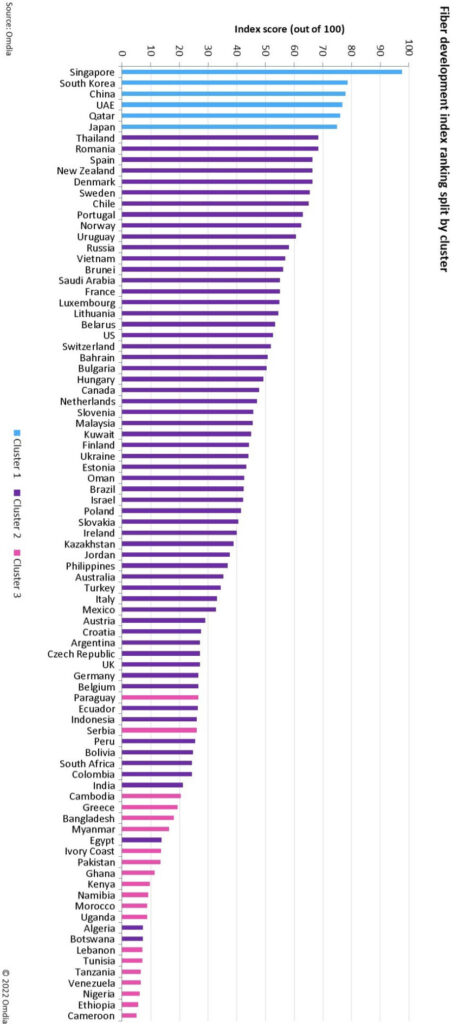

Omdia’s index demonstrates simple market forces are no substitute for long term planning and consistent execution

No big surprise that Singapore holds the lead position in Omdia’s Fiber Development Index 2022. It scored the maximum in seven of the 10 metrics (see below) that Omdia uses to rank countries’ fibre infrastructure. South Korea, China, the UAE, Qatar and Japan are not far behind: all territories in the leading cluster benefit from strong national broadband plans with ambitious targets around ultra-high-speed services.

Network X’s Research Director, Michael Philpott, comments, “Countries, such as the UK and the US, that are further down the list than many less developed countries, may need to consider policy reforms to ensure that it is easy to deploy infrastructure and that competition in the market remains high in light of mergers taking place.”

Not sure about the use of “may need to” regarding national governments pulling their fingers out and getting a cohesive plan in place fast. But even in the US, where the Biden Administration is putting its shoulder to the wheel, the trouble is you can’t build fibre networks overnight.

Those in Cluster 1 started their planning and building years ahead of most of the rest. It is, from a European perspective, poor that only one out of its four biggest economies – France – appeared to have the foresight and resolve to follow through on its national fibre plan.

The incumbent operators in Germany and the UK both mightily resisted going full-fibre – determined to squeeze every last ounce out of their copper-based last mile – and the regulators and legislators apparently didn’t grasp the importance of digital infrastructure or that it needs malice aforethought.

One thing that is often overlooked in studies like this by Omdia, and can give something of a skewed view, is that some countries have substantial cable infrastructure which of course also supports high speed broadband, such as the US, Belgium, Germany and the UK.

Vodafone in Germany does not appear to be getting as much advantage as it expected from its €19 billion acquisition of Liberty Global’s cable infrastructure in Germany, as well as the Czech Republic, Hungary and Romania, nor its fibre expansion of it. In the UK, Liberty Global – part owner of Virgin Media O2 – is building out fibre as fast as it can go.

To me this is the crux of the matter:

In nearly all the countries that BCG studied for a World Economic Forum report, the consultancy found that it can take a decade for CSPs to get their return on investment, especially in sparsely populated and hard to reach areas. On the other hand, countries get the economic boost from bringing people online far more quickly, in under two years.

This is why public policy, planning and investment are so important, and why simply leaving it to the economics of the private sector or market forces is dim when they are typically measured in quarterly results and CEOs rewarded by short term profitabilitly.

The UK is an outstanding case in government indecisiveness and a long catalogue of broken promises and ignored targets, with the government of the day lambasted repeatedly by Parliamentary oversight committees. In just the most recent times, when Boris Johnson became Prime Minister, the UK Government’s manifesto commitment was to deliver nationwide gigabit-broadband (FTTP) by 2025. This was diluted in November 2020 to a minimum of 85% of premises by 2025, as Omdia points out.

Then in February 2022, the UK set a new target for nationwide gigabit-broadband to be available by 2030. In comparison, Singapore is already claiming full FTTP coverage, where it is treated as ‘strategic infrastructure’.

So the British – and other governments – see the benefits but don’t want to spend the money and try and shove the onus onto the private sector, which of course is driven by profit and returns to shareholders.

Or as Omdia puts it, “Historically, several otherwise highly developed broadband territories that rank lower in the fibre index tended to suffer from less clear or ambitious national plans, providing weaker incentives for operators to invest. However, due in part to the COVID-19 crisis demonstrating how important broadband networks are, governments are now strengthening their broadband targets and increasing their focus and investments in fibre-based infrastructure.”

Omdia’s Fiber Development Index tracks and benchmarks fibre against a broad set of fibre investment metrics across 88 countries, including:

- FTTP coverage

- FTTH penetration

- Fiber to the business penetration

- Mobile cell site fibre penetration

- Investment in advanced wave division multiplex technology

Based on Omdia’s analysis of Ookla Speedtest data, the Index also quantifies the overall broadband quality of experience improvements driven by that investment, namely:

- Median download speed

- Median upload speed

- Median latency

- Median jitter

The findings from this report will be discussed at the upcoming Network X event in Amsterdam, 18-20 October 2022.