Concludes they are doing well in terms of adopting a software-based operating model and developing enterprise digital services, but their focus on verticals needs work

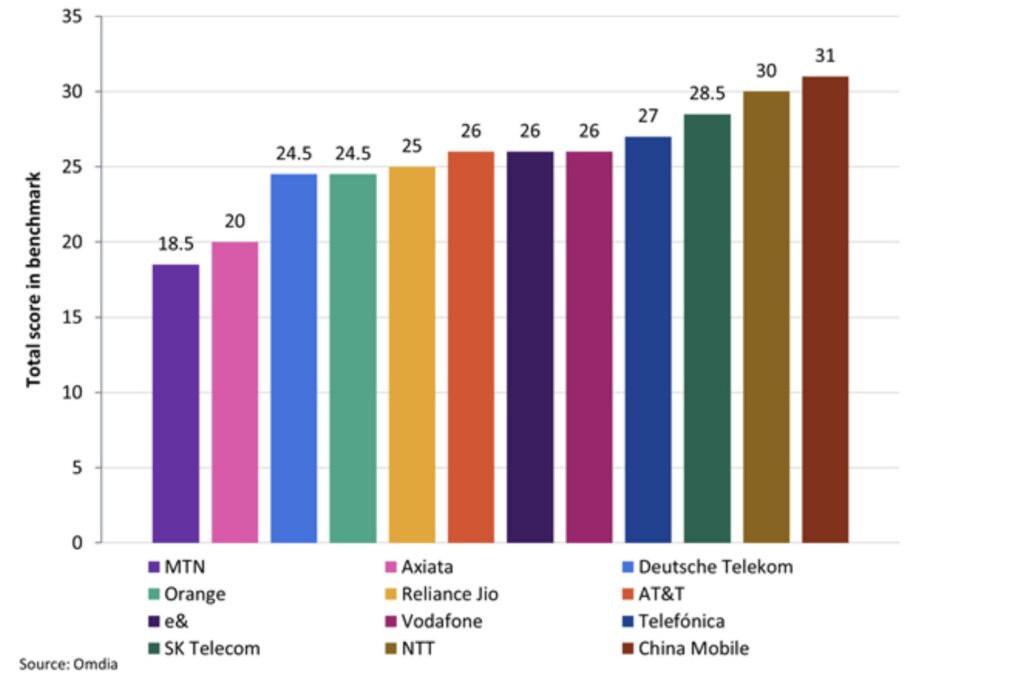

China Mobile is ranked as the top overall performer in Omdia’s telco-to-techco benchmark. The Omdia study assesses the efforts of 12 leading telecom service providers globally as they transition towards the techco operator model, integrating communications and technology services.

Indeed the top three are in Asia, with the leading European group, Deutsche Telekom, four points behind the leader. The US’ leader, AT&T, is joint fifth.

Telco-to-techco benchmark total scores by service provider

The high cost of deploying 5G and fibre networks, combined with low growth in revenues for communications and connectivity services, is leading many telcos to reinvent themselves as techcos that provide technology services, primarily to the enterprise sector.

“A telco that has adopted the techco model successfully is a software-based organization that offers services in areas such as AI, big data, the cloud, and IoT, and can implement digital transformation for specific vertical sectors,” said Matthew Reed, Chief Analyst, Service Provider Strategies, at Omdia.

China first

China Mobile ranks first in the telco-to-techco benchmark with a score of 31 points out of a potential maximum of 40, based on the scale of its high-speed broadband platform; its capabilities in AI, big data, and security; and its portfolio of enterprise digital services and vertical market solutions.

Digital transformation revenue, which is China Mobile’s term for revenue from new digital services, accounted for 29.4% of China Mobile’s service revenue in 2023, an increase of 22.2% year on year, according to the company’s reports. (At the end of 2023, Orange’s had reached 44%.)

NTT ranks second in the benchmark, reflecting its strengths in software services and in the enterprise market, while SK Telecom, which ranks third, recently unveiled a new strategy to become a global AI company. SK Telecom’s new AI services include an AI-based digital assistant, A., which it plans to launch around the world with other telcos.

Top Europeans

Telefónica ranks fourth in the benchmark, reflecting its progress as a provider of cybersecurity and other enterprise digital services through a dedicated unit, Telefónica Tech.

AT&T, e&, and Vodafone rank equal-fifth in the benchmark. AT&T says that being an early adopter of AI has helped it to make operating cost savings of $6 billion. e& adopted a new strategy in 2022 to become a leading global technology and investment group [including a substantial stake in Vodafone], and has acquired or developed assets and capabilities in multiple digital service and technology areas.

Vodafone has increased its focus on the business market, including enterprise digital services, and aims to expand its IoT operation, already the largest of its kind outside China, as a standalone unit as part of ten-year, GenAI services agreement between with Microsoft.

“Overall, the operators covered in the benchmark are making good progress towards a software-based operating model and with their development of enterprise digital services,” said Reed. “But their vertical markets focus is less advanced generally and is an area that needs more work.”