As broadband providers grapple with low take-up rates in some countries, two surveys cast light on what consumers want and what operators are doing about it

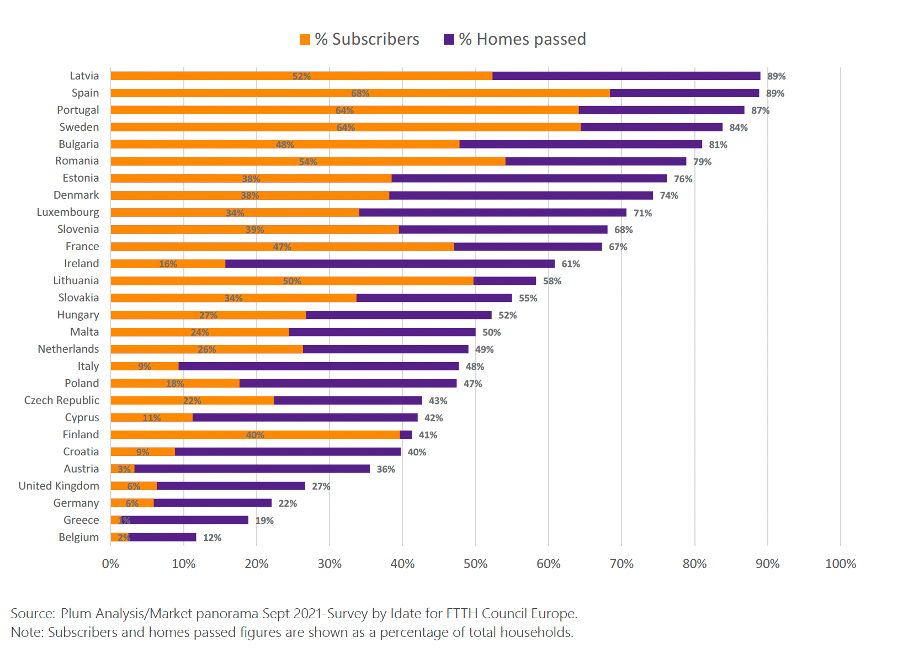

The take-up rate of fibre broadband is about 50% on average across Europe, although it varies considerably from country to country (see graph), as does fibre penetration. As inflation bites, it becomes harder for network operators to attract new investment and more expensive to renew loans.

The focus is shifting to take-up as operators need return on investment. Also, existing and potential investors, and shareholders are scrutinising adoption rates as well as roll-out strategies.

So what can operators do to improve the rates and how well do they understand what consumers want? Research published in late 2023 by analyst house Omdia in conjunction with Broadband Forum found that 72% of the 111 telcos it interviewed are prioritising bandwidth within the broadband to the most demanding applications like video streaming and gaming.

Broadband Forum’s Vice President Strategic Marketing and Business Development, Craig Thomas, said, “In the future, delivering a great broadband experience will be less about speed and more about providing value-added and tailored services to the end customer. Open standards can deliver the sort of service-aware and application-appropriate network capabilities that can help providers improve their products and provide customers with greater user experience.”

Reliability matters most

This is an encouraging, given the findings of a EY’s most recent, annual Decoding the digital home study. It surveyed more than 21,000 consumers across eight countries. People from Canada, France, Italy, South Korea, Spain, Sweden, the UK and the US were asked about their attitudes to technology, media and telecoms experienced in the home.

Adrian Baschnonga, Associate Director at EY, Global Technology Media Telecoms (TMT) told Mobile Europe, “The speed message doesn’t resonate that well with customers…there’s a lot of apathy around speed; they clearly want something that works.” He says that when customers are asked the speed of their broadband, up to four out of every 10 don’t know.

This year EY added a question to its survey, asking what consumers consider the single most important improvement their broadband provider could make? Reliability was the clear winner, which is interesting in the midst of a cost of living crisis across most countries.

The EY survey found performance promises are among the top attributes people look for in broadband provider, along with performance of the Wi-Fi within their homes, the quality of the router, technical support and transparent, easy to understand pricing.

Wi-Fi quality in the home

Baschnonga says that year-on-year, the survey’s findings are “fairly consistent” about people experiencing performance issues like buffering, although figures are improving “slightly”, with people experiencing them less often. However, he says there is “a stubborn rump” that is not seeing improvement.

This could be caused by many issues. For example, the construction of the building, and how and where customers set up routers. He adds, “Also, [retail broadband] is a market where a number of retailers…are buying wholesale off another provider, questions can arise about whose responsibility [performance] is from the service providers’ perspective” – see copy in italics at end.

EY’s survey found that just over a third (34%) of households said they were potentially interested in dropping fixed broadband service in favour of mobile. However, although they might be considering this with cost in mind, they are very conscious about what kind of performance they would get and if it would match fixed broadband.

The same attitudes are true for customers mulling replacing fixed lines with 5G fixed wireless access (FWA) some customers might opt to replace fixed with FWA. At the time of the survey, there were 94 operators globally offering FWA.

Predictable pricing

While respondents to the EY survey were not planning to cut back on fixed broadband, a large proportion (more than 70%) want fixed price guarantees. He says, “the demand for connectivity…that became front of mind during the pandemic…has endured.”

Many of wary, though, of what Baschnonga calls “inflationary escalators” built into contracts in many countries. This might be about to change, however. For example, there was a public outcry in the UK about a number of operators’ price rises last March.

