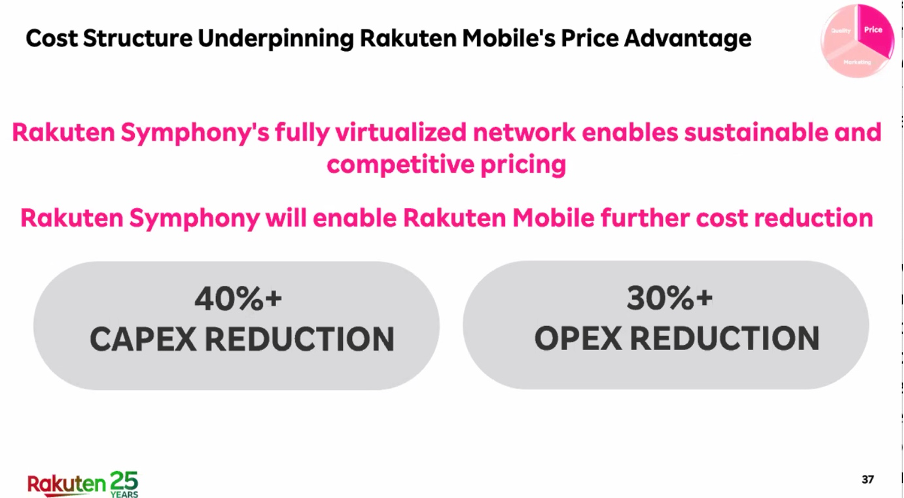

CEO Amin sticks to his guns about being able to win a price war with 30% less opex and 40% less capex than trad networks

Rakuten Mobile’s revenue rose to ¥84.6 billion (€613.65 million) in Q2 of its 2022 financial year, a rise of 64.5% over the same period last year. This is down to a number of factors. First, the growth in paying subscriber numbers after the free service plan campaign ended plus new subscribers, but that still means that as of end of June it had 5.46 million subscribers in total compared with 5.8 million at the end of April.

Projections now seem to be 12 million users, which is quite an adjustment from the target Rakuten group’s founder and CEO, Hiroshi Mikitani, had talked about previously. No timeline was given for the revised target.

However, Rakuten points out that 80% of those who churned were users whose data use was under 1GB monthly, while there has been an increase in users consuming over 1GB on a monthly basis. New subscribers accounted for 21.5% of Rakuten Mobile’s customer base and the operator is an increasingly important contributor to the wider Rakuten ecosystem (e-commerce, financial and travel services etc.).

Among customers who already used Rakuten services the average monthly per-user gross merchandise sales or GSM on Rakuten Ichiba increased by 52% after subscribing to Rakuten Mobile, suggesting increased customer loyalty.

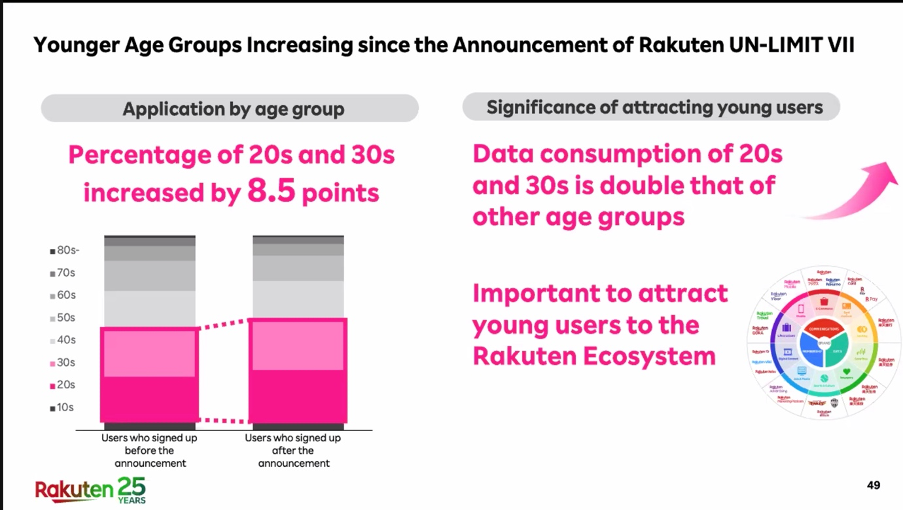

Also, since announcing the new pricing plan, UN-LIMIT VII, in May 2022, the percentage of subscribers who use Rakuten Mobile as their primary ‘line’ increased by 8.3 points, and the percentage of users with monthly data usage of 20GB or more also increased by 5.7 points. The age of new customers also matters, as shown below.

Amin also said localised marketing was paying off too with an uplift of 24.4% in Shizuoka and 23.9% in Toyama and Ishikawa. Other enticements include eSIM can be activated within minutes for those with a dual-SIM and same-day activation for online applications to become a subscriber.

Revenues were boosted by the drop in roaming costs on KDDI’s network as Rakuten switches customers onto its own, rapidly expanding infrastructure. At the end of June, Rakuten Mobile reached 97.6% coverage of Japan’s population with its 4G network.

In 2023 Rakuten Mobile plans to expand its 4G population coverage area to more than 99% with more than 60,000 4G base stations enabling that reach as well as densifying the network to improve its quality.

Rakuten Mobile’s CEO, Tareq Amin, is still insisting that undercutting competitors is a long-term strategy because of the cost structure of the network – see below. These figures have been much debated – and doubted – across the telecoms industry, but Amin is sticking to his guns and says they will be proved right as capex nosedives next year, as the infrastructure nears completion.

When asked about 5G roll out at the press briefing today, Amin said, “We have now deployed 12,000 base stations in 5G [up from about 4,000 in February]. Rakuten Mobile only deploys 32T/32R massive MIMO but because of the architecture of our Open RAN, our cost structure is dramatically lower than you would see had you had to purchase this product through a traditional vendor.

“Most of my capex is not necessarily being driven by 5G deployment. Unlike any other mobile operators, Rakuten software is owned by Rakuten Symphony [set up to sell tech and consulting to other operators], meaning the radio software. The cloud is owned by Rakuten Symphony and [so is] the entire orchestration. So the only capex we have to spend is on the massive MIMO hardware.

Amin added, “One additional thing to keep in mind is the reason that we’re not even fast tracking more 5G is for one practical issue…Massive MIMO works really, really well, but I have one problem: I can’t transmit at max power and that makes my in-building penetration for 5G not that great.…all operators in Japan share the same issue.

“In 2023 this restriction will be lifted, so at least in Tokyo will be able to transmit that max power and continue this deployment of 5G in high capacity-driven areas. So with 12,000 [antennas] we’re happy where we’re where we are now, but I think we’re going to push faster…at the latter end of this year under the deployment. This is definitely not a major contributor to our capex.”

Another factor that Amin expects to accelerate its 5G deployment is the radio units it has designed with Qualcomm which will be used in 32T32R (which denotes the number of transmitters and receivers per unit) and 64T64R. He says this will be an industry “shocker”.

The technological achievement and zeal is not in doubt, but they count for little without a lot more customers.