The operator panellists shared their candid experiences around how fully integrated telcos can transition to NetCo, ServCo and InfraCo models that work

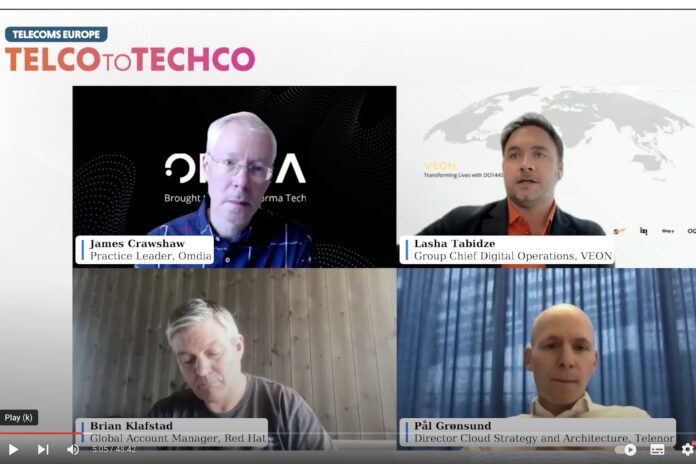

The discussion took place at our recent Telecom Europe Telco to Techco virtual event, moderated by Omdia practice leader James Crawshaw. Our panellists were Telenor cloud strategy and architecture director Pål Grønsund, Veon Group chief digital operations Lasha Tabidze and Redhat global account manager Brian Klafstad.

The sum of the parts is greater than the whole

Grønsund explained that three models are emerging for service providers: Infraco which is the towers and fibre; NetCo which is network-as-a-service; and ServCo which is connectivity as a service. Telenor split passive infrastructure from active infrastructure but in some markets where it operates, some of the joint ventures include active infrastructure. “It is really important to look at the specific business ambitions and market conditions as well to see what out of those models would be the better fit,” he said.

Tibidze said operators separate to gain efficiencies or create value. He said Veon’s approach is to potentially sell a portion of the TowerCo/NetCo to free up capital to reallocate to the ServCo business, whether that is service delivery, AI or digital services.

Different investor classes

Klafstad highlighted that each model attracts different investor classes. “The ones that invest in your your ServCo will be wanting a much higher margin, because there used to the EBITDA, so they’re looking at 30%+ margins,” he said, adding that InfraCo investors are long-term and can be happy with 5%+ margins. He said telcos must explore efficiencies and automation here and realise that each new telco layer moves closer to customers so can sell more things to them, rather than just space.

For example, Telenor Infrastructure has three focuses now, the sites (including building and power), the fibre and the data centre. “The key motivation is to focus on what is the utilisation of these assets and then that could be attracting new customers, it could be attracting external investors as we have talked about. Another important thing is also how to improve the main processes, dealing with those assets and managing them,” said Grønsund.

Not just cost savings for the split

Veon’s digital operator strategy, according to Tibidze, is not about cost saving at all. It’s not just about selling off towers, it’s more about creating a dedicated organisation that’s looking after that infrastructure within the telco with its own p&l. Then they have the right incentives to run their business segment more efficiently than when it was just a cost centre inside of a larger telco organisation.

“TowerCos when separated are more focused and can move into things like green energy – it’s not about just new clients on your towers,” he said. Therefore changing the telco business model is “not initially done because of the cost saving; it’s initially done because of specialisation and increasing the efficiency.”

“We clearly see that dedicated specialised teams or companies are really doing much better on the passive infrastructure side,” he added. “Of course, you can keep this company within your umbrella and structure. But there is a huge possibility of finding the investor, going into the JV or even selling to specialised companies, all this infrastructure.”

The discussion also explored:

• Where edge services fit into the bigger picture and what the business model might look like including the opportunity for CPU-as-a-service

• Creating sources of funds to grow your ServCo business

• New InfraCo services which are working in the market

• Different investor models emerging for the different telco layers

• Attracting new customers onto your various asset classes

• Infracos own many sites around in the markets where they operate. That’s an opportunity for ServCos to build at the edge but also for others to come in and put their edge cloud into those locations

• Sovereign cloud opportunities and rising requirments in this space from the likes of government and defence

• Veon’s lessons with its Bangladesh operational restructure

• How the ServCo/NetCo/InfraCo model allows each segment to create more value through their focused investment decisions beyond what an integrated telco can do given it must make judgements on everything from building and conduits right though to investing in GenAI

• Lessons from Danish incumbents TDC’s painful structural separation

• Strategies to successfully migrate from legacy IT to open stack software despite consensus believing this is difficult for telcos to pull off

• Building the right teams to make these more-focused organisations work better

• How a more focused business and management has helped Telenor and Veon with emerging edge services and what these may look like