won’t mention but end in 5, the operator also “rolled out” some new tariff plans.

Writing on the Yankee Group’s site, analyst Declan Lonergan picked up on the “multi-SIM” aspect of SFR’s new tariffs. Group data plans are not exactly a controversial topic in the industry, but they do cause debate. Just to remind you, a group data plan is where an operator offers a single user, or a family, or even a small business, a single tariff and usage limit that can be spread across a number of devices.

The upside is that you get that second and third connection that you may not have done otherwise. A teenager say, might otherwise go with a cheaper brand or PAYG provider, rather than coming in under the umbrella of a family tariff. A smartphone user may add his iPad to a slightly enlarged data tariff, rather than get only a WiFi version of the tablet. The downside is that it will have the apparent effect of destroying ARPUs, as 3 SIMs are under a €50 bundle, say, rather than 3x€35. However, there are those who point out that that €15 is €15 per month that the operator may well have lost out on. In that case, perhaps it’s the financia reporting metrics that now need to change.

Let Lonergan explain:

“Connecting multiple devices to the mobile network via shared data plans represents an enormous opportunity for mobile network operators. In the U.S., AT&T and Verizon have led the way with this type of offer, and their European counterparts are beginning to launch similar plans. Though customer adoption of shared data allowances across multiple connected devices will result in ARPU-dilution, there will be some important benefits for operators. The most important of these is the potential for reduced customer churn and growth in top line revenues. Customers will respond favorably to data sharing and we expect 2013 to be the year of shared data plans in Europe.”

One thing that is apparent: shared data plans are more common in the USA because they have LTE networks, with the spectral efficiency they entail, to make the data package more palatable to the in-house economists. As European operators begin to go down the LTE path, and more devices with LTE, and as in SFR’s case DC-HSPA capability, come along then we are likely to see operators feeling they have the headroom to redesign their pricing landscape to sweep up more devices under a single bill.

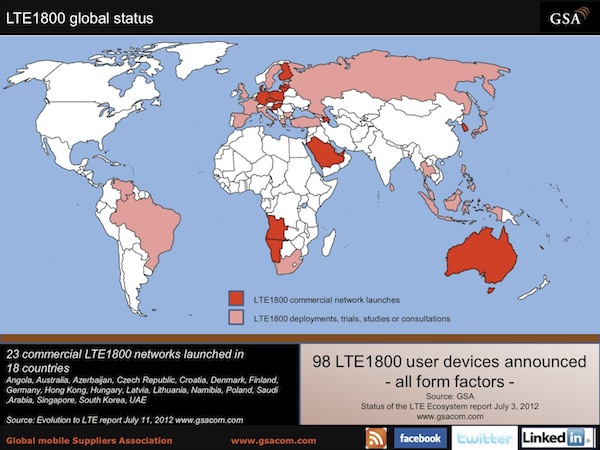

But let’s come back to SFR’s network plan, because it’s an example that we are on the edge of a network landscape (can you be on the edge of a landscape) that will include refarmed 1800MHz and 2.6GHz and 800MHz for LTE. HSPA at 900Mhz and at 2.1GHz. Small cells in the mix, both WiFi and in licensed spectrum, backhaul over….well backhaul over whatever works, seems to be the current mantra.

This week we saw Alcatel Lucent, which is trying to present itself as the one-stop-shop for the metro wireless network, add another backhaul string to its bow, with the addition of a 60GHz provider, Sub10Systems, so its supplier list. And we saw DragonWave announce live trials of radios with 2048QAM modulation providing Gigabit capacities on microwave links. Virgin Media, which presented at Avren Events’ Basestation Conference, is building a wholesale backhaul business on its fibre. O2, which also presented, is using 5GHz WiFi where it can, but adding in fibre (5GHz can’t always get to its rooftop sites) where it needs it, and is considering 60GHz as a small cell solution (pace Alcatel Lucent/Sub10).

Operators are still working this stuff out. O2’s speaker at the Avren event presented the backhaul options with an image of the wild west. Deutsche Telekom’s speaker said that he was still unsure how to cost backhaul into the small cell model. I think we’ll see a lot of this shake down over the next year because a) there will be more small cell trials in Europe and b) there are some big US public access small cell deployments coming that will test out the claims of the competing providers.

One thing that is also clear is that when you put small cells into an area, they get used. O2 gave us actual traffic volumes for its London deployment this summer. (By the way, just as an aside, it saw a near 40% increase in volumes during the Olympics compared to before and after.) Virgin said there have been 40 million “sessions” since it started turning on its WiFi in London, although it didn’t tell us how long most of those sessions are, or what users were actually doing. Given that most people are trying to get somewhere when they are in the tube, that’s still a lot of attempted sessions.

So deploying small cells for free access is a nice to have for consumers, but it gives operators issues. We mentioned backhaul, and we could throw in site acquisition which can be a terror, but there is also traffic management and mobility co-ordination – the business of how to connect people to which part of the network, to ensure service continuity and also quality. This is why we saw NSN present its vision of CEM for LiquidNet – combining customer experience insights with network intelligence to give operators tools to manage capacity and traffic flows. If you think this is all pie-in-the-sky marketing speak, note that Vodafone has a development programme in place to roll out a single SON architecture for its networks, and is working out which processes to centralise and which to push out to the edge. The whole aim is to be able to handle QoS as a differentiator, as well as operate as efficiently as possible. Accessing and processing the data to feed those SON engines will be key. That’s where NSN is going, as well as its competitors in the NEP space, of course, and many others that target different points of the data flow along the way.

So, small cells = consumers like them (well, like the effects), good capacities, offload and onload possibilities. They bring with them backhaul and logistical issues, and act as a catalyst for thinking about network co-ordination, automation, and plugging CEM into network management. It think that about sums it up. Have a browse through this week’s news items, as seen by Mobile Europe, to see how some of those issues are currently playing out.

Keith Dyer

Editor

Mobile Europe