But it looks like telcos are still caught on the horns of the digital dilemma – enabling everyone else to profit rather than raking it in themselves.

IDC’s Worldwide Semiannual Telecom Services Tracker found revenues from telecoms services and pay TV amounted to $1.53 trillion in 2020, reflecting no growth over the previous year.

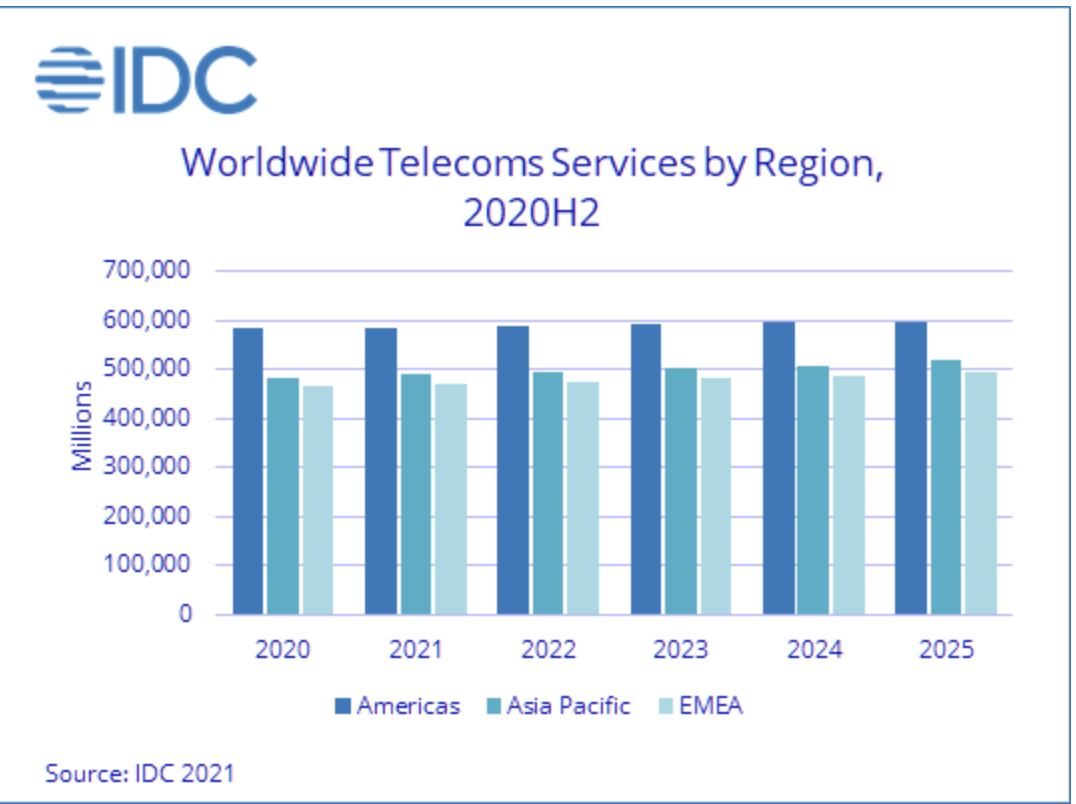

However, it expects to see growth of 0.7% in 2021, to reach a total of $1.54 trillion, but as the graph shows, the analyst house is not expecting to see the jump that so many hope 5G will deliver between now and 2025 – the time it used to take the ITU to deliver a new set of global telecoms standards, but a long time in modern telecoms.

Consider what the hyperscale cloud market looked like four years ago – and the level of debt most European telcos are mired in now.

Short-term pandemic effects

Obviously, the pandemic is blamed for the lack of growth in 2020 as the number of subscribers fell and people spent less on some services as a result of lockdowns and people cutting back on spending.

In the second half of 2020, demand improved due to economic stimulus measures and the progress of vaccines boosted optimism. Hence the second half saw revenues close to those of the previous year for the same period.

IDC says that although the revenue outcome in 2020 was neutral, the pandemic drastically changed the trends that have shaped the global telco market for a long time.

Consumer fixed data services suddenly became the most important type of connectivity, enabling home-bound people to work and entertain.

Business fixed data services temporarily lost momentum due to the migration of traffic to the consumer segment, but most of these connections were preserved as they were protected by long-term contracts.

Fixed voice services dropped a little due to bankruptcies among small businesses and some residential clients gave up connections to save money.

Mobile services spending also declined slightly due to slower renewals of contract, reduced out-of-bundle spending, and a sharp decrease in roaming revenues due to travel restrictions.

In the Pay TV segment, the migration from traditional Pay TV to Over the Top (OTT) services accelerated during the COVID-19 crisis, driven by increased consumption of video content and new OTT services.

What now?

IDC believes that connectivity will become an even more critical asset for households and businesses after the pandemic, as some of the habits adopted during the crisis (remote working, collaboration, online media consumption) are expected to become part of everyday life.

The migration toward FTTP is expected to accelerate in many country markets, while the business fixed data market will recover in the longer term as the economic recovery drives increased investments in the cloudification of enterprise business activities.

Mobile revenue growth will be buoyed to a degree by 5G adoption, which will invite users to deploy more advanced data capabilities and take up content and services dependent on high-speed data connectivity.

“The COVID-19 pandemic demonstrates the resilience and value of the telecoms industry,” said Chris Barnard, VP, European Infrastructure and Telecoms.

“New ways of working will persist beyond the pandemic, shaping future revenue opportunities, while the network-centricity of consumers will drive bandwidth requirements in that segment as well.”