The Dutch telco has big aspirations but first must undertake big perspirations to sort out its back-office systems

Dutch telco Odido is taking action to overcome its back office integration woes by choosing BSS and ecosystem orchestration company Beyond Now to help it achieve large scale digital transformation, at least in the B2B space initially.

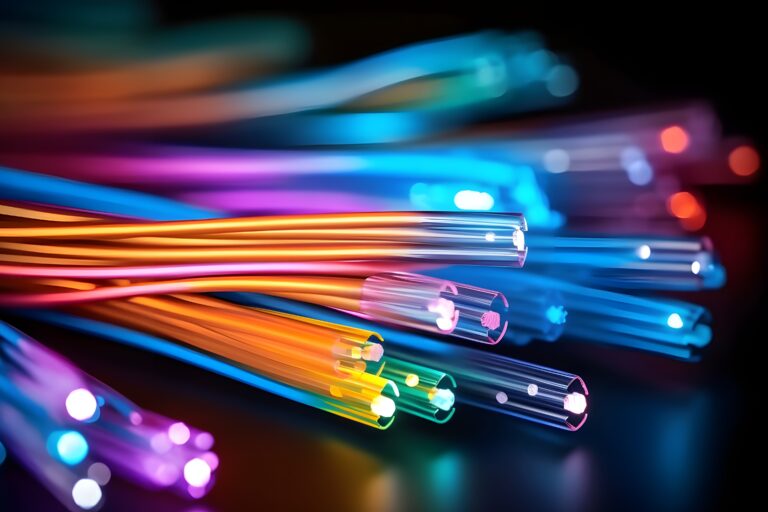

With approximately eight million customers, Odido is one of the big three telecom providers in the Netherlands, serving both individuals and businesses. It wants to be the largest provider of 100 percent fiber-optic internet in the country, aiming to offer internet and TV services via fiber optic to more than six million households.

However, since the merger between Tele2 Mobile and T-Mobile Netherlands – and subsequent new brand launch last September – Odido has been dogged by internet connections issues and poorly functioning customer service. Dutch consumer TV show Radar has received more than 1,000 complaints about Odido. According to Emerce, a third of people with an internet connection at home have had problems with the quality of this connection in the past 12 months. Odido scored the worst: customers experience the most problems and these are also solved the least often.

In addition, Odido has the highest percentage of unresolved complaints at 49%, while for the other providers this is between 32% (VodafoneZiggo) and 43% (KPN). Of this group of Odido customers, 80 percent have been experiencing these problems for more than a month.

Sorting out enterprise services first

Beyond Now will now underpin the telco’s B2B expansion strategy. The adoption of Beyond Now’s platform will enable the Dutch operator to partner with third parties, offer “enriched B2B solutions” to its SMB and enterprise customers, and replace its legacy BSS. The operator is fast tracking its monetisation and orchestration of partner offerings at scale, helping to drive new revenues from the growth in demand for B2B2X solutions. For those wondering, B2B2X is a business model that allows business one to use technology to sell its products through business two – a marketplace.

Beyond Now’s Digital Business Platform is a cloud native solution built on a microservices architecture with Open APIs and it’s delivered through containers. Those containers are orchestrated by Kubernetes with a PostgreSQL database backend, delivering high performance data access through Elasticsearch and Redis.

The new platform covers more than just billing; it also covers charging, order fulfilment, product lifecycle management, and product catalogue, as well as partner orchestration. Odido aims to replace what it inherited from Tele2. This will focus on replacing the legacy manual partner management processes and product databases.

Odido uses Netcracker to sort consumer

Last month, Odido engaged Netcracker Technology to expand the introduction of existing back office workflows in the plan of consolidating several critical processes across various sub brands and legacy environments onto Netcracker Digital BSS.

The operator was already using Netcracker Digital BSS for Configure, Price, Quote (CPQ) and Order Management. In the expanded transformation project, this will grow to include Product Management (Product Catalog and Product Lifecycle Management. Netcracker will lead the BSS platform consolidation project, which will positively impact Odido’s B2C customers through a reduction of complexity and legacy systems, modernization of the entire technology stack, cloudification of its BSS platform and enhancement of the end user experience.

Orchestrating enterprise service partners

In the latest project, Odido will use Beyond Now’s platform to facilitate the rapid onboarding of its 40 partners to seamlessly co-create and co-sell their solutions, benefiting from faster time to market and improved ability to scale operations. The 40 providers will be migrated onto Beyond Now’s digital business platform, which critically, will support ecosystem management and orchestration.

Essentially, the platform supports a model for creating multi-partner solutions which will be key to Odido expanding its range of offerings for business customers. It improves partner management capabilities which will enable Odido to experiment, test, launch and monetise new offerings quickly – across multiple technologies and services (e.g. OTT, TV, 5G or IoT), from its entire partner ecosystem. Beyond Now’s platform will also help to facilitate Odido to launch new services including fixed internet, partner products, mobile and SD-WAN.

“We aim to deliver the best customer experience and service. Since Odido’s rebranding last year, we have been on a fast track towards digital transformation, driving efficiency improvements that enable us to focus resources on developing partner-led solutions that meet our business customers’ needs,” said Odido chief commercial officer enterprise Martijn Teekens. “We’re delighted to have Beyond Now at our side, supporting us with proven expertise that will enable us to rapidly introduce these new offerings and grow our business.”

“Odido recognises that improving operational agility and time-to-market is fundamental to addressing the significant growth opportunity available to CSPs in the B2B sector,” said Beyond Now CEO Angus Ward. “Ecosystem orchestration is a growing priority for CSPs that want to maximise partner synergies, especially if they are to capitalise on new revenues coming from B2B2X offerings.”

He added: “Our platform ensures that Odido will be well positioned to monetise new technologies and orchestrate complex use cases involving multiple partners, suppliers and industry specialists. Slotting in this final piece to the partner puzzle will provide Odido’s tech savvy SMB and Enterprise customers with the complete solutions they need.”

Watching Telekom’s experience

No doubt Odido has been watching Telekom Deutschland – the domestic subsidiary of Telekom – and its progress in building its Infonova Digital Business Platform, which underpins the customer support and service portal for a central marketplace for customers in Germany, allowing them to orchestrate the sale, ordering and fulfilment of this B2B2X offering – with Beyond Now at its heart.

Last year, Deutsche Telekom launched a new digital unit aimed at Germany’s enterprise market under Telekom Deutschland (TD) which is responsible for the group’s domestic market operations. This will make digital services from Deutsche Telekom and partner companies more accessible to enterprise customers in Germany, and to the customers of those organisations (B2B2X), delivered through a B2B2X digital marketplace.

Beyond Now’s platform underpins the customer support and service portal for a central marketplace for customers in Germany, allowing them to orchestrate the sale, ordering and fulfilment of this B2B2X offering. Through its multi-tenancy capabilities, every partner or reseller will have their own tenant, so that they can not only sell the TD services catalogue to their customers, but also integrate their own products and services and manage them through the platform.