Using the model set out by regulator Ofcom, BT increased fixed and mobile prices by 14.4%, based on the December 2022 Consumer Price Index plus 3.9%. This formula looks likely to be dropped by Ofcom in favour of operators stating how much in-contract price rises will be in pounds and pence when consumers sign up. Even before Ofcom made a final decision, BT said it will adopt this approach.

The fact that operators must also cover the cost of upgrading the network cut little ice with consumers although “That’s certainly something that’s part of the dialogue between service provider and regulator,” according to Baschnonga.

Bundles become attractive

The EY survey found that some respondents were becoming more receptive to having other services bundled in with connectivity. Baschnonga said, “We saw an uptick in in a number of categories across markets…like packages that include certain kinds of content, or maybe smart home (see page XX), for example. I wonder how enduring that trend will be. Is it something we’ll see accelerate going forward?”

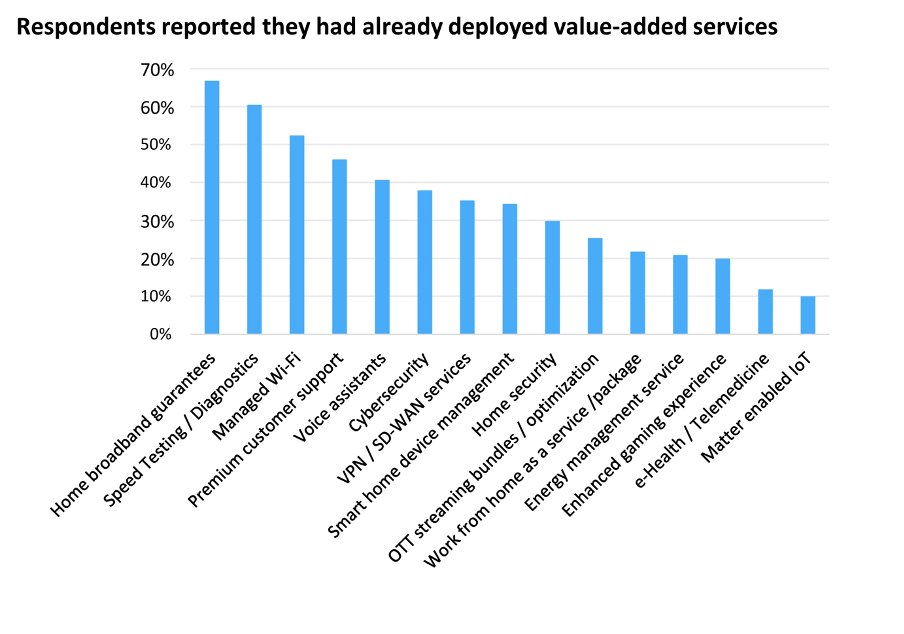

These findings were confirmed by Omdia’s report from the operators’ point of view – see the graph below. It reports many broadband service providers are already offering value-added services around basic connectivity. Over the next 12 months and beyond, operator respondents said they will look to offer premium services beyond those related to the connection itself.

Options include home security, working from home packages, energy management, and IoT

enablement through the new Matter standard, launched last autumn. It was created by Amazon, Apple, Google, Samsung, Verizon and others through the Connectivity Standards Alliance.

Home broadband, Wi-Fi speed and reliability guarantees, and speed testing and diagnostics were among the most popular value-added services telcos plan to offer. More than half (60%) of respondents stated they are already deploying some of them but managed Wi-Fi, premium customer support, voice assistants and cybersecurity feature heavily in many respondents’ plans.

Source: Source: Omdia/Broadband Forum, The future of the connected home and the rise of home applications, published October 2023

Progress with smart homes?

According to the Omdia report, 85% of respondents said they had already deployed the Broadband Forum’s User Services Platform (USP) or plan to within the next six to 18 months. USP was developed to help deploy, implement and manage the smart home. It includes a data model, architecture and communications protocol to support the remote management of devices, such as Wi-Fi home gateways, independent of the device’s manufacturer.

More than half (58% of respondents) said they use or will use USP to manage Wi-Fi. Other popular uses include premium customer support, cybersecurity, voice assistants, and energy management.

All respondents agreed that reduced fragmentation and proprietary technology at the chipset, customer premises equipment and software platform level would drive greater innovation. They also thought it would lead to faster onboarding of value-added services.

Michael Philpott, Research Director – Service Provider Consumer, at Omdia observed, “A key barrier of time to market for new services from network operators has been the integration time with devices and platforms that may use different vendors and proprietary technologies.

“Some network operators may opt for a ‘best of breed’ strategy to develop their own, bespoke, in-home platform to take full control over the ecosystem they create and give them the best chance of differentiation in the market. Adopting a fully open standards model at both the lower and higher layers can ensure that both applications and software, or hardware and chipsets can be quickly and efficiently swapped out at any time without the need for further integration work.”

Improving interoperability for better in-home ops

In December, three vendors became the first to undergo interoperability testing for the Broadband Forum’s virtualised optical network unit (ONU) management and control interface or vOMCI standard (TR-451)[2].

Operators’ optical line terminals (OLTs) connects to the ONUs to help manage end users’ connections. The ONU converts the optical connection to an Ethernet link which are typically supported by consumers’ routers. Put another way, the TR-451 standard decouples the ONU and the OLT by virtualising the OMCI software.

The standard is intended to make it easier for operators to deliver new services to and within customers’ homes, using products have been tested and certified as compliant. The testing took place at a plugfest that ran from June to September last year at Altice Labs. The three vendors taking part were MT2, Nokia and Radisys Corp.

The Broadband Forum is calling for others to contribute to this work.