It will investigate other markets, including personal comms apps and devices for accessing audio-visual content

The UK’s telecoms and digital services regulator Ofcom has apparently just noticed that Amazon, Microsoft and Google are big in the cloud services market. It is to examine their position as part ofa new programme of work “to ensure that digital communications markets are working well for people and businesses in the UK”.

Which is what we thought Ofcom’s day-time job was anyway?

In the coming weeks, Ofcom will launch a market study under the Enterprise Act 2002 into the UK’s cloud sector. Just so we’re clear, “market studies are examinations into the causes of why particular markets may not be working well in the interests of consumers”. Right-o.

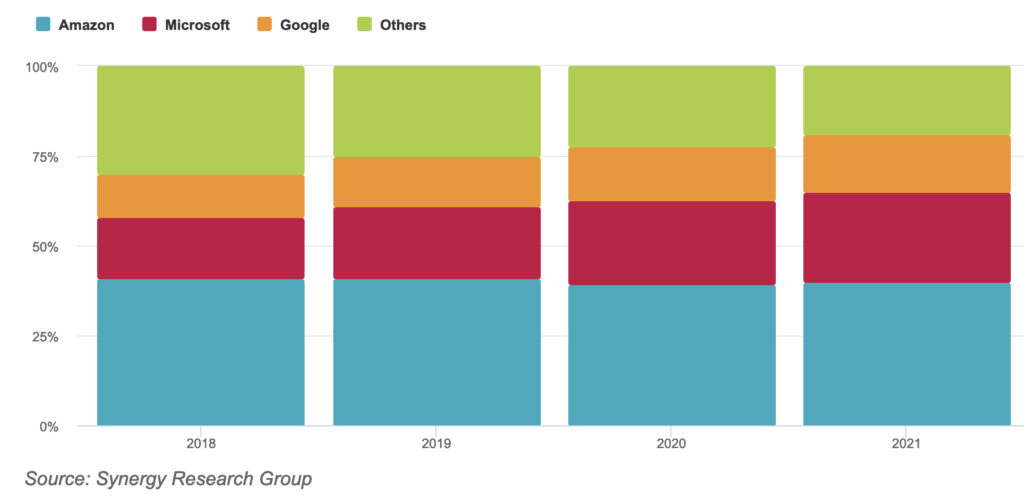

Ofcom says AWS, Microsoft and Google collectively generate around 81% of revenues in the UK public cloud infrastructure services market. In 2018, less than 10% of all businesses’ global IT spending was on public cloud services. This rose to reach 17% last year, as the Covid-19 pandemic increased the need for remote working. Some analysts expect 45% of businesses’ IT spend to be on public cloud by 2026 (see: Gartner Says Four Trends Are Shaping the Future of Public Cloud).

The UK’s cloud services market worth an estimated £15 billion

The study will formally assess how well this market is working, the strength of competition in cloud services and the position the three hyperscalers hold in the market. It will also consider any market features that might limit innovation and growth by making it difficult for other companies to enter the market and expand their share.

It “will look at how the market is working today and how it expects it to develop in the future – aiming to identify any potential competition concerns early to prevent them becoming embedded as the market matures.” Where have the people at Ofcom been living? With 81% of the market, embedded is a done deal.

Still, it will invite initial views on the UK cloud market from interested or affected parties and plans to consult on our interim findings and publish a final report – including any concerns or proposed recommendations, note – within twelve months.

If it finds a market is not working well, there can be negative impacts on businesses and ultimately consumers, through higher prices, lower service quality and reduced innovation it might do one of these things:

- make recommendations to government to change regulations or policy;

- take competition or consumer enforcement action;

- make a market investigation reference to the Competition and Markets Authority (CMA);

- accept undertakings in place of making a market investigation reference.

WhatsApp, Zoom and smart speakers

Not done yet, Ofcom will also start a broader programme of work to examine other digital markets, including online personal communication apps and devices for accessing audio-visual content.

It is interested in how services such as WhatsApp, FaceTime and Zoom affect traditional calling and messaging, and how competition and innovation in these markets may evolve over the coming years. Again, which rock has Ofcom been under?

It also want to understand whether any limitations on their ability to interact with each other raises potential concerns.

Another area of focus for Ofcom is the nature and intensity of competition among digital personal assistants and audiovisual ‘gateways’ – such as connected televisions and smart speakers – through which people access traditional TV and radio, as well as online content.

Analyst’s viewpoint

This is what Paolo Pescatore of PP Foresight has to say about Ofcom’s newly announced cloud curiousity: “There are different aspects and it is not a clear slam dunk. Each area needs to be independently assessed. Ultimately Ofcom is concerned with the dominance of a small number of players which has seen their share grow significantly.

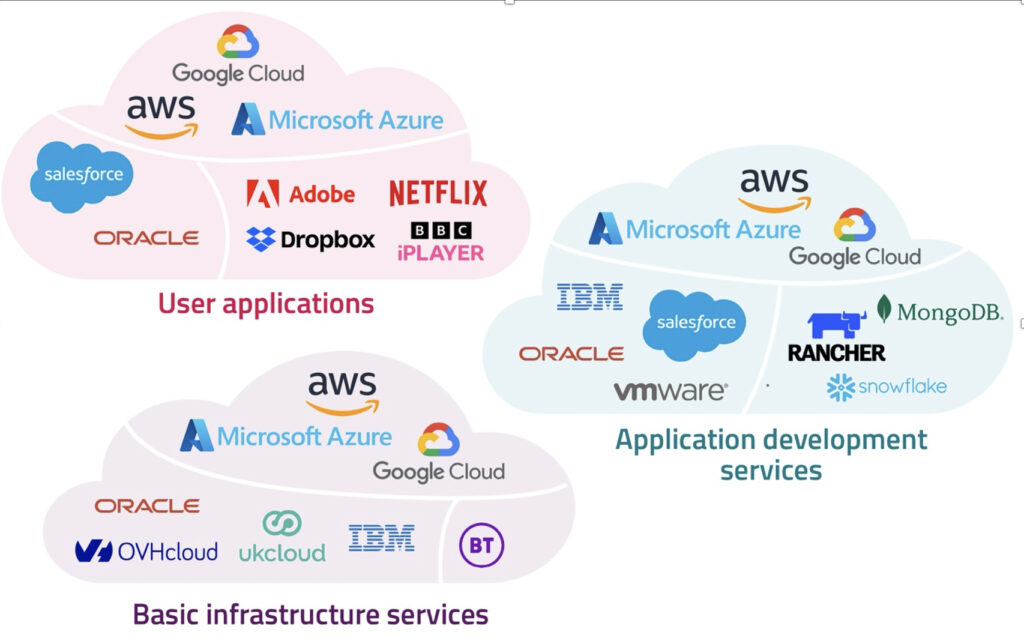

“It is becoming increasingly hard for new entrants or any emerging player to compete given the established position of the big ones. In cloud there are fewer providers with the market dominated by AWS with Microsoft Azure and Google Cloud challengers competing in large part by price.

“Timing is interesting as people have shown a strong appetite to buy and use a slew of connected devices such as smart speakers and messaging services. These have been highly sought after during the pandemic and have now become the norm in everyday usage.

{Therefore, it is hard to see what Ofcom will do if big techcos are stifling competition. We might see restrictions, incentives to foster new players. Let’s not forget the current uncertain geo-political and macroeconomic climate with prices heading in one direction. Can the market sustain new players or significant price increases that will impact consumers?”

You can read more from Ofcom here.