Telefónica came out on top in GlobalData’s annual analysis of the global IoT industrial services market.

Telefónica’s rise is apparently due to its portfolio which integrates IoT services with AI, analytics and security, which has helped it gain “solid traction in the sector,” with more than 10,000 corporate customers and over 35 million IoT connections worldwide.

It was also cited for its strong experience in deploying solutions for large and small customers.

Moving up

Of the seven areas evaluated, Telefónica maintained its position in five and improved in two, which are also considered by GlobalData as key in its considerations for potential IoT service customers. Specifically, it has improved in the areas of value services (capabilities in professional services, consulting, security and data analytics) and partnerships, where it was upgraded from strong to very strong.

Its commercial partners include its Partnership Programme for the resale channel and application partners – such as Geotab, edge solutions with Microsoft Azure, and its collaboration with Amazon Web Services (AWS), among others.

GlobalData is keen on Telefónica’s vision of AI of Things, uniting ecosystems and capabilities to offer real end to end services that bring additonal value.

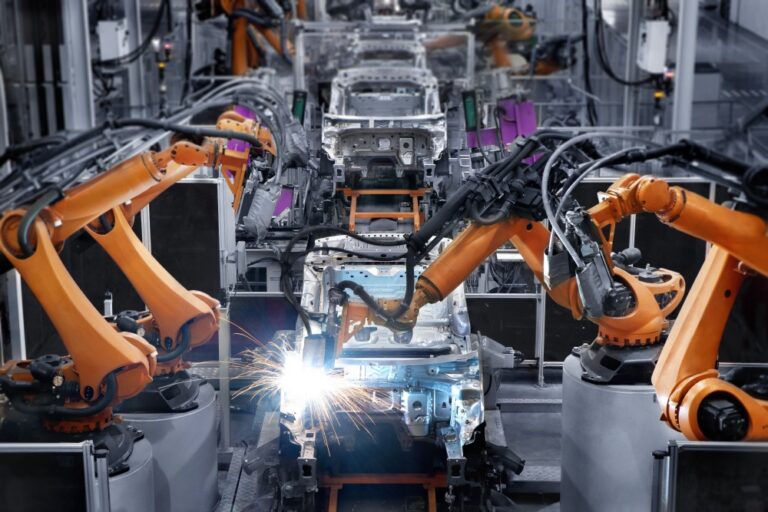

Telefónica was also upgraded for its progress in Industry 4.0, for working with specialist partners to offer services for complex use cases beyond connectivity.

Recognition

“We are very proud that GlobalData has evaluated us so positively and improved our position in its global benchmarking of industrial IoT services,” said Gonzalo Martín-Villa, CEO of IoT & Big Data at Telefónica Tech.

“It recognises our market vision, leadership within our broad footprint and the ability to adapt to what our customers expect from a company like Telefónica, regardless of their size, sector or previous technological capabilities thanks to a deep portfolio of IoT and Big Data solutions”